Market News

BANK NIFTY expiry: Watch out for 20-DMA test, key trading levels

.png)

5 min read | Updated on May 15, 2024, 08:30 IST

SUMMARY

Traders should keep an eye on the price action near the immediate resistance of the BANK NIFTY which is at 20-DMA (around 48,200). A close above or rejection from this level will provide more directional clues. Based on the options data, traders are expecting the index to trade between 47,200 and 48,300.

After a flat start, the BANK NIFTY shrugged off the initial volatility and traded in a narrow range of 300 points ahead of the weekly expiry of its options contracts.

Asian markets update 7 am

Indian equities are off to a positive start as the GIFT NIFTY rises 0.2% to cross 22,350. Other Asian markets are also trading in the green. Japan's Nikkei is up 0.4%, while Hong Kong markets are closed for a public holiday.

U.S. market update

U.S. stocks closed higher on Tuesday after President Joe Biden's comments on China tariffs. Investors are looking ahead to today's Consumer Price Index (inflation data). Meanwhile, wholesale inflation as measured by the Producer Price Index rose more than expected in April, but the previous month's reading was revised down.

The S&P 500 gained 0.4% and closed at 5,246, while the Nasdaq Composite gained 0.7% and ended the day at 16,511. The Dow Jones Indsutrial Average added 0.3% to end at 39,558.

NIFTY50

May Futures: 22,308 (▲0.5%)

Open Interest: 4,33,325 (▼7.6%)

The NIFTY50 extended its rally for the third consecutive day, closing Tuesday's session above the 22,200 level. The index confirmed the bullish reversal pattern that formed on the 13 May and approached immediate resistance at the 20 and 50 day moving averages (DMAs).

In our yesterday’s analysis we highlighted traders to keep an eye on the confirmation of the hammer pattern, which is also known as a reversal pattern. Today, the NIFTY50 extended the rebound and closed above the high of the hammer as well as the high of the inside candle which was formed on 12 May.

However, with the broader trend of the index still negative, the NIFTY50 has now approached the crucial zone next to its 20 and 50 DMAs. At this point, the risk/reward remains favourable for both buyers and sellers. In this scenario, traders may want to keep an eye on the 50 DMA for a close above or below it. A close above the 50 DMA may see the index begin its journey towards 22,500, while a rejection of the 50 DMA will lead to further weakness.

