Market News

RBI keeps repo rate unchanged at 5.5%: What is the takeaway for equity market investors?

3 min read | Updated on August 06, 2025, 11:10 IST

SUMMARY

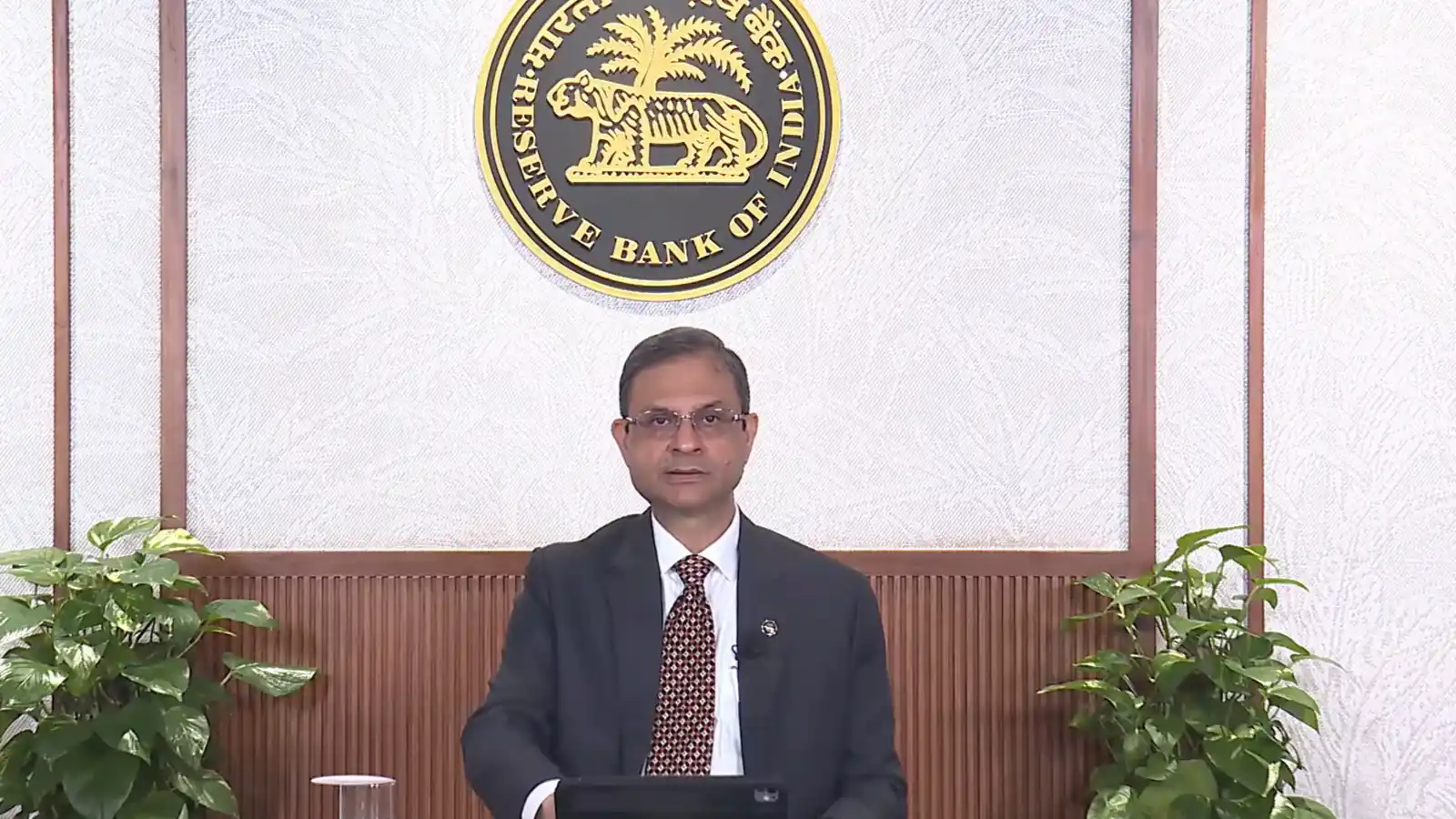

RBI Monetary Policy 2025: Announcing the third bi-monthly monetary policy of the current fiscal year, RBI Governor Sanjay Malhotra on Wednesday, August 6, said the growth rate projection for FY26 has been retained at 6.5%.

The RBI's MPC retained the neutral stance, weighed down by concerns over tariff uncertainties. | Image: Shutterstock

Announcing the third bi-monthly monetary policy of the current fiscal year, RBI Governor Sanjay Malhotra on Wednesday, August 6, said the growth rate projection for FY26 has been retained at 6.5%.

The governor further said the MPC unanimously decided to keep the short-term lending rate, or repo rate, unchanged at 5.5% with a neutral stance.

Sharing their views on the RBI's decision, fund managers note that the status quo on rates signals a deliberate pause after frontloading 100 bps in cuts earlier this year. They note that the continued emphasis on withdrawal of accommodation reflects a prudent balancing act between anchoring inflation expectations and supporting growth momentum.

"With headline inflation easing sharply – June CPI at just 2.1% and core inflation remaining well anchored – the central bank is justified in maintaining a wait-and-watch approach. The policy stance remains neutral, but with a distinctly dovish tone, suggesting openness to further easing should growth or global conditions warrant it," said Anil Rego, Founder & Fund Manager of Right Horizons PMS.

Sonam Srivastava, Founder and Fund Manager at Wright Research PMS, said the central bank has rightly highlighted the upside risks to inflation from global crude prices, erratic monsoons, and supply-side uncertainties, even as the domestic macro backdrop remains resilient.

With core inflation moderating and economic activity holding up—evident from robust GST collections, credit growth, and PMI readings—the RBI is likely to remain data-dependent and cautious, Srivastava opined.

"Markets, however, are starting to price in a pivot later this year, especially if food inflation eases and global financial conditions soften. We believe rate cuts may materialise in late Q4 FY26, not before. On the equity front, this stance reinforces a case for being selective, with a tilt towards domestic cyclical themes such as financials, industrials, and consumption, which stand to benefit from eventual monetary easing and potential fiscal stimuli ahead of the 2026 elections," the fund manager said further.

Meanwhile, Rego notes the RBI continues to highlight global uncertainties, including tariff-related risks and volatile capital flows, as key watchpoints.

At the same time, India’s domestic macro environment remains resilient, buoyed by strong government capex, stable rural demand, and improving liquidity conditions. However, subdued credit growth below 10% and uneven urban consumption trends are likely to keep the policy accommodative at the margins.

"From a market perspective, the RBI’s tone will be viewed as growth-supportive without being reckless, especially as inflation is expected to be at 3.1% for FY26. Rate-sensitive sectors such as banking, real estate, and autos could benefit from the sustained dovish backdrop," Rego added.

Related News

About The Author

Next Story