Market News

Index breadth analysis: NIFTY50, NIFTY Midcap 100 in fair zone; NIFTY Smallcap 100 remains overvalued

4 min read | Updated on January 14, 2025, 15:50 IST

SUMMARY

Despite a steep correction from record high levels, key indices pose more downside risks as poor earnings growth and other external factors are likely to weigh down on markets. Index breadth for the NIFTY50, NIFTY Midcap 100, and NIFTY Smallcap 100 indices suggests that most of the stocks trade below their 200 SMA levels, indicating weakness in the markets.

Index breadth analysis: NIFTY50, NIFTY Midcap 100 in fair zone; NIFTY Smallcap 100 remains overvalued

The domestic benchmark indices opened higher on Tuesday after a steep fall on Monday. After Monday’s fall, the market erased all the gains from the post-election rally, closing near the levels of June 5 on Monday. Meanwhile, the broader market indices of NIFTY Midcap 100 and NIFTY Smallcap 100 witnessed intense corrections compared to the benchmark NIFTY50 and SENSEX.

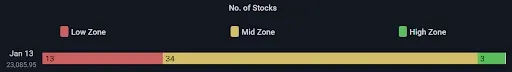

NIFTY50

(Source: Stockedge.pro)

(Source: Stockedge.pro)The NIFTY50 has corrected more than 12% from its peak achieved in September 2024. Since then, the overall index breadth has shifted to the weaker side. NIFTY50 hit an all-time high of 26,277 on September 27, 2024, when 40 of the 50 stocks traded in the high range. On the other hand, on January 13, only three stocks traded at high levels, while 34 were in the mid-range and 13 traded in the low range.

This indicates that markets traded in an overvalued zone in September and have shown a sizable correction, improving the affordability of the stocks. On the technical parameters, 15 of the NIFTY50 stocks traded above 200 SMA levels, indicating a broader weakness in the top 50 companies in the market. Fundamentally, NIFTY50’s price-to-earnings (PE) ratio improved from 24.3x in September to 21.2x on Jan 13, 2025.

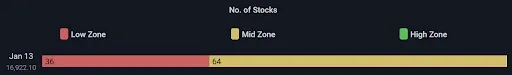

NIFTY Midcap 100

(Source: Stockedge.pro)

(Source: Stockedge.pro)NIFTY Midcap 100, which consists of key midcap stocks, has corrected more than 14% from the peak achieved in September 2024. The midcap segment was touted as a frothy space, with exaggerated share price performance. However, the market breadth for the NIFTY Midcap 100 remained stable even during the peak, as 41 of the 100 stocks in the index traded in the high range during September 2024, followed by 50 in the mid-range and 3 in the lower range. On January 13, the index breadth looked weak, with only 3 stocks trading in the high range, followed by 62 in the mid-range and 36 in the low range.

Technically, the index looks under-owned at the current juncture, as only 24 stocks traded above 200 SMA levels compared to 85 on September 23, 2024, when the index hit record highs of 60,925. On the fundamental parameters, the index eased from overvalued to fairly valued, as the PE ratio of NIFTY Midcap 100 stood at 39x on January 13, as compared to 45x in September 2024.

NIFTY Smallcap 100

(Source: Stockedge.pro)

(Source: Stockedge.pro)Market participants witnessed the highest froth in the NIFTY Smallcap 100 index, which comprises some of the highest-growth companies and small businesses. The index achieved a record high of 19718 in December 2024, slightly higher than the peak achieved in September 2024 at 19,640. The index breadth during the September record high levels was stable, as most stocks traded in the mid-range zone. While 32 stocks traded in the high zone, six traded in the low range. On January 13, 64 stocks traded in the mid-range, while 36 were in the lower range and no stocks were in the high range.

On the technical parameters, the index looks in the fair value zone as only 27 stocks traded above 200 SMA levels compared to 71 in September. On fundamental parameters, there is a big divergence in terms of valuation compared to other NIFTY50 and NIFTY Midcap 100. The small-cap 100 index is still overvalued after a 14% correction from the top as the earnings for the NIFTY smallcap 100 index have declined 16% from ₹642 in Q1FY25 to ₹540 in Q2FY25. Hence, the NIFTY small-cap 100 PE ratio is still in an expensive zone of 31x compared to 30x in September, when it touched a record. However, it has corrected significantly from 36x in December 2024, when it gave a slightly higher peak at 19,718.

In conclusion

The broader market sentiment looks weak as market participants expect factors like FII selling, poor earnings growth, and GDP growth slowdown to impact market performance. Index-wise, the NIFTY50 and NIFTY midcap 100 look in a more stabilised zone compared to the NIFTY smallcap 100, where earnings de-growth is likely to impact share price performance.

About The Author

Next Story