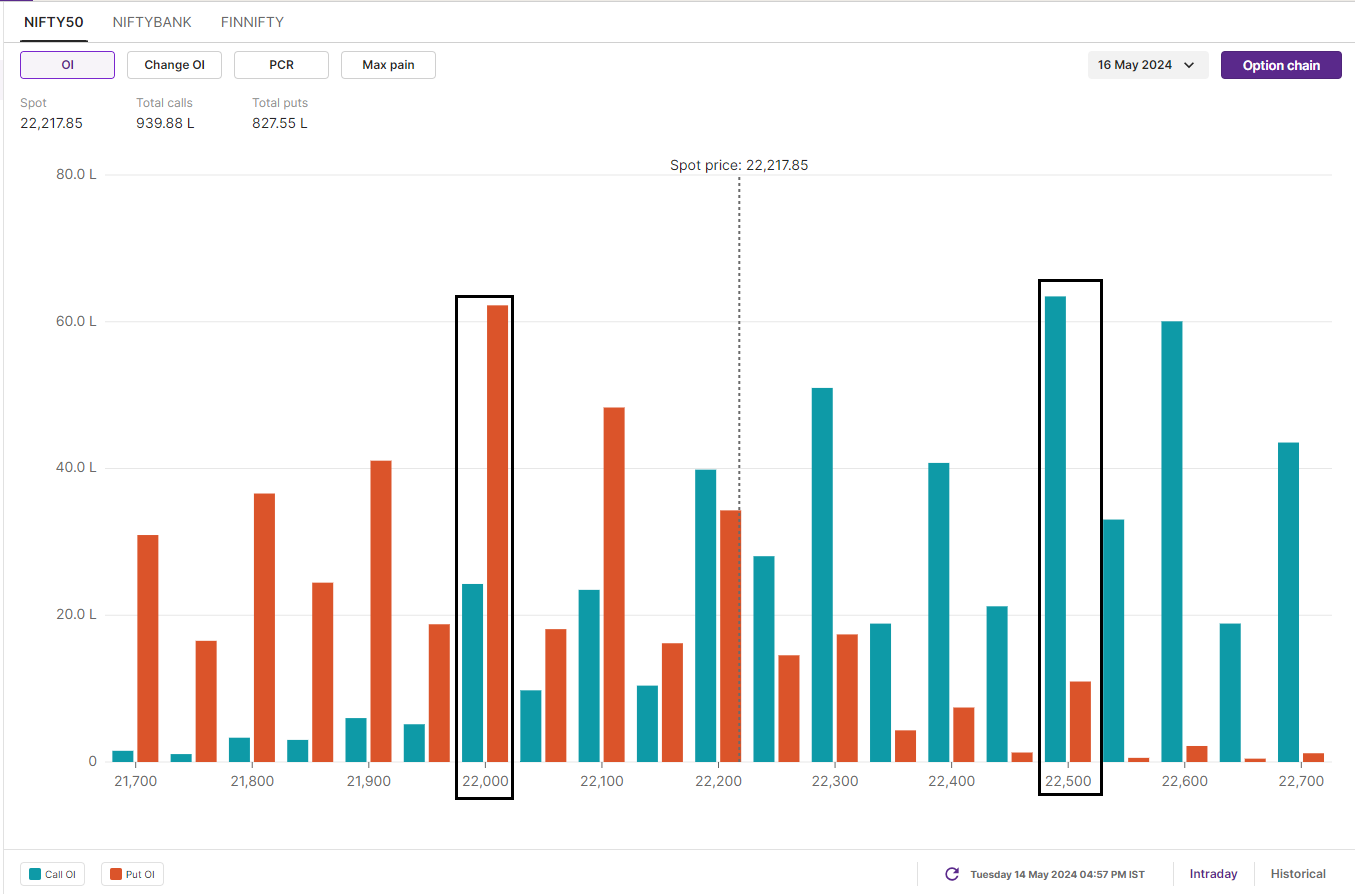

The open interest (OI) analysis for the 16 May expiry shows significant call OI at the 22,500 and 22,400 strikes. On the other hand, the put OI is at the 22,000 and 22,100 strikes. Based on the options data, traders expect the NIFTY50 to trade between 21,900 and 22,500.

BANK NIFTY

May Futures: 48,003 (▲0.1%)

Open Interest: 1,56,322(▲2.6%)

After a flat start, the BANK NIFTY shrugged off the initial volatility and traded in a narrow range of 300 points ahead of the weekly expiry of its options contracts. The banking index extended the upmove from its 50-DMA and formed a small positive candle on the daily chart, confirming the hammer pattern formed on 13 May.

In our previous two blogs we highlighted the inverted hammer and hammer patterns, both of which formed on the 13 and 14 of May. As mentioned, the banking index closed above the high of the hammer pattern, confirming the bounce as a reversal. However, with the broader trend still weak, traders will want to keep an eye on the price action near the index's immediate resistance at the 20 DMA (around 48,200). A close above or a rejection of this level will provide further directional clues for the index.

For today's expiry, we have provided our readers with an hourly chart. As you can see on the chart below, the blue area (47,600) is the immediate support for the index and the resistance remains between the 48,000 and 48,200 zones. A break on either side will give additional clues for today's expiry.

