Market News

Stock market slump: Why are Indian markets falling even as global markets continue to rise?

4 min read | Updated on July 29, 2025, 16:26 IST

SUMMARY

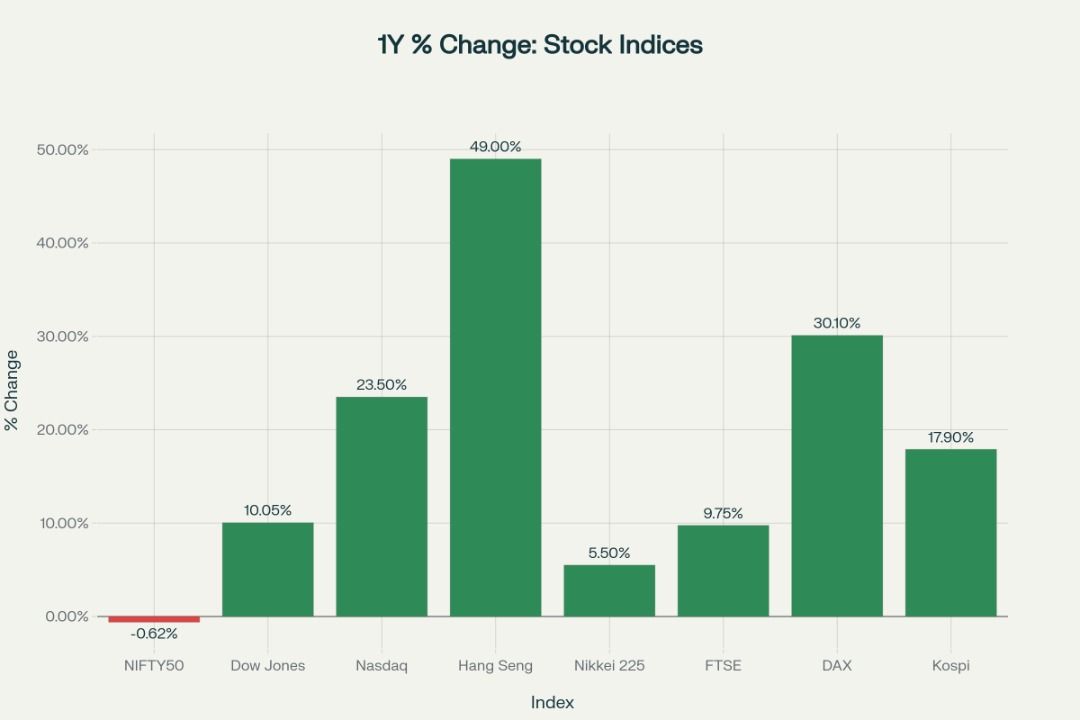

NIFTY50 has underperformed the global indices on an annual basis for the period from July 2024 to July 2025. This underperformance is led by multiple factors such as stretched valuations, delay in trade deal, renewed FII selling and more.

NIFTY50 traded 0.5% lower on a annual basis, as compared from July 2024 to July 2025.

Indian equity investors are witnessing a different phase of markets, where the markets are broadly at the same levels as they were a year ago. After witnessing sharp swings on either side and a strong rally post the election outcome to record high levels above 26,000 in September, Indian markets have witnessed selling pressure at higher levels. In March 2025, the index touched a 52-week low of 21984 and recouped some lost ground to trade near 25,000 levels for the past two months.

The sluggishness of Indian markets is of more significance amid other global peers hitting record high levels. The divergent trade and decoupling from the global trend have led many investors to exhibit a high level of patience. Here’s how Indian markets are faring against their global peers

Source: Investing.com

Earnings disappointment

The Q1FY26 earnings season so far has shown more misses than hits and especially from the bellwether companies across sectors. The overall earnings from the IT sector have been disappointing on all fronts, as IT companies face strong headwinds like demand slowdown in the US, implementation of AI in projects, and slow renewals. The commentary for upcoming quarters also remains on a subdued note, adding pressure to margins and profitability. Apart from IT, the early results from the FMCG pack too have shown margin contraction across categories, denting the profitability. Banking sector earnings also failed to boost investor sentiments, which were expected to perform better.

Overall, the Q1 earnings are on the verge of posting dismal performance, making global and domestic investors less excited about adding fresh positions into Indian equities.

Renewed FII selling

The foreign institutional investors that bought ₹427 crore worth of Indian equities in 2025 have sold ₹85,824 crore so far on a net basis. After becoming net buyers for three consecutive months in April, May and June, the FIIs have resumed as net sellers worth ₹7,980 crore in July. The renewed selling pressure from the Indian markets is primarily due to a shift of exposure from Indian to other Asian markets like Vietnam, Indonesia and China. Asset managers from Franklin Templeton, Goldman Sachs have increased their exposure to China, citing favourable valuations, technological advances and policy support. Data from Goldman Sachs shows global funds have increased their exposure on China to 6.4% in April 2025 from 5% in late 2024.

Delay in trade deal with the US

As all major economies march ahead post-signing a trade deal with the US, the India-US trade deal negotiations are still ongoing. Experts believe that the deal is unlikely to be finalised before the deadline of August 1, beyond which India is subject to 26% tariffs. Reports say, Indian counterparts are putting national interest first over meeting the deadline as it plan to protect their agricultural and dairy sector. The delay in the trade deal with the US is among the key overhangs on the Indian markets.

Stretched valuations

Indian benchmark indices, especially NIFTY50, are trading at slightly higher valuations as compared to historical averages, making it costlier for risk-averse investors unattractive to invest. NIFTY50’s current price-to-earnings ratio stands at 21.7x as of 28 July 2025, near to its historical average of 21x. However, slower earnings growth makes it look more expensive when compared to its peers. For eg, Shanghai Composite index, China’s benchmark index, trades at 14.8x, lower than its historical average of 17-18x. Nikkei 225, Japan’s benchmark index, trades at a 13.8x price-to-earnings ratio, lower than its historical average of 15-18x.

On the other hand, the US markets now trade at a sharp premium to their historical averages. Dow Jones and NASDAQ 20.7x and 41x are much higher than the average of 17x and 29x, respectively. However, despite the premium, the US benchmark indices are rallying as the US signed favourable trade deals with partner nations and falling inflation hints at more rate cuts, which could boost the US economy further.

At the outset, the Indian markets lack positive triggers that could boost animal spirits amongst the Indian and global investors. In addition, the reduced investor participation in the derivatives market also impacted the overall volumes and led to a less volatile period. Consequently, it kept the short-term traders and investors at bay.

About The Author

Next Story