Market News

Expiry day trade setup: NIFTY50 stays in consolidation mode, support seen at 22,300

.png)

3 min read | Updated on March 13, 2025, 07:17 IST

SUMMARY

NIFTY50 once again tested the 22,300 support zone and held firm, absorbing selling pressure despite weakness in the IT sector. On the other hand, the resistance for the index remians around the 22,700 zone. A breakout of this range will provide further directional insights.

The NIFTY50 started Wednesday's session on a positive note and faced selling pressure at higher levels. | Image: Shutterstock

NIFTY50

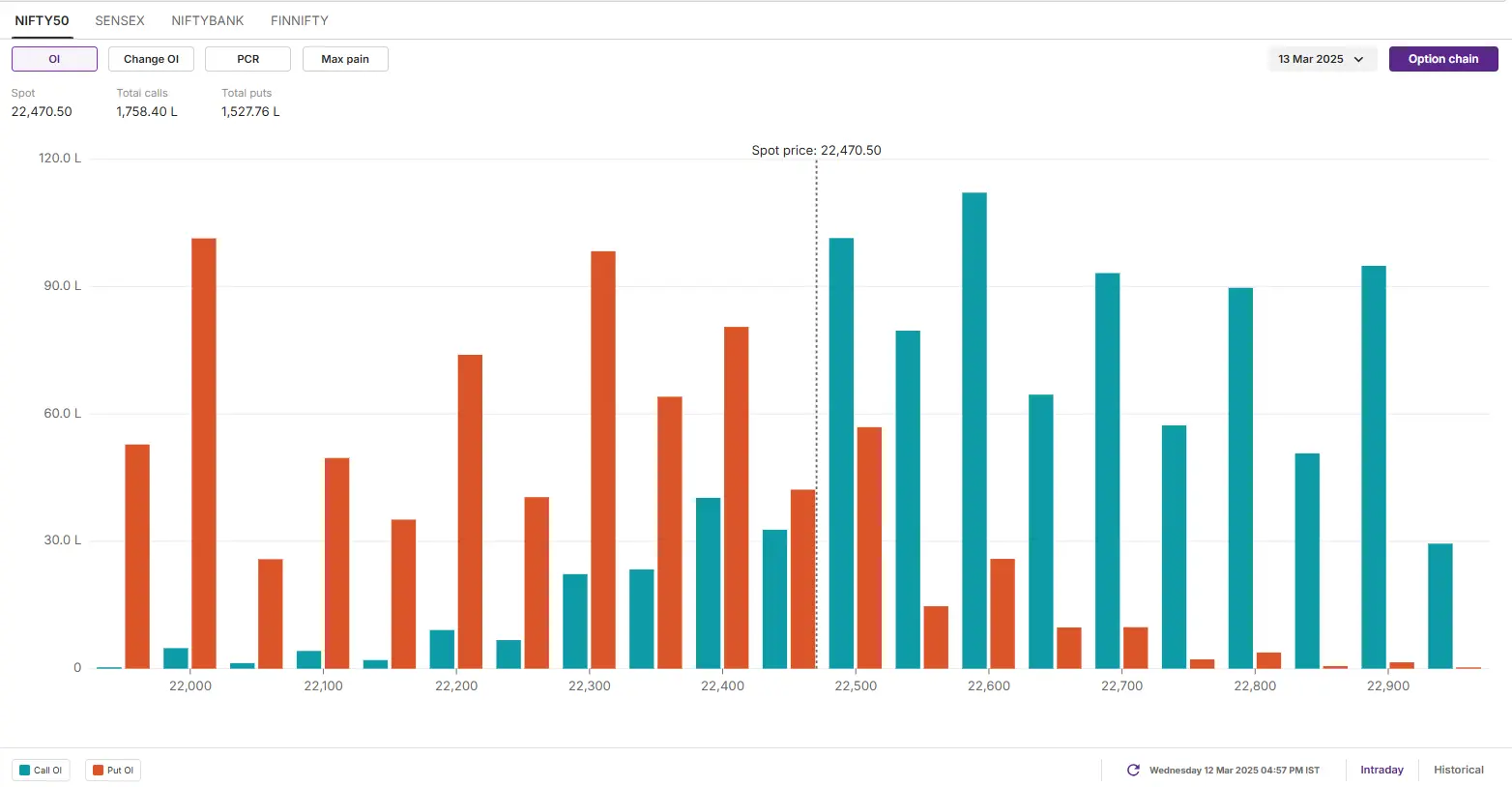

- Max call OI: 22,600

- Max put OI: 22,000

- PCR: 0.8

- (10 strikes from ATM)

The NIFTY50 started Wednesday's session on a positive note and faced selling pressure at higher levels. It slipped towards the 22,300 support zone for the second consecutive day and staged a recovery of over 100 points from the day's low. This indicates support based buying from lower levels.

The position setup for the NIFTY50 index remains range-bound on the daily chart. Immediate support for the index is found at the 22,200 level, while resistance remains at the 21-day exponential moving average (EMA). A break above or below these levels on a closing basis will provide further directional insight.

Intraday range

On the 15 minute chart, the index has been range trading between 22,300 and 22,650 for the past two trading sessions. The index has also encountered resistance around the declining trendline, which coincides with the 22,500 zone.

For directional clues, traders can monitor the 22,500 resistance zone and a break above the trendline. A break with a strong candle above the trendline could push the index towards the 22,650 zone. On the other hand, a close below the 22,300 zone will signal weakness.

Options build-up

Open interest (OI) data for the 6th March expiry showed a significant call options base at the 22,600 and 22,500 strikes, indicating resistance for the index around these levels. Conversely, the put OI base was observed at the 22,300 and 22,000 strikes, suggesting support for the index around these levels.

Bullish outlook

Traders looking for a breakout above the 22,500 resistance on the 15-minute chart, confirmed by a close, may consider a long call strategy.

On Wednesday, NIFTY50 closed at 22,470, making 22,450 the at-the-money (ATM) strike. Purchasing an ATM call option sets the breakeven at 22,528, which is 0.3% above Wednesday’s close. The trade turns profitable if NIFTY50 gains more than 0.3%.

Bearish outlook

If you anticipate NIFTY50 breaking the 22,300 support zone on expiry, a long put strategy could benefit from the bearish move. Buying an at-the-money (ATM) put option with a 22,450 strike sets the breakeven at 22,396. The trade becomes profitable if NIFTY50 drops more than 0.3%.

Range-bound outlook

Traders expecting NIFTY50 to stay range-bound, with options build-up between 22,600 call and 22,300 put strikes, can consider an iron condor strategy. The trade reaches maximum profit if the index remains within the short put and short call strike prices.

Conclusion

In simple terms, a long call strategy allows traders to take advantage of rising prices, while a long put takes advantage of falling prices. Options offer the flexibility to navigate different market conditions - bullish, bearish or range-bound. However, past performance isn't a guarantee of future results. Before implementing any strategy, it's important to assess the risks and have a clear plan for managing potential losses.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story