Market News

Market weekly wrap: Benchmarks hit record highs, NIFTY sees longest winning streak ever

.png)

4 min read | Updated on August 31, 2024, 20:08 IST

SUMMARY

The winning run of the benchmark indices in the preceding week got extended further in the last week of August. As a result, NIFTY and SENSEX registered new highs in the last trading session of the month.

Benchmark NIFTY registered its longest winning streak ever as the 50-share index hit fresh record highs on Friday

• NIFTY marked its longest gaining streak since its launch in 1996. • During the 12-day rally since August 14, NIFTY gained 4.5%. • Bharti Airtel stock hit its record high of ₹1,608.4 per share this week, rallying 10% in the last 8 sessions. • Sugar stocks surged up to 16% on Friday after the government eased Ethanol policy.

Hey everyone. We are back again to talk about the week that was! Or to say, what a week that was for the stock markets! The winning run of the benchmark indices in the previous week got extended further in the last week of August. Result: the NIFTY and SENSEX registered new highs in the last trading session of the month.

Monday started with a bang, as the NIFTY jumped 188 points to close above 25,000 levels, while the BSE SENSEX rose 612 points to hit 81,700 levels.

Tuesday was a completely flat session for the markets, while Wednesday was only mildly positive. The key indices added nearly 88 points and 42 points, respectively, together in the two sessions.

On Thursday, the markets showed signs of weak opening, but trends reversed as the day progressed, after buying intensified in frontline stocks like Reliance Industries Ltd (RIL). The SENSEX settled 349 points higher to end above 82,000 for the first time, while the NIFTY added another 100 points.

Lastly, Friday proved to be another big day for traders. The SENSEX ended 231 points higher to close at a record high of 82,366, while the NIFTY also hit an all-time high of 25,236 after rising 84 points. Broadly, both the indices were up 1% for the week.

