Market News

Decoding the wealth creation by Tata and Aditya Birla Group companies for investors

.png)

8 min read | Updated on June 14, 2024, 13:58 IST

SUMMARY

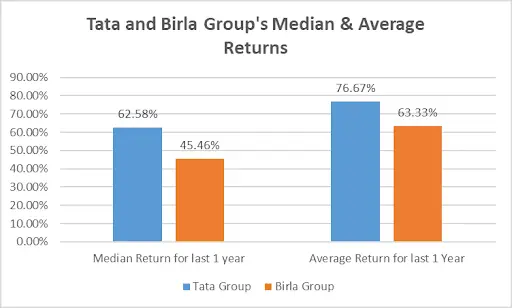

Tata and Aditya Birla both have reputable names in India. Tata Group has over 15 actively traded companies and Aditya Birla has 8 actively traded companies. In the last year, the Tata Group stocks have generated a median return of 62.58% and Birla has generated a median return of 45.46%.

Clash of the titans - Decoding the wealth creation ability of Tata and Birla Group for investors

Legacy business houses in India have been instrumental in shaping the country's industrial and economic landscape. These conglomerates have deep-rooted histories, often spanning several generations and are known for their diverse business interests and significant contributions to India's development.

Notable legacy business houses include -

- Tata Group

- Reliance Industries

- Aditya Birla Group

- Bajaj Group

- Godrej Group

- Adani Group & many more

However, the prominent names that come up when we talk about legacy business groups are Tata Group and Aditya Birla Group.

Both groups have multiple listed companies & established brand names. They originate back the 19th century. Both stood against tides of tough times including the great depression of the 1930s, two world wars, plague epidemics, partition, the Gulf War, the Cold War, the 2008 economic crisis and covid pandemic. They have tasted the waters of all adverse circumstances yet shone brighter after almost being in business for 2 centuries and generating value for investors.

Aditya Birla Group

The Aditya Birla Group is one of India's oldest and largest conglomerates, with a rich history dating back over a century.

It is a diversified conglomerate with operations in over 36 countries and a workforce exceeding 120,000 employees. It has established leadership in various sectors such as metals, cement, textiles, carbon black, telecom, financial services, and retail.

In 1857 Seth Shiv Narayan Birla founded the group, as a cotton trading business in the small town of Pilani, Rajasthan. The notable figures in group's history include Ghanshyam Das Birla, Basant Kumar Birla, Aditya Vikram Birla and Kumar Mangalam Birla who took leadership of the group at the young age of 28.

Tata Group

The Tata Group is one of India’s most prestigious and influential conglomerates, with a history that spans over 150 years.

The Tata Group is renowned for its emphasis on ethics, corporate social responsibility, and philanthropy. The Tata Trusts, which own a significant share of the group's holding company, are instrumental in funding numerous charitable initiatives in healthcare, education, and rural development.

In 1868 Jamsetji Tata began the group with a trading company, Tata & Sons, in Mumbai.

The notable figures in the group's history include JRD Tata, Ratan Tata, Cyrus Mistry and Natarajan Chandrasekaran.

Brief analysis of the listed companies of both groups as of June 12 2024

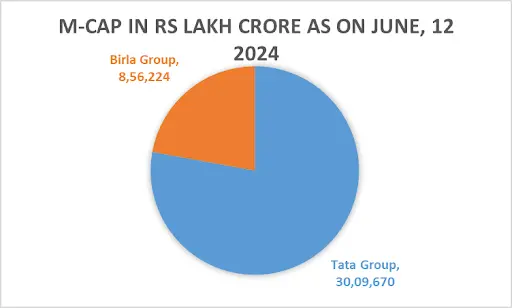

The below chart summarizes the market capitalization of Tata and Birla Group on NSE.

Over 15 stocks of Tata Group and 8 stocks of Aditya Birla Group actively trade on the exchange at present.

Tata Consultancy Services and Ultratech Cement are the most valued companies of Tata Group and Aditya Birla Group respectively.

