Market News

Bajaj Finance Q3 results: Earnings preview, technical structure and options strategy ahead of results

.png)

4 min read | Updated on January 29, 2025, 08:10 IST

SUMMARY

Shares of Bajaj Finance are trading within a range and is forming a symmetrical triangle pattern since October 2021. Positional traders can monitor this pattern on the weekly chart as bthe reak of the pattern on a closing basis will provide further clues

Bajaj Finance to announce Q3 today

Leading non-banking financial company (NBFC) Bajaj Finance is set to announce its December quarter (Q3FY25) results on January 29, 2025, likely after market hours. Analysts expect strong growth in net interest income (NII) and net profit, driven by robust expansion in the loan book and assets under management (AUM).

Bajaj Finance’s NII is projected to rise 19-24% year-on-year to ₹9,150–₹9,450 crore, while net profit is estimated to increase 10-14% YoY, ranging between ₹4,050 and ₹4,200 crore. For context, the company reported a standalone net profit of ₹5,614 crore in Q2FY25 and ₹3,177 crore in Q3FY24. In its quarterly business update, Bajaj Finance highlighted a 22% YoY growth in new loans booked, reaching 1.20 crore, and a 28% YoY increase in AUM to ₹3.98 lakh crore.

Investors will closely monitor the management’s commentary on key aspects such as loan growth outlook, net interest margin, and trends in gross and non-performing assets (NPAs). Ahead of the results, Bajaj Finance shares closed at ₹7,606, up 4.2% on January 28, and have gained 11.4% so far this month.

Technical View

Shares of Bajaj Finance have been consolidating within a range since October 2021 and forming a symmetrical triangle pattern on the weekly chart. As shown in the chart below, Bajaj Finance is currently trading above its weekly 21, 50 and 200 exponential moving averages (EMAs), signalling strength. Positionally, traders can monitor the pattern as a breakout or breakdown of this pattern on a closing basis will provide further clues.

Options outlook

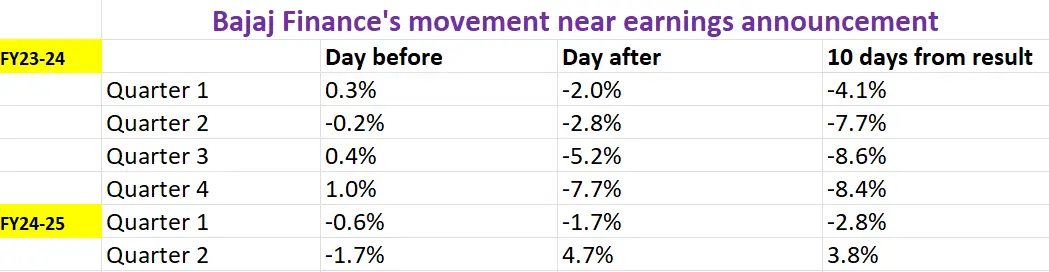

Bajaj Finance's 27 February at-the-money strike is 7,600, with both the call and put options priced at ₹592 as of 28 January. This suggests that traders are expecting a price movement of ±7.8% till its 27 February expiry. However, let's take a look at Bajaj Finance's historical price behaviour during past earnings announcements to make more informed trading decisions.

Options strategy for Bajaj Finance

Given the implied movement of ±7.8% from the options market ahead of the 27 February expiry, traders can take a look at the long and short Straddle strategies to take advantage of the anticipated volatility and price swings.

For those looking to capitalise on the expected volatility, the Long Straddle strategy is appropriate. This involves buying both an at-the-money (ATM) call and put option with the same strike price and expiry of Bajaj Finance, with the aim of profiting from a move of more than ±7.8% in either direction.

Conversely, the Short Straddle strategy is suitable for scenarios where volatility is expected to fall. In this approach, a trader would sell both an ATM call and put option with the same strike price and expiry, implying that the price of Bajaj Finance will remain within a range of ±7.8% after the earnings release.

Traders looking to implement bullish or bearish option strategies can consider directional spreads, which offer a slightly more advanced approach. For a bullish outlook, a bull call spread can be used by buying a call option and simultaneously selling a call option with a higher strike and the same expiry date. Similarly, for a bearish view, traders can use a bear put spread by buying a put option and selling a put option with a lower strike and the same expiry date.

Interested in learning more about Straddles? Check out our UpLearn educational content for a deeper dive. If you're keen on exploring more historical earnings price data like the example above, join our community and get in touch—we'd be happy to share it with you!

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story