Market News

50% tariff on India a reality now: What would be the impact? Check three scenarios

3 min read | Updated on August 28, 2025, 12:13 IST

SUMMARY

50% tariff on India: Exporters said the imposition of a 25% penalty on India over and above the 25% tariff move will disrupt the flow of Indian goods to its largest export market.

The US accounted for about 20% of India's $437.42 billion worth of goods exports in 2024-25. | Image: Shutterstock

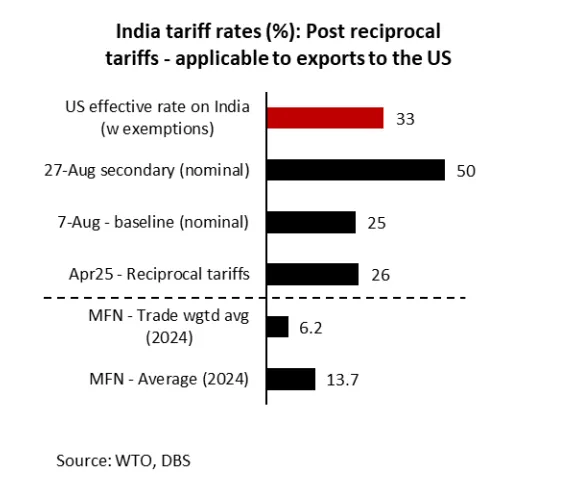

Exporters said the imposition of a 25% penalty on India over and above the 25% tariff move will disrupt the flow of Indian goods to its largest export market.

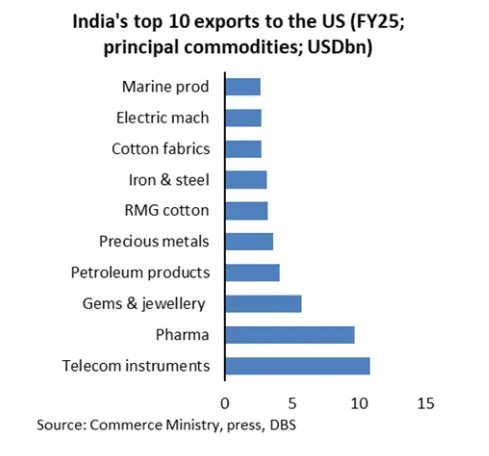

The US accounted for about 20% of India's $437.42 billion worth of goods exports in 2024-25.

The US was the largest trading partner of India from 2021 to 2022.

In 2024-25, the bilateral trade in goods stood at $131.8 billion ($86.5 billion in exports and $45.3 billion in imports).

According to a research report authored by Radhika Rao, Senior Economist at DBS Group Research, the impact on growth will depend on the duration of these high tariffs.

The group has outlined three scenarios.

- Firstly, assuming the punitive high tariff of 50% only remains in place until the end of 2025 and returns to a more competitive baseline rate of 15-20% thereafter, the impact on growth will be less.

"We would maintain our sub-consensus forecast of 6.3% yoy for FY26 under this assumption. While a US delegation’s visit to India in August was deferred, there is a likelihood that a broader compromise between the US and Russia might provide some pipeline support to India, especially on the additional levy," the report adds.

-

Secondly, assuming the 50% tariff rate applies for FY26 and FY27, the impact is likely to be more material, necessitating a 50-60 bps (basis points) reduction in growth forecasts, split between the 2H FY26 and FY27 growth.

-

Third and the most bearish scenario is that high tariffs effectively squeeze out half of India’s export basket to the US, comprising the most vulnerable sectors, which will then have a deeper, nearly 1.0-1.2 percentage point impact on growth outcomes.

"We see this as less probable, given the scope of bilateral and multilateral negotiations in the rest of this year and 2026," the report says.

Balance of payments (BoP) front

The report adds that the material impact on growth due to an extended period of high tariff – impacting goods trade balance as well as capital account due to negative portfolio flows – will push the BOP into a deeper negative, weighing on the currency.

"The strong foreign reserves buffer of over $690 billion, however, provides good defence and will mitigate any one-sided/extended weakness in the currency," the report said.

Monetary policy implications

Signs of downside risks to growth could draw in the central bank’s hand via rate cuts, alongside potential relief on the credit and liquidity front. Relief on direct (income tax relief) and indirect taxes (GST rationalisation) are timely support levers, although the lift might be one-off and not demand accretive beyond FY26.

"Our baseline forecast is for the repo rate to be maintained at 5.5% in the rest of FY26," the report said.

Related News

About The Author

Next Story