Market News

ICICI Prudential Mutual Fund launches India’s first ever Oil & Gas ETF

.png)

4 min read | Updated on August 21, 2024, 07:32 IST

SUMMARY

The ICICI Prudential Mutual Fund unveiled the first Nifty Oil & Gas ETF in India on July 8, 2024. It tracks the Nifty Oil & Gas TRI index that gives diversified oil and gas sector exposure to investors with a minimum investment of ₹100 and its New fund offer (NFO) will close on July 18, 2024.

The minimum investment amount is ₹100 and there is no exit load for units sold on the secondary market

ICICI Prudential Nifty Oil & Gas ETF is an open-ended exchange-traded fund (ETF) launched by ICICI Prudential Mutual Fund on July 8, 2024. The objective of the scheme is to track the performance of the Nifty Oil & Gas TRI, an index that reflects the performance of companies in the oil and gas sector.

The minimum investment amount is ₹100 and there is no exit load for units sold on the secondary market. However, investors will be responsible for any brokerage charges incurred during the sale. The new fund offer (NFO) closes on July 18, 2024.

The Nifty Oil & Gas Index features 15 companies from the oil, gas and petroleum industry. These companies are chosen from the Nifty 500 based on their market value that is freely available for trading. The selection ensures that no single company has more than 33% weight, and the top three companies together do not exceed 62% of the index. This approach ensures a well-balanced and diversified exposure to the sector.

Speaking on the launch of the product, Chintan Haria, Principal - Investment Strategy at ICICI Prudential AMC, said, "ICICI Prudential Nifty Oil & Gas ETF is designed to provide investors with access to a sector that is pivotal to the economy and is currently undervalued. The oil and gas sector is the driving force of modern economic growth, and with growing demand and consumption, it presents a significant investment opportunity. Our ETF aims to allow investors to capitalise on the resurgence in global interest in this sector."

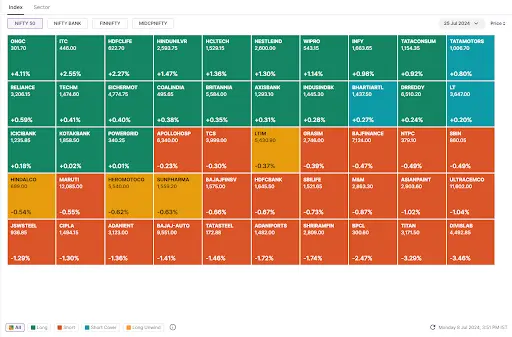

Performance of the Index: Calendar Year Returns (%)

Nifty Oil & Gas TRI has Outperformed the Nifty 500 TRI six times in the last 10 years. On a YTD basis (as of June 20, 2024) also the index has been outperforming the Nifty 500 TRI.

Data as of June 20, 2024. Data Source: Company press release

The Nifty Oil & Gas Index is updated twice a year to reflect the sector's performance accurately and has outperformed broader market indices in many years, as shown in the above graph, demonstrating its potential for delivering superior returns.

ICICI Prudential Nifty Oil & Gas ETF

The performance of the scheme will be benchmarked against Nifty Oil & Gas TRI. Since the scheme is an ETF scheme, the composition of the benchmark is such that it is most suited for comparing the performance of the scheme.

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity of companies constituting the underlying index (Nifty Oil & Gas Index) | Very High | 95% | 100% |

| Money market instruments including TREPs | Very Low | 0% | 5% |

Source: Scheme information document

Why invest in ICICI Prudential Nifty Oil & Gas ETF?

- Provides exposure to companies within the oil and gas sector.

- Enables diversification across different segments of the oil and gas value chain.

- Historically, the Nifty Oil & Gas Index has had a strong performance with a favourable valuation compared to broader market indices.

Who manages the scheme?

Nishit Patel has been serving as a fund manager at ICICI Prudential Mutual Fund since July 8, 2024. He holds a Bachelor of Commerce degree and is a qualified Chartered Accountant. Before joining ICICI Prudential Mutual Fund, he gained experience working at K.K. Dand & Co.

Since July 8, 2024, Priya Sridhar has also served as a portfolio manager with ICICI Prudential Mutual Fund. She holds a Bachelor of Commerce and a Masters of Financial Management. She was previously associated with ITI Mutual Fund as well as LIC Housing Finance Ltd.

Conclusion

The ICICI Prudential Nifty Oil & Gas ETF offers a unique investment opportunity in the undervalued oil and gas sector, providing diversified exposure with a strong historical performance. Managed by experienced professionals, the ETF is well-positioned to capitalise on the sector's growth and resurgence in global interest.

About The Author

Next Story