Market News

Aegis Vopak IPO Day 1: Issue subscribed 26%; retail portion booked 19%; 10 key things you need to know

.png)

5 min read | Updated on May 26, 2025, 17:10 IST

SUMMARY

Aegis Vopak IPO Day 1: The IPO is entirely a fresh issue of equity shares worth ₹2,800 crore with no offer-for-sale (OFS) component, according to the red herring prospectus (RHP).

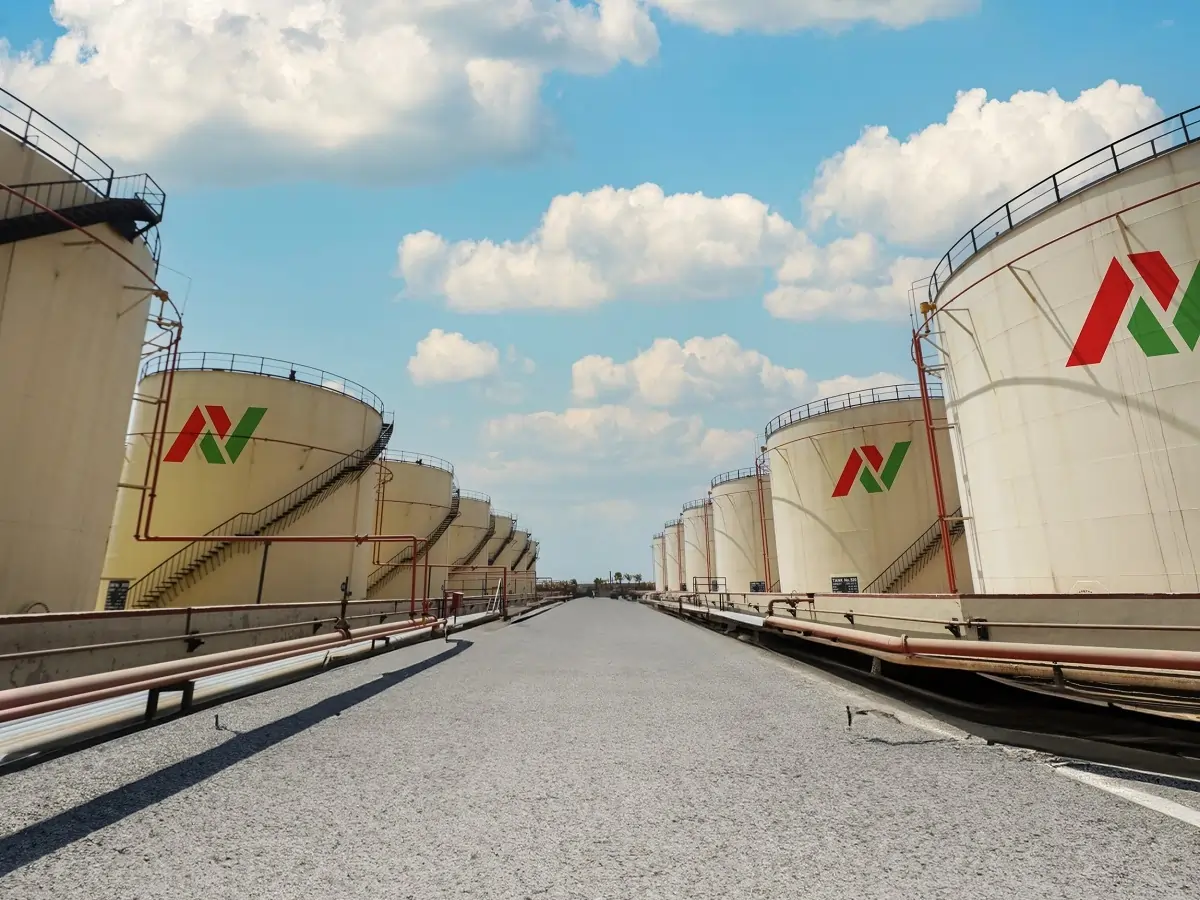

Aegis Vopak Terminals is a strategic joint venture between Aegis Logistics Limited India and Royal Vopak of the Netherlands. | Image: Company website

By 5 PM, the issue was subscribed 26%. BSE data showed that out of 69,058,296 shares put on offer, the issue received bids for 17,771,355 shares. The retail portion was subscribed 19%, while the qualified institutional buyers (QIBs) portion was booked 39%.

About Aegis Vopak Terminals

Aegis Vopak Terminals Ltd, a strategic joint venture between Aegis Logistics Limited India and Royal Vopak of the Netherlands, operates a chain of 20 tank terminals across six key Indian ports like Haldia, Kandla, Pipavav, JNPT (upcoming), Mangalore, and Kochi.

