Market News

Helios Mutual Fund ventures into financial services with Helios financial services fund

.png)

6 min read | Updated on May 31, 2024, 20:04 IST

SUMMARY

Helios Mutual Fund has launched the Helios Financial Services Fund, focusing on long-term growth through investments in financial services companies. This open-ended sectoral fund requires a minimum investment of ₹5,000 and no exit load after 3 months.

Helios Mutual Fund Ventures into Financial Services with Helios Financial Services Fund

Helios Mutual Fund is launching a new fund called Helios Financial Services Fund. This fund aims to grow your money over the long term by investing in stocks of companies that provide financial services, like banks and insurance companies.

An open-ended fund, meaning you can buy and sell units whenever you want. It is a sectoral fund, so it only invests in one industry, which can be risky. There is no upfront fee to invest (entry load), but if you sell your units within 3 months of buying them, you might get hit with an exit load. You can invest for as little as ₹5,000 and then add more. The fund is open for subscription starting today, May 31, 2024, and closes on June 14, 2024.

Why invest in the financial service sector?

Investing in India's financial services sector offers a robust opportunity, driven by several key factors. India's demographic advantage is notable, with 68% of the population being young and 55% within the working age group of 20-59 years as of 2020. By 2030, the country is set to add 140 million middle-income and 21 million high-income households. This demographic shift is expected to drive significant demand across financial services.

Additionally, India’s middle class is expanding rapidly, with households earning $35,000+ increasing by 4.5 times from 25.2 million in 2021 to 112.3 million by 2031. Concurrently, the number of households with an annual income between $10,000 and $35,000 will surge by 95 million, indicating a massive influx of potential consumers for financial products and services.

Technological advancements further bolster this sector's attractiveness. India, the second-largest internet market globally, is projected to reach approximately 1 billion internet users by 2026. This is complemented by a dramatic rise in digital transactions, with UPI processing 51,049 million transactions worth ₹76,117 billion between January and April 2024. The digital lending market is set to expand from $90 billion in 2020 to over $720 billion by 2030, representing a significant growth trajectory.

Furthermore, the proliferation of smartphones and the lowest global data costs have enabled broader access to digital financial services, propelling sectors such as digital lending, which is projected to constitute 60% of India’s fintech market by 2030. These factors collectively highlight the immense growth potential and diverse investment opportunities within India's financial services sector.

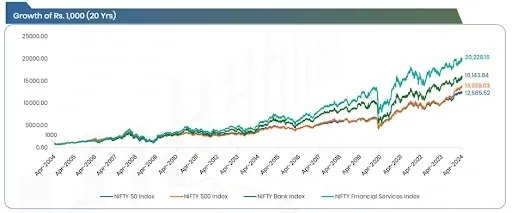

Over the past 20 years, the financial services sector as well as the banking sector has outperformed the broad market indices as follows:

| Indices | NIFTY 50 Index | NIFTY 500 Index | NIFTY Bank Index | NIFTY Financial Services Index |

|---|---|---|---|---|

| CAGR Returns (20 Years) | 13.50% | 14.08% | 14.92% | 16.22% |

Helios Financial Services Fund

The investment objective of the Helios Financial Services Fund is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity-related securities of companies engaged in financial services. However, there can be no assurance that the investment objective of the Scheme will be realized.

Benchmark

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity - Financial Services Sector | Very High | 80% | 100% |

| Equity - Other | Very High | 0% | 20% |

| Debt and Money Market | Low to Medium | 0% | 20% |

Who Should Invest?

This NFO of Helios Financial Services Fund is designed for investors who want to build wealth over time, avoiding a balance to mainly invest in financial services equity or related financial securities.

Peer Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year | 3 Years | 5 Years | 10 Years | **Since Launch ** |

|---|---|---|---|---|---|---|---|

| Returns (%) | |||||||

| Sundaram Fin Services Opportunities | 1258.41 | 2.13 | 30.49 | 18.03 | 15.72 | 14.78 | 14.86 |

| Invesco India Fin Services Retail | 811.68 | 2.31 | 30.11 | 15.83 | 13.51 | 15.43 | 16.47 |

| SBI Banking and Fin Services | 5326.55 | 1.85 | 27.18 | 13.5 | 12.57 | - | 14.07 |

| Baroda BNP Paribas Banking and Fin Services Plan A | 135.30 | 2.46 | 22.49 | 12.53 | 10.17 | 11.6 | 12.26 |

| Nippon India Banking and Financial Services Fund | 5541.72 | 1.9 | 21.42 | 17.16 | 11.66 | 13.74 | 20.68 |

| Category Average | - | - | 20.35 | 13.7 | 11.39 | 13.47 | 15.73 |

| Nifty Financial Services TRI | - | - | 11.88 | 10.51 | 10.93 | 14.54 | 17.53 |

Who Manages the Scheme?

He has over 32 years of work experience in the area of investment. He has been a part of Helios Group since its inception in 2005 and was one of the first employees in Helios’ Singapore office. For the 18 years that Alok has been with Helios, he has been the second senior most resource in the investment team at Helios Singapore, where he had an important role in assisting the portfolio manager. Before joining Helios, Alok worked in India with various broking firms in sales roles for over 14 years.

Helios Financial Services Fund is an attractive option for investors seeking long-term capital appreciation in the financial services sector. Managed by experienced professionals, it leverages India's favourable demographics and technological advancements to tap into substantial growth potential. This fund is suitable for those looking to diversify their portfolio within a high-growth industry.

About The Author

Next Story