Market News

Motilal Oswal Mutual Fund forays into the defence sector; Launches first ever Defence Index Fund – details inside

.png)

5 min read | Updated on June 13, 2024, 18:42 IST

SUMMARY

Motilal Oswal Mutual Fund has launched India's first defence-focused index fund, the Motilal Oswal Nifty India Defence Index Fund. This open-ended fund tracks the Nifty India Defence Index, reflecting companies in defence manufacturing and servicing. With a minimum investment of ₹500 and a 1% exit load within 15 days, it aims to capitalize on India's growing defence sector.

Motilal Oswal Mutual Fund forays into the defence sector; Launches first ever Defence Index Fund – details inside

Motilal Oswal Mutual Fund launched the Motilal Oswal Nifty India Defence Index Fund, India's first-ever index fund focused on defence companies. This open-ended fund aims to mirror the performance of the Nifty India Defence Index, which tracks companies involved in defence manufacturing and servicing. The fund has a minimum investment of ₹500 and there is no charge to get in, but there is a 1% exit load if you redeem your investment within 15 days of allotment. The offer is open until June 24th, so if you are interested in getting a piece of the growing Indian defence sector, this could be a good option for you.

The index fund will track the Nifty India Defence Index, which comprises 15 companies operational in the defence manufacturing and servicing industry. The fund house said the government's thrust on reducing imports and focus on national security bodes well for defence companies. “According to market experts, companies in this sector have improved their balance sheets and also their profitability through the continued increase in exports and increase in defence expenditure by the government,” it said.

Why invest in the Defence Theme of India?

Nomura research indicates that there is considerably high potential in defence sector development in the country with an estimated $138 billion pipeline in FY24-FY32. A bright future awaits those who want to take part in the Indian defence sector growth.

Various changes to government policies and the defence sector leading to prioritizing this sector are responsible for the recent stellar performance of this sector. To reduce imports and increase defence manufacturing within India the government of India has put an import embargo on 4600+ defence items by December 2027 hence moving towards self-reliance('Atmanirbhar Bharat'). The government is also actively aiming to increase exports of defence goods and services which is estimated to double in the coming 3-4 years according to Nomura Research.

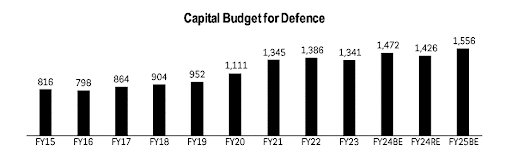

India’s Defence Capex: Focus on self-reliance

Over the next 5-6 years, there is a significant domestic defence opportunity valued at USD 100-120 billion, augmented by an embargo list of defence items that restricts their import, thereby creating opportunities for the Indian defence industry, further bolstered by the allocation of 68% of the capital-acquisition budget for FY23 towards domestic procurement.

Source: Ministry of Defence Budget FY24 Data as of April 2024

Source: Ministry of Defence Budget FY24 Data as of April 2024Motilal Oswal Nifty India Defence Index Fund

The investment objective of the Motilal Oswal Nifty India Defence Index Fund is to provide returns that, before expenses, correspond to the total returns of the securities as represented by the Nifty India Defence Total Return Index, subject to tracking error. However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

Benchmark

The performance of the Motilal Oswal Nifty India Defence Index Fund will be benchmarked to the performance of the Nifty India Defence Total Return Index.

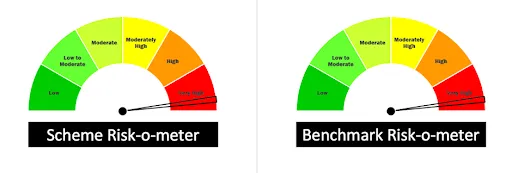

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Constituents of Nifty India Defence Index | Very High | 95% | 100% |

| Liquid schemes and Money Market | Low | 0% | 5% |

Who Should Invest?

Motilal Oswal Nifty India Defence Index Fund is helpful to people looking for income that mirrors the movement of the Nifty India Defence Total Return Index in addition to tracking errors as well as long-term capital appreciation.

Other Defence Theme Mutual Fund Schemes

| Scheme Name | Exposure as a % of the portfolio |

|---|---|

| HDFC Defence Fund | 65.29 |

| 360 ONE Quant Fund | 9.99 |

| Kotak Emerging Equity Fund | 9.67 |

| DSP India T.I.G.E.R Fund | 8.52 |

| Edelweiss Mid Cap Fund | 8.27 |

| HSBC Infrastructure Fund | 7.14 |

| Source: PersonalFN Research, Data as of March 31, 2024. |

Who Manages the Scheme?

Conclusion

Investors seeking exposure to India's burgeoning defence sector may find the Motilal Oswal Nifty India Defence Index Fund attractive. With government initiatives promoting self-reliance and increased defence expenditure, the fund offers potential long-term capital appreciation and income mirroring the Nifty India Defence Index's performance, managed by experienced professionals.

About The Author

Next Story