With a storage capacity of 1.7 million cbm for liquid storage and 201K MT for LPG, the company's operations form a crucial link in the storage and movement of LPG, oil, liquid chemicals, petrochemicals, gases, bitumen and vegetable oil products.

The strategic location of the company's terminals near key ports, closer to major shipping routes, offers competitive advantages, including faster evacuation through pipelines, rail, and road, lower delivery costs, and improved delivery times.

The terminaling industry relies heavily on the strategic location of storage terminals. Terminals near major shipping routes and well-connected ports gain a competitive edge by reducing last-mile delivery costs and ensuring faster delivery times.

Aegis Vopak Terminals IPO type

The IPO is entirely a fresh issue of equity shares worth ₹2,800 crore with no offer-for-sale (OFS) component, according to the red herring prospectus (RHP).

Aegis Vopak Terminals IPO price band

The company has fixed a price band of ₹223 to ₹235 per share for its ₹2,800 crore initial public offering (IPO). The company is valued at around ₹26,000 crore at the upper end of the price band, analysts note.

Aegis Vopak Terminals IPO date

Aegis Vopak Terminals IPO: Fund utilisation

The company said that the proceeds worth ₹2,016 crore will be used for payment of debt, ₹671.30 crore to fund capital expenditure for the acquisition of a cryogenic LPG terminal at Mangalore, and the remaining amount will be allocated for general corporate purposes.

Aegis Vopak Terminals IPO: Quota and lot size

The company announced that 75% of the issue size has been reserved for qualified institutional buyers, 15% for non-institutional buyers and the remaining 10% for retail investors.

Investors can bid for a minimum of 63 equity shares and in multiples of 63 thereafter.

Aegis Vopak Terminals IPO: Book-running lead managers

ICICI Securities, BNP Paribas, IIFL Capital Services, Jefferies India and HDFC Bank are the book-running lead managers to the issue.

Aegis Vopak Terminals IPO listing

Shares of the company are expected to be listed on the bourses by June 2.

Aegis Vopak Terminals IPO: Anchor investors' allotment

Aegis Vopak Terminals last week raised ₹1,260 crore from anchor investors, ahead of its initial share sale.

Some of the investors include American Funds Insurance, HDFC Mutual Fund, Smallcap World Fund, 360One, Motilal Oswal, SBI General Insurance and Think India, according to a circular uploaded on BSE's website on Friday.

As per the circular, Aegis Vopak Terminals has allotted 5.36 crore equity shares to 32 funds at the upper price band of ₹235 per equity share. This aggregates the transaction size to ₹1,260 crore.

Aegis Vopak Terminals IPO: Key risk factors

In its Red Herring Prospectus (RHP), the company has highlighted key risks to its business. They are as below.

- Aegis Vopak Terminals' terminal services and other operations are subject to operational risks that could adversely affect our business, results of operations and financial condition.

The operation of our terminal services may be adversely affected by many factors, such as the breakdown of equipment, accidents, fatalities, labour disputes, and hazards associated with liquids and gases such as petroleum, oil and lubricants, LPG and various categories of chemicals, including fires, explosions, chemical spills or other discharges or releases of toxic or hazardous substances or gases, storage tank leaks, and other environmental risks.

These hazards can result from a number of factors, including misconduct and improper operations, severe weather and natural disasters, equipment ageing, mechanical failure, unscheduled downtime, transportation interruptions, and terrorist attacks, the company said.

-

The company notes that it derived 42.07%, 44.56%, 47.20% and 44.76% of its revenue from its top 10 customers in the last in the fiscal years, 2023 and 2024, and in the nine months ended December 31, 2023 and 2024, respectively. "Any deterioration of their business, substantial reduction in their dealings with us or a loss of any of these customers could have an adverse effect on our business, results of operations, financial condition and cash flows," it adds.

-

The company highlights that it operates as a joint venture between Aegis Logistics Limited and Vopak India BV and any conflicts between its promoters could result in potential disruption in its business and operations, which may adversely affect its business, results of operations, financial condition and cash flows.

-

Aegis Vopak Terminals highlights that some of the lease agreements entered into by one of its subsidiaries, CRL Terminals, for its properties located at Kandla terminal have expired and have not been renewed at the time of filing the Red Herring Prospectus.

"Such non-renewal of lease may affect our business, as we may be unable to carry out our business at such locations, and this may have a material and adverse impact on the business of our company. Further, our company and its subsidiary have not executed or registered and/or have inadequately stamped certain lease agreements in relation to some of the properties held by them," the company added.

Related News

About The Author

Next Story