Market News

Budget 2025:Here’s how NIFTY50 and SENSEX are placed on technical charts ahead of the budget session

3 min read | Updated on February 01, 2025, 09:37 IST

SUMMARY

The NIFTY50 and SENSEX came close to their 200 DEMA levels, and the broader indices formed a bullish hammer pattern, indicating strength in the recovery. However, the budget day is expected to bring wild swings on the special session arranged on Saturday.

NIFTY50 and SENSEX fell for four consecutive months starting October, the most in two decades. | image source: shutterstock.

Indian markets started the new year on a weak note. For the first time in over two decades, the benchmark indices had closed in the red on a monthly basis for four months in a row. The sharp fall from the peaks achieved in September 2024 was largely due to sluggish economic growth, poor earnings, and relentless FII selling of Indian equities. Geopolitical tensions in the Middle East added to the overall market headwinds.

Market participants are looking for some respite from the bearish sentiments as they expect major announcements from the Union Budget 2025. Investors, institutions, and traders expect the budget to be populous and give much-needed economic stimulus.

After a nearly 13% fall from the peak in September 2024, markets have recovered from the recent lows. Here is how markets are placed on the technical charts ahead of the Union Budget 2025

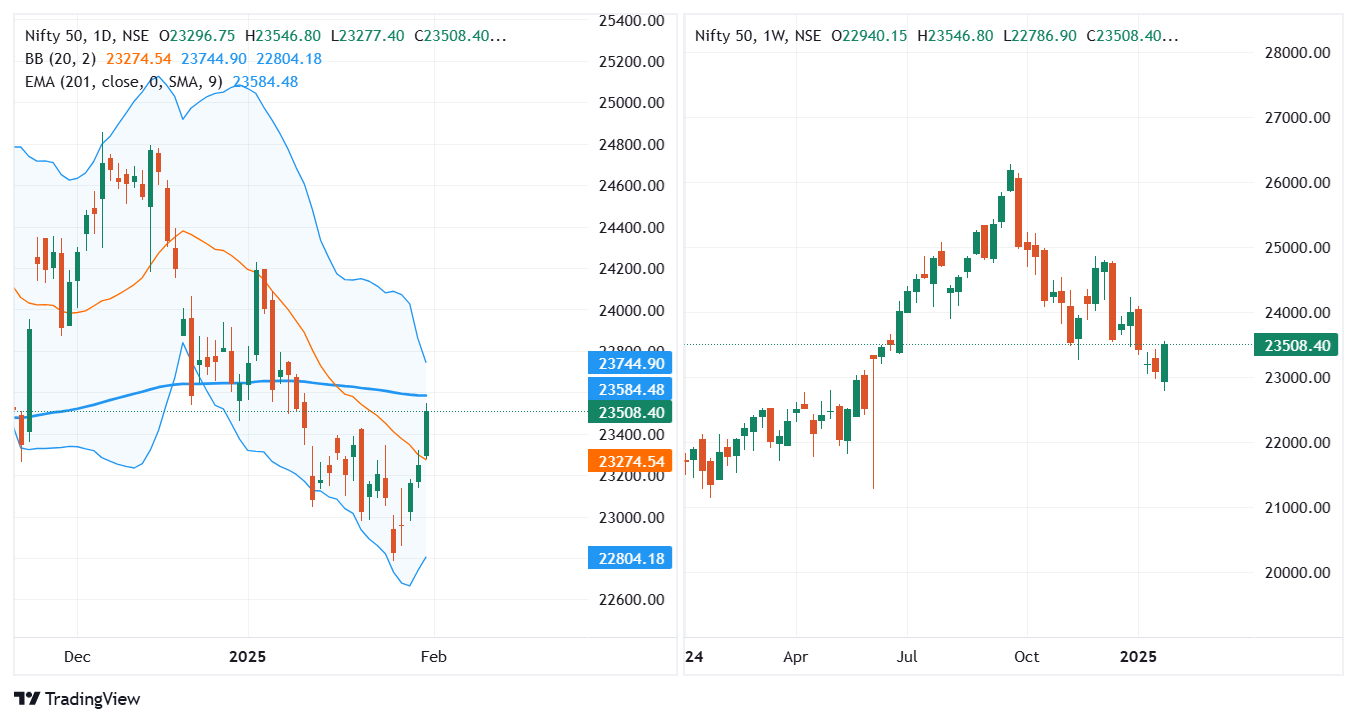

NIFTY50

(Source: Upstox.pro,Tradingview)

The benchmark index touched an all-time high of 26,270 in September 2024 and fell more than 13% to hit a 6-month low of 22,786 on 27 January 2024. Before this, the index managed to hover around 200 DEMA levels of 23,600 but witnessed a breakdown on 10 January to fall further.

