Market News

Economic Survey 2025-26: What the survey said on household savings and bond markets in India

.png)

3 min read | Updated on January 29, 2026, 15:19 IST

SUMMARY

Economic Survey: The survey added that a well-diversified portfolio should include adequate exposure across a broad range of asset classes. In this context, participation in debt, specifically market-based debt instruments, has not kept pace with the significant reorientation of household savings towards equities.

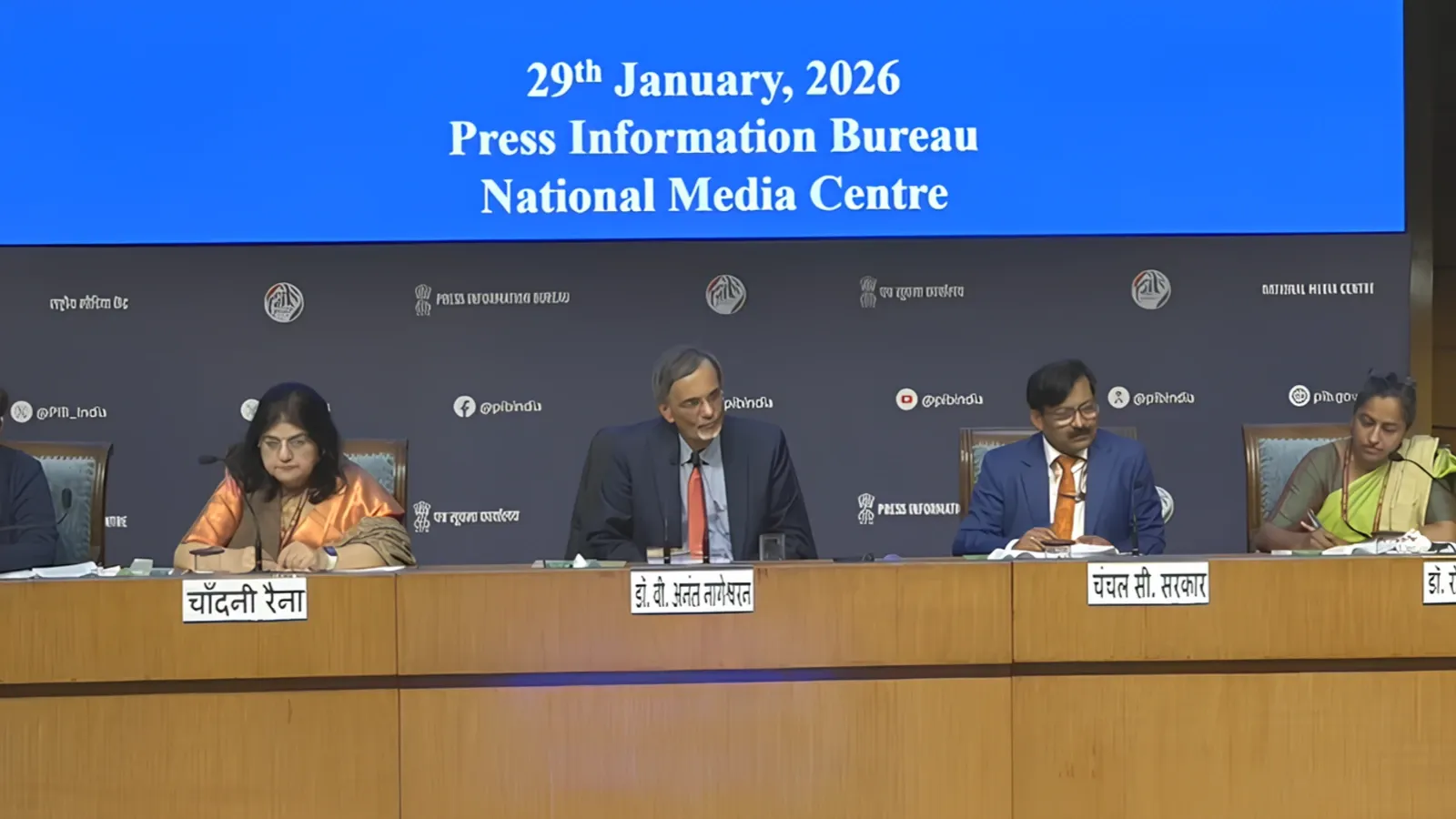

Retail engagement with corporate bonds and debt-oriented investment products remains limited, the Economic Survey points out. | Image: Shutterstock

This transition has been marked by a gradual but persistent movement towards market-linked instruments, particularly equities, reflecting both structural changes in the financial system and evolving household risk preferences, it added.

Equity investments, which were once ancillary to household balance sheets, have increasingly become a significant component of financial wealth, supported by broader participation and more diversified channels of access.

Beyond equities, the development of debt-linked instrument markets is a logical next step towards achieving balanced, diversified portfolios and meeting long-term financial goals.

Post-COVID period

The survey said that the post-pandemic period marked a decisive inflexion in household engagement with equity markets. The unique investor base expanded sharply in the initial years following the pandemic, rising from around 3.1 crore in FY20 to over 11 crore by FY25.

Although net additions to the investor base have moderated in the current fiscal year, net inflows of domestic investors into equity markets have remained resilient.

Over the past five years, cumulative inflows by domestic investors into the equity markets have been substantially higher than from foreign investors. This shift highlights the increasing ability of domestic savings to support equity markets, stabilise the market, and mitigate the volatility associated with external capital flows.

Ideal Portfolio

The survey added that a well-diversified portfolio should include adequate exposure across a broad range of asset classes. In this context, participation in debt, specifically market-based debt instruments, has not kept pace with the significant reorientation of household savings towards equities.

The household ownership share of deposits has decreased, while that of pension and insurance assets has remained almost unchanged over the period from FY19 to FY24.

Bonds and retail investors

Retail engagement with corporate bonds and debt-oriented investment products remains limited, resulting in debt securities comprising a small portion of household financial assets.

This limited participation of households in market-based debt instruments is mirrored in the overall shallow depth of India’s corporate bond market.

The document added that India’s corporate bond market remains underdeveloped, accounting for around 16-17% of GDP, compared with the equity market capitalisation of over 130% of GDP.

This is substantially lower than in major peer economies, such as the United States and China, where corporate bond markets constitute approximately 40% and 36% of GDP, as of 2024, respectively.

Related News

About The Author

Next Story