Market News

Pace Digitek IPO Day 1: Issue subscribed 7% so far; check price band, business model & more

3 min read | Updated on September 26, 2025, 14:09 IST

SUMMARY

Until 2 PM, the initial share sale received bids for 2,016,744 shares as compared to 27,606,555 shares on offer, garnering a total subscription of 0.07 times, exchange data showed

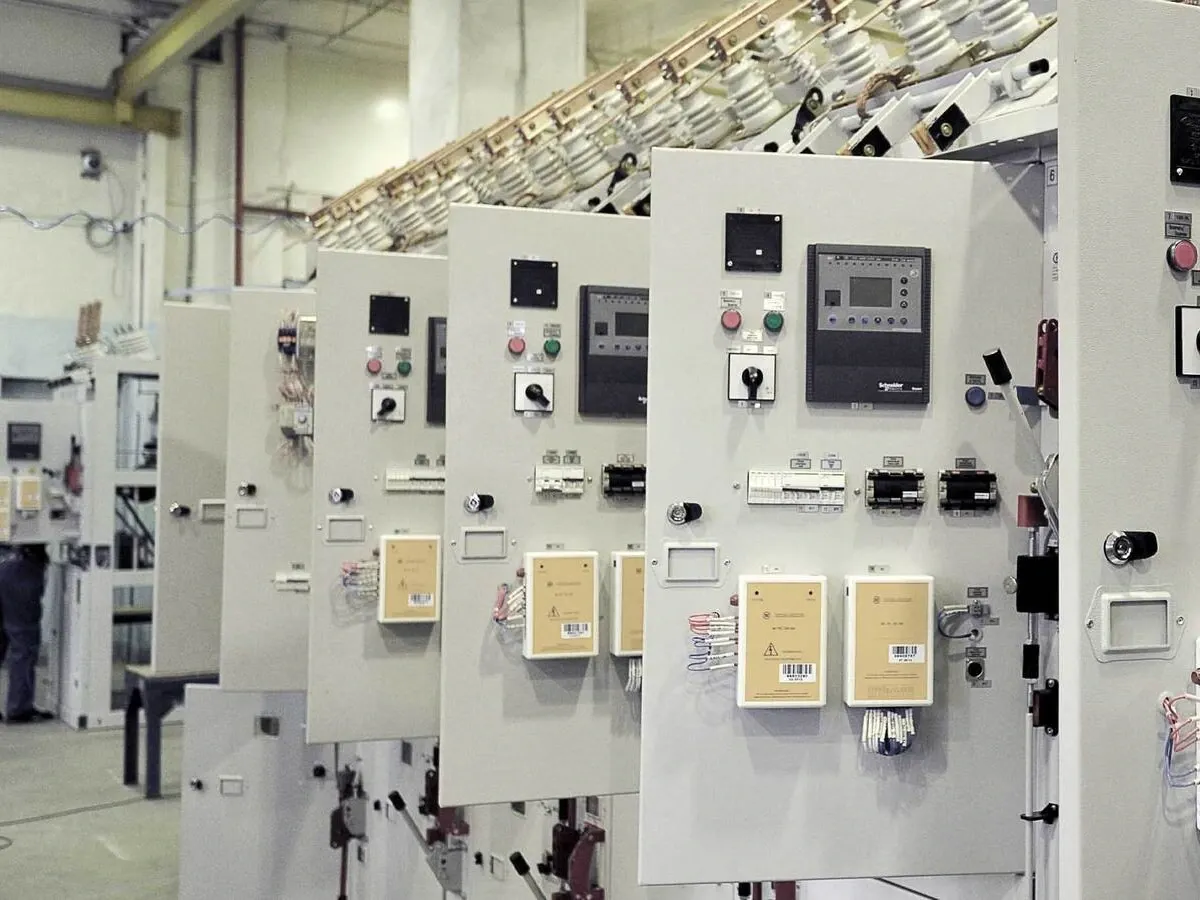

Pace Digitek is a telecom infrastructure solution provider with a focus on the telecom infrastructure industry, including telecom towers and optical fibre cables. | Image: pacedigitek.com

Until 2 PM, the initial share sale received bids for 2,016,744 shares as compared to 27,606,555 shares on offer, garnering a total subscription of 0.07 times, exchange data showed.

• Qualified Institutional Buyers (QIBs): 0.00x

• Non-institutional Investors: 0.06x

• Retail Individual Investors (RIIs): 0.12x

Incorporated in March 2007, Pace Digitek Limited is a telecom infrastructure solution provider with a significant focus on telecom tower erection and optical fibre cables. It undertakes manufacturing, installation, commissioning, operation and maintenance (O&M) of the telecom tower and optical fibre cable laying.

Pace Digitek IPO aims to raise ₹819.15 crore through its public issue. The issue is 100% book-built and a fresh issue of 3.74 crore shares.

The company has fixed the price band of the issue at ₹208 to ₹219 per share. The lot size, or the minimum bid quantity to apply for the issue, is 68 shares. This equates to a minimum investment amount of ₹14,892 per lot at the upper end of the price band for retail investors.

Pace Digitek has appointed Unistone Capital Pvt. Ltd as the book-running lead manager of the IPO, while MUFG Intime India Pvt. Ltd is the registrar for the issue.

After the bidding is closed, the allotment of shares is expected to be finalised on October 1.

Successful bidders can expect the shares to be credited to their demat accounts by October 3, with others receiving refunds on the same day. Pace Digitek shares are scheduled to list on the BSE and NSE on October 6.

Pace Digitek Limited generates its revenue through three business verticals: telecommunications, energy, and information and communication technology (ICT). The telecom segment accounted for 94.22% of FY25 revenues, underpinned by turnkey tower installation, laying of optical fibre cable (OFC), and end-to-end O&M services.

The company, through its subsidiary Lineage Power, operates three plants in Bengaluru and Bidadi covering 200,000 sq. ft., manufacturing telecom power systems, lithium-ion batteries, and BESS. In FY25, it executed 3,740 telecom towers, laid 6,619 km of OFC, and produced over 4,200 telecom power units and 3,300 battery racks, showcasing strong execution and manufacturing capabilities.

Related News

About The Author

Next Story