Market News

LG Electronics IPO: Amid mega public issue, finer details every investor must know

5 min read | Updated on October 07, 2025, 15:45 IST

SUMMARY

LG Electronics India IPO dazzles with size and growth potential, but competition from parent-linked entities and high valuations make understanding the subtle risks crucial before investing.

LG Electronics India has no exclusivity arrangement with its South Korean parent company

Home-appliance giant LG Electronics India has launched its IPO on October 7, and it is making headlines for obvious reasons.

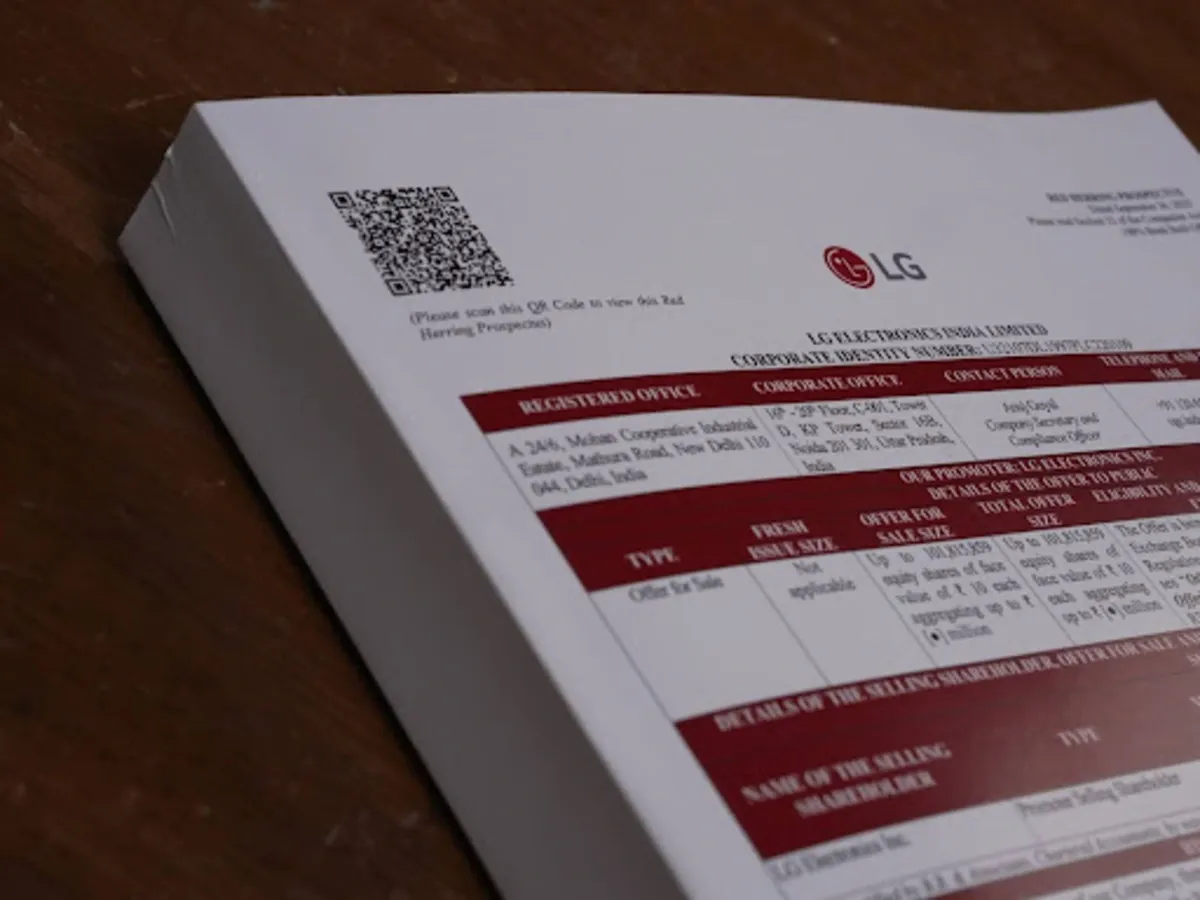

Everything about the LG Electronics IPO is huge—be it the company, the parent group, the issue size (over ₹11,600 crore) and even the media booklet I received in the company's media interaction! See the picture below for your reference.

But more often than not, big things have a tendency to take the attention away from the finer details, which can be crucial from an investor’s perspective. The same goes for the LG Electronics IPO.

Potential competition from within?

As per LG Electronics India’s red herring prospectus or RHP filed with the Securities and Exchange Board of India (SEBI), the company explicitly confirmed having no exclusivity arrangement with its South Korean parent company. This essentially allows LG Group to start a business through any other entity in India.

One might be tempted to ignore this as a generic caution. But in LG’s case, the RHP also mentions the name of its potential competitor: Hi-M Solutek India. It is a subsidiary of LG Electronics specialising in commercial air conditioner services and currently provides servicing only for LG products in India. In the future, however, it is free to offer the same services to LG’s rivals or even start a parallel business.

While the RHP does not quantify this risk, highlighting a specific subsidiary suggests it is a meaningful risk factor for investors to assess.

Now, is this unprecedented? Short answer: No.

We also checked Hyundai Motor India’s RHP. It explicitly mentions significant conflicts of interest originating from its ties with parent Hyundai Motor Company and its sister company, Kia Corporation.

The Korean discount

The second angle in our focus is equally fascinating: the phenomenon called the Korean discount. In South Korea, companies often trade at levels lower than they should. Several factors drive this undervaluation:

- Corporate governance concerns

- Distrust over chaebol structures (a chaebol is a Korean word referring to a large, family-controlled South Korean business conglomerate operating in various industries)

- Geopolitical tensions with North Korea

- Limited foreign investor participation

And the numbers support it. The Korean market’s (Kospi) average price-to-book or P/B ratio stands at just ~1.1x. Compare this to India, where the benchmark index NIFTY50 trades at a P/B ratio over 3.3x.

This opens a window of opportunity for South Korean companies. Businesses that are undervalued in South Korea could get a premium valuation in India due to higher investor appetite, growth prospects and valuation multiples. This pushes giants like Hyundai and LG to list their Indian subsidiaries to compensate for the ‘Korean discount’.

Hyundai Motor India’s IPO valuation was at a price-to-earnings (P/E) multiple of 26x, a huge premium over the South Korean parent’s P/E of around 4x. As per analysts, LG Electronics India’s IPO is valued at 33–35x FY25 earnings, which is more than double the 15x P/E of LG Corp.

While it’s not entirely fair to compare the IPOs of Hyundai Motor India and LG Electronics India, the similarities are too stark to ignore.

| LG Electronics India | Hyundai Motors India | |

|---|---|---|

| Massive issue size | ₹11,607.01 crore | ₹27,870.16 crore |

| OFS structure | Entire IPO proceeds to go to the South Korean parent, LG Corp | Entire IPO proceeds went to the South Korean parent, Hyundai Motor Co |

| Premium valuation | PE of 33–35x vs 15x of the parent group | PE of 26x vs 4x of the parent group |

So, will the LG Electronics IPO head in the same direction as Hyundai’s? We shall wait for the judgment day, aka listing day!

About The Author

Next Story