In a sharp recovery from the lows, the NIFTY50 closed a tad lower than the 200 DEMA levels on the daily chart. The index also made a bullish-engulfing pattern on the weekly chart, indicating a reversal of bullish momentum.

SENSEX

(Source: Upstox.pro,Tradingview)

(Source: Upstox.pro,Tradingview)The 30-share SENSEX touched a record-high of 85,798 and corrected 12.3% from these levels. Like the NIFTY50, it hovered around 200 EMA levels of 77,980 but witnessed a breakdown on January 10, 2025. On Friday’s closing at 77,500 levels, SENSEX had also given a bullish engulfing pattern on a weekly basis and is approaching the 200 DEMA levels of 77,830.

On a daily chart, the SENSEX also crossed 20SMA levels of 77,830 on Friday by closing at 77,500, indicating market bullishness. However, with the Union Budget being a highly volatile day, market participants expect wild swings throughout the day on February 1.

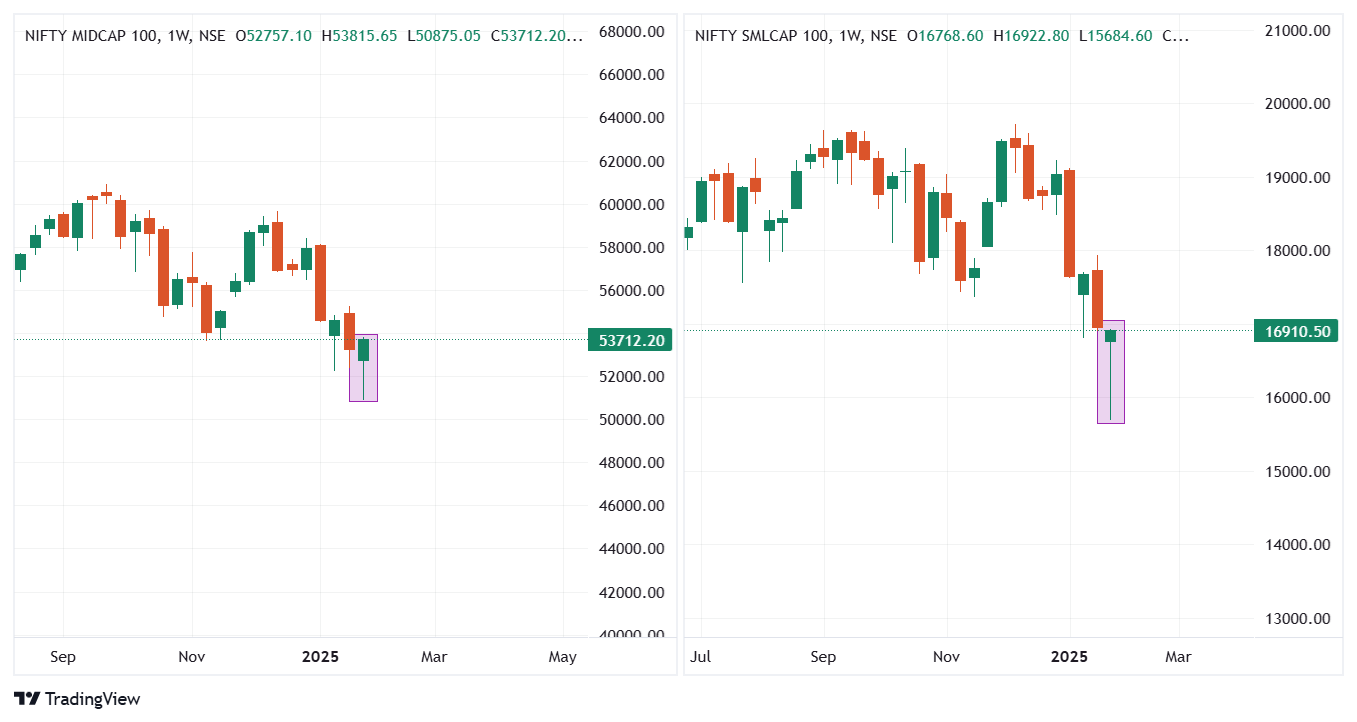

NIFTY Midcap 100 & Smallcap 100

(Source: Upstox.pro,Tradingview)

(Source: Upstox.pro,Tradingview)The broader market indices of NIFTY Midcap 100 and NIFTY Smallcap 100 have witnessed sharper corrections than the benchmark indices. The NIFTY Midcap 100 index touched the record high of 60,925 in September and fell more than 16% from the peak to touch the six-month low of 50,875. Similarly, the NIFTY Smallcap 100 index fell nearly 20% from the peak of 19,716 achieved in December 2024 to hit a six-month low of 15,864.

Both indices witnessed a sharp recovery this week, rising 5.5% and 7.7%, respectively, from the lows. On the weekly chart, the broader indices have made a bullish hammer pattern, indicating strength in the market.

About The Author

Next Story