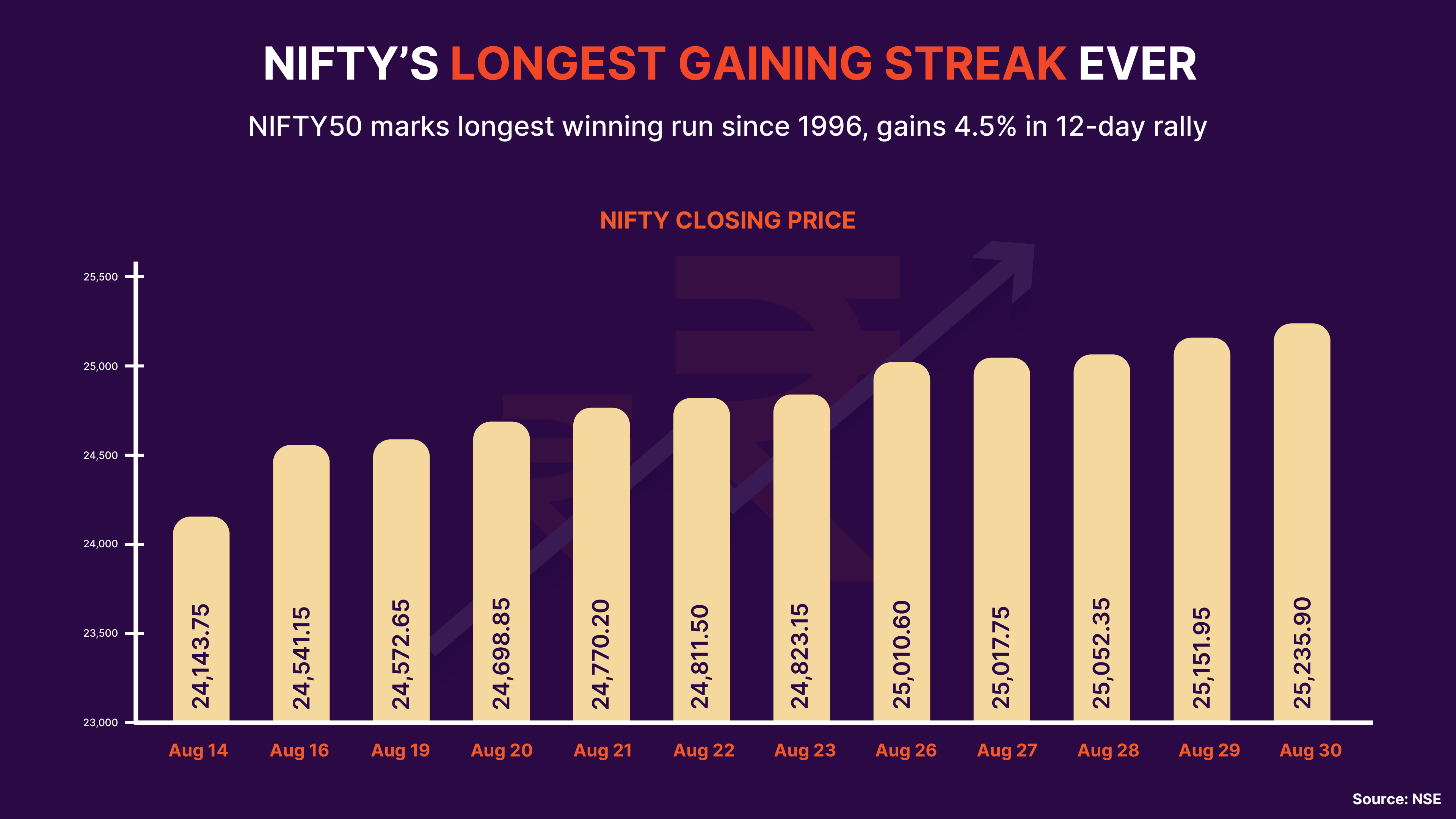

NIFTY registered longest winning streak since launch

Benchmark NIFTY registered its longest winning streak ever as the 50-share index hit fresh record highs on Friday. NIFTY extended the rally for the 12th straight day on Friday, marking its longest gaining streak since launch in 1996. During the 12-day rally since August 14, NIFTY has gained 4.5%.

RIL kept the party going

The company’s ambitious plans for the Artificial Intelligence (AI) technology along with its major investment targets in the new energy business fuelled optimism in shareholders.

Additionally, the company’s announcement regarding the 1:1 bonus issue, to be considered next week on September 5, proved to be the cherry on the top of the cake.

Bharti Airtel hits new highs

A combination of factors aided the share price rally – Bharti Airtel became a majority stakeholder in Indus Towers after the completion of the latter’s buyback offer this week.

Separately, investors also pinned hopes from the Supreme Court’s hearing on the curative petitions filed by Bharti Airtel and Vodafone Idea in the Adjusted Gross Revenue (AGR) case on Friday.

Sugar stocks spike on policy relief

In a surprise development, sugar stocks staged a huge recovery on the last day of the week after the government permitted the use of sugarcane juice and sugar syrup for ethanol production in the 2024-25 ethanol supply year (ESY), reversing the ban imposed last year.

Experts say that the move will give sugar companies more operational flexibility and help in improving their potential profitability.

Shares of almost all sugar companies, including Dalmia Bharat Sugar, Shree Renuka Sugar, Balrampur Chini Mills, Triveni Engineering, Bajaj Hindusthan, Dwarikesh Sugar Industries, among others, climbed as much as 6-16% during Friday’s trade.

Choppy ride for Ola Electric Mobility since listing

Ola Electric investors were in for a rude jolt this week as the stock cracked over 25% from the record high of ₹157.4 seen on August 20 last week.

Ola Electric shares had doubled within two weeks of listing compared with its initial public offering (IPO) price of ₹76. However, the downtrend started soon thereafter, with the stock closing in the red for seven of the past nine sessions on the back of stretched valuations.

The company’s co-founder Bhavish Aggarwal, meanwhile, announced on Thursday that Ola Electric’s products will be available on the Open Network for Digital Commerce (ONDC) starting next week.

Related News

About The Author

Next Story