Market News

Robust IPO activity boosts BSE IPO index to record highs in 2024

.png)

3 min read | Updated on December 11, 2024, 14:09 IST

SUMMARY

The IPO market in India has been buzzing, with the BSE IPO Index soaring 34.83% in 2024 compared to SENSEX’s return of 12.83%. In the calendar year 2024, 139 IPOs were launched, raising ₹1,34,359 crore, with 88 constituents in the index (provisionally). Despite market corrections since September impacted subscriptions, the BSE IPO Index has outperformed benchmarks over 5 years with significant returns.

Robust IPO activity boosts BSE IPO index to record highs in 2024

Since the beginning of 2024, the Indian IPO market has demonstrated impressive strength, with the S&P BSE IPO index surging by 34.83%, significantly outperforming the Sensex's 12.83% returns. This IPO boom was driven by favourable market sentiment and India’s resilient economic growth, which attracted strong investor participation.

However, since September, the momentum has reversed sharply due to factors such as Foreign Institutional Investor (FII) outflows, rising inflation, geopolitical uncertainties, and subdued corporate earnings. This market correction has dampened investor enthusiasm, leading to a noticeable slowdown in IPO subscriptions during October and November.

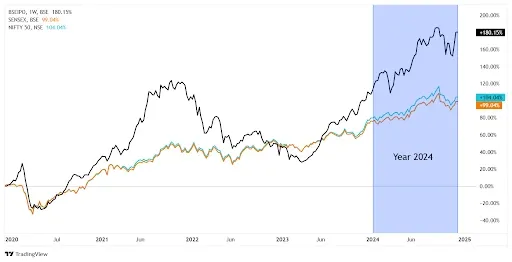

In the last 5 years, the BSE IPO index has outperformed Indian Benchmark indices by a wide margin. BSE IPO index surged by 180.15% compared to the NIFTY50’s 104.04% gains and SENSEX advanced by 99.04% in the last 5-year period. There were 269 new firms listed on exchanges with a total fundraising of ₹4,02,932 crore in the 5 years boosting the Indian stock market without any liquidity concerns.

BSE IPO Index vs Benchmark Indices - 5 Years

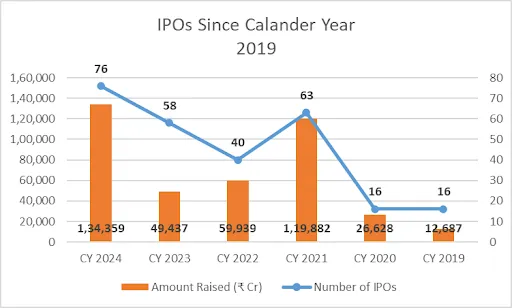

IPOs in the last 5 years in Indian Stock Market

Source: chittorgarh.com

The above chart shows the trend of IPOs and the amount raised in India over recent years. In 2024*, 76 IPOs raised ₹1,34,359 crore, marking a significant increase compared to ₹49,437 crore from 58 IPOs in 2023. In 2022, 40 IPOs raised ₹59,939 crore, while 2021 saw 63 IPOs raising ₹1,19,882 crore. In 2020, 16 IPOs raised ₹26,628 crore. This indicates varying activity and fundraising levels in the IPO market. (*2024 data is provisional.)

This year, India’s IPO market has remained flashy, with popular brands Hyundai Motors and Ola Electric stocks stumbling on listing day. Vibhor Steel Tubes, BLS E-Services, and Bajaj Housing Finance’s stocks skyrocketed on listing day. This IPO boom was fueled by high liquidity and investor’s FOMO (Fear of Missing Out). Over the last twelve months, the Indian IPO market has performed strongly, with the BSE IPO index increasing by 39.22%, surpassing the NIFTY50 Returns of 17.51% and SENSEX returns of 16.84%.

BSE IPO Index Vs Benchmark Indices - 1 Year

A total of 139 IPOs were launched in 2024 on BSE, with 76 mainboard IPOs and 63 from the BSE SME Segment. 2024 saw the highest concentration of mainboard IPOs, out of 136 IPOs 116 IPOs listed with positive gains.

The BSE IPO index is currently trading with a total market capitalisation of ₹10,19,671.57 crore. The price-to-earnings ratio for the index is 194.22x and price to book value ratio is 11.85x. As of November 30, 2024, there are 88 constituents for the index.

About the BSE IPO Index

The BSE IPO index was launched in August 2009 with a base value of 1000. Companies listed on BSE after the completion of their IPO are considered eligible for inclusion in the index. Follow-on public issues are not eligible for inclusion. For inclusion, the company must have a minimum float-adjusted market capitalisation of ₹100 crore based on the issue price. A minimum of 10 companies are maintained in the index.

About The Author

Next Story