Market News

Kotak Mahindra mutual fund introduces fund catering to special situations

.png)

4 min read | Updated on June 11, 2024, 19:31 IST

SUMMARY

Kotak Mahindra Mutual Fund has launched the Kotak Special Opportunities Fund, aiming to capitalise on special situations like mergers and policy changes for long-term capital growth. This open-ended thematic fund requires a minimum investment of ₹100, has no lock-in period, and is open until June 24, 2024.

Kotak Mutual fund launches special situations fund

Kotak Special Opportunities Fund is a new mutual fund launched by Kotak Mahindra Mutual Fund that aims to grow your money over the long term. It will be looking to invest in companies facing special situations, like mergers, government policy changes, or even temporary challenges. The idea is to find opportunities where these events can lead to big gains.

It is an open-ended thematic fund, which means you can invest any time and there's no lock-in period for your money. The minimum investment is just ₹100, and the offer is open until June 24, 2024. Just keep in mind that there is no guarantee on how the fund will perform.

What are special situations?

Special situations refer to opportunities, challenges, or events such as Company Specific Events/Developments, Corporate Restructuring, Government Policy changes, Regulatory changes, Technology led Disruption/Innovation, companies going through temporary but unique challenges, and other similar instances.

What are some examples of special situations?

Technology Led Disruption/Innovation

The above list is illustrative and not exhaustive, several other opportunities may give rise to special situations.

Kotak Special Opportunities Fund

The investment objective of the Kotak Special Opportunities Fund is to generate long-term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Events/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

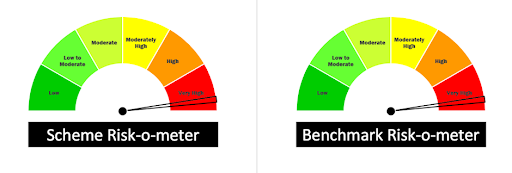

The performance of the Kotak Special Opportunities Fund will be benchmarked to the performance of Nifty 500 TRI.

Fund allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity - special situations theme | Very High | 80% | 100% |

| Equity - Other than of special situation’s theme and Overseas Mutual Funds schemes/ETFs /Foreign Securities | Very High | 0% | 20% |

| Debt and Money Market | Low to Moderate | 0% | 20% |

| REITs & InvITs | Very High | 0% | 10% |

- Investors interested in capitalizing on unique market conditions.

- Investors willing to have Strategic Allocation to an overall equity portfolio.

- Investors with long-term investment horizon i.e. 5 years and above.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Ret (%) |

|---|---|---|---|---|---|---|

| ICICI Pru India Opportunities | 19072.35 | 1.65 | 47.95 | 27.36 | 24.19 | 23.54 |

| Axis Special Situations Fund | 1216.846 | 2.23 | 33.02 | 14.77 | - | 16.27 |

Who Manages the Scheme?

Devender Singhal is a highly experienced expert in the Indian equity markets whose career spans 22 years. He worked at Kotak Mahindra AMC for more than 15 years during which he specialised in fund management for most of his tenure lasting for eight years. As an analyst mainly in the consumer, auto and media sectors, he has developed a good feel for market behaviour across different industries.

Investors seeking long-term capital growth from unique market conditions may find the Kotak Special Opportunities Fund appealing, managed by experienced equity market expert Mr. Devender Singhal. However, like all investments, it carries risks and performance may vary.

About The Author

Next Story