Market News

Economic Survey 2025-26: Foreign investors’ medium-term view of India remains positive

.png)

3 min read | Updated on January 29, 2026, 13:59 IST

SUMMARY

Economic Survey 2025-26: The Survey said that while India attracts substantial foreign investment, episodes of sharp outflows, such as after the global financial crisis, during the 2013 ‘taper tantrum’, the 2018 tightening cycle, and pandemic volatility, reflect global financial-cycle sensitivities.

FPIs during FY26 (April-December) have fluctuated, mainly influenced by global financial conditions, the survey said. | Image: Shutterstock

"The outlook, therefore, is one of steady growth amid global uncertainty, requiring caution, but not pessimism," said the pre-Budget document tabled in the Lok Sabha.

Foreign Portfolio Investments

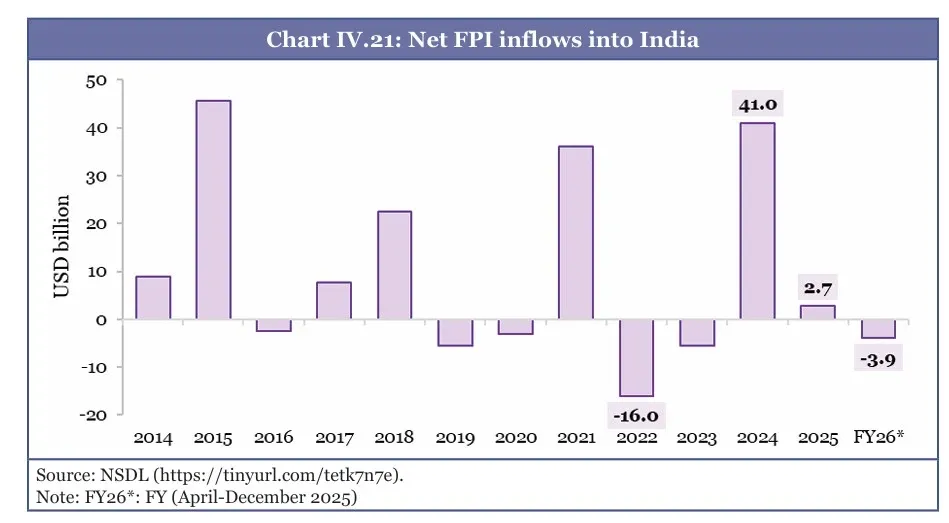

As regards foreign portfolio investments (FPIs), the survey notes that India's FPI pattern shows recurring cycles of inflows and outflows, with significant shifts often linked to global financial changes.

While India attracts substantial foreign investment, episodes of sharp outflows, such as after the global financial crisis, during the 2013 ‘taper tantrum’, the 2018 tightening cycle, and pandemic volatility, reflect global financial-cycle sensitivities.

These fluctuations underscore how FPI flows, a key external capital source, also serve as channels through which global shocks can impact domestic markets.

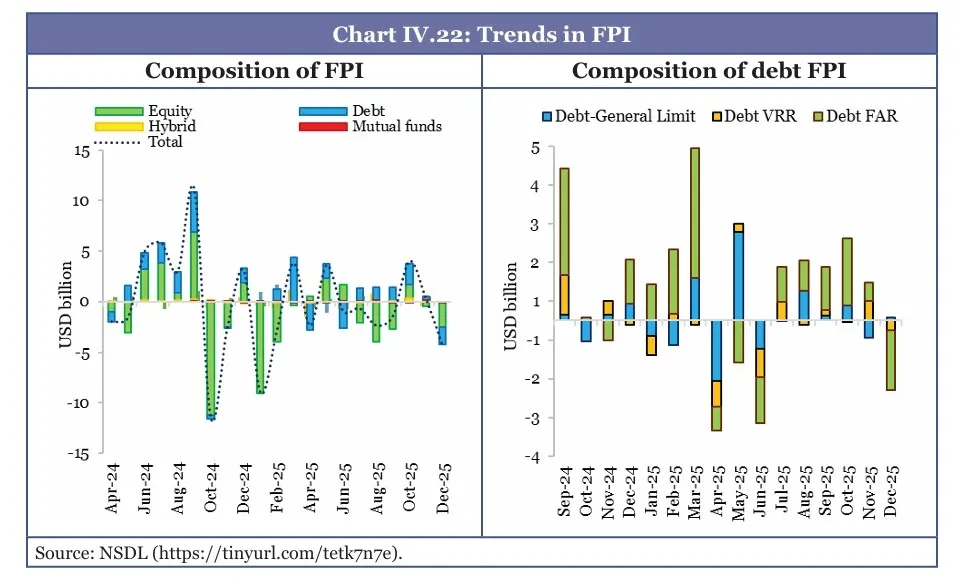

A breakdown of FPI components shows how foreign participation has evolved.

Equity flows tend to dominate in positive years, especially during periods of strong earnings and favourable valuations, whereas debt flows are more sensitive to interest rates and global risk.

The Voluntary Retention Route (VRR) 104 and Fully Accessible Route (FAR) 105 routes have stabilised debt flows, particularly when traditional flows were weak.

FPIs during FY26 (April-December) have fluctuated, mainly influenced by global financial conditions rather than domestic macroeconomic factors. The data indicate volatility, with six months of net outflows and three months of sizable net inflows, resulting in a modest net balance for the year-to-date.

The outflow periods in FY26 coincided with periods of tightening global financial conditions, such as rising US Treasury yields, which often trigger ‘flight-to-safety’ flows into advanced-economy assets.

During these periods, foreign investors reduced their holdings in both Indian equities and debt; even categories that typically showed greater stability, such as VRR, experienced occasional selling.

The three months of inflows in FY26 occurred during periods when global markets reassessed the interest-rate outlook and became more receptive to emerging market risks (May, October, and November).

These rebounds were mainly driven by the equity segment, supported by renewed interest in India’s corporate earnings trajectory and flows into the debt market as global long-term yields declined.

The swift return of inflows during these periods highlights that foreign investors’ medium-term view of India remains positive, even though their short-term allocations are influenced by still high valuations of Indian stocks and uncertainty about the trajectory of the India-US relationship amid the high tariffs that Indian goods face in the United States.

Related News

About The Author

Next Story