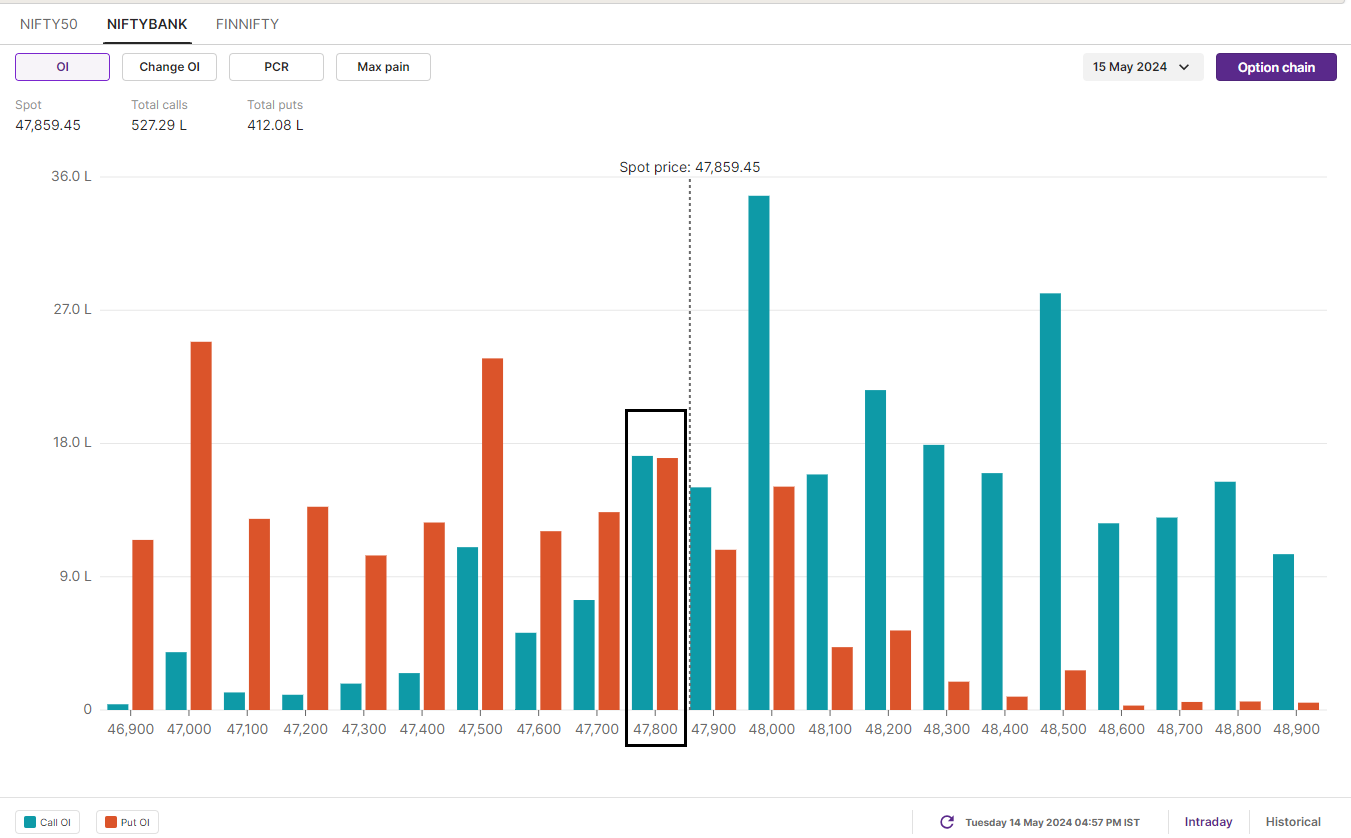

The options build-up for today's expiry has the highest call open interest at the 48,000 strike, while the put base is set at the 47,500 and 47,000 strikes. Based on the options data, traders expect the BANK NIFTY to trade between 47,200 and 48,300.

FII-DII activity

Stock scanner

Long build-up: National Aluminium, Jindal Steel, Hindustan Aeronautics, Birlasoft, Oberoi Realty and ONGC

Short build-up: Cipla, Lupin and PVR Inox

Under F&O ban: Balrampur Chini, Birlasoft, Canara Bank, GMR Infra, Hindustan Copper, Idea, Piramal Enterprises, Steel Authority of India (SAIL) and Zee Entertainment

Out of F&O ban: Punjab National Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story