(Source: NSE Data)

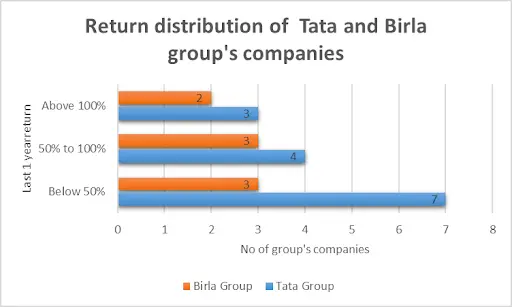

(Source: NSE Data)Below return distribution chart summarizes the number of stocks of both groups with returns in the given range in the last one year.

(Source: NSE Data)

(Source: NSE Data)Below chart shows the median return and the average of the entire group

(Source: NSE Data)

The median return is the middle value in a set of returns, while the average return is the sum of all returns divided by the number of returns.

(Source: NSE Data)

The median return is the middle value in a set of returns, while the average return is the sum of all returns divided by the number of returns.Tata Group’s stock performance

(Source: NSE Data)

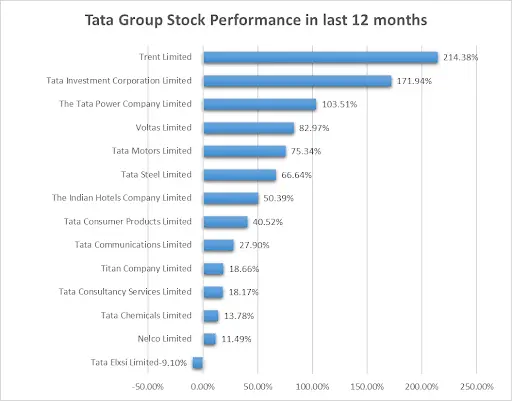

(Source: NSE Data)Top performing stocks

The aggressive expansion of stores under the brand name of Zudio and Westside has facilitated growth for the company. As of March 31 2024, the store portfolio included 232 Westside, 545 Zudio and 34 other lifestyle stores.

In a recently conducted investor meeting, the management shared insights and plans for becoming net debt-free, proposed the demerger of the passenger vehicles (PV) and commercial vehicles (CV) businesses, maintaining strong margins, free cash flow (FCF), and strategies for electric vehicles (EVs) and local markets.

The company is focusing on improving its renewable energy revenues, with the government launching the PM Surya Ghar Muft Bijlee scheme (Rooftop Solar Subsidy scheme) covering over 1 crore houses. The company plans to capture 20% of the scheme over the next five years.

| Company Name | NSE Price | M-Cap | Last 1 Year Return |

|---|---|---|---|

| Trent Limited | 5,015.45 | 1,78,293 | 214.38% |

| Tata Investment Corporation Limited | 6,412.95 | 32,447 | 171.94% |

| The Tata Power Company Limited | 449.65 | 1,43,678 | 103.51% |

| Voltas Limited | 1,446.65 | 47,867 | 82.97% |

| Tata Motors Limited | 989.2 | 3,28,808 | 75.34% |

| Tata Steel Limited | 182.47 | 2,27,787 | 66.64% |

| The Indian Hotels Company Limited | 583.05 | 82,993 | 50.39% |

| Tata Consumer Products Limited | 1,125.25 | 1,07,218 | 40.52% |

| Tata Communications Limited | 1,891.10 | 53,896 | 27.90% |

| Titan Company Limited | 3,384.95 | 3,00,511 | 18.66% |

| Tata Consultancy Services Limited | 3,837.00 | 13,88,260 | 18.17% |

| Tata Chemicals Limited | 1,123.85 | 28,631 | 13.78% |

| Nelco Limited | 776 | 1,771 | 11.49% |

| Tata Elxsi Limited | 7,143.00 | 44,484 | -9.10% |

| Tata Technologies Limited | 1060.6 | 43,025 | - |

(Source: NSE Data) Tata Technologies made its debut on the exchange in November 2023, therefore the 1-year period has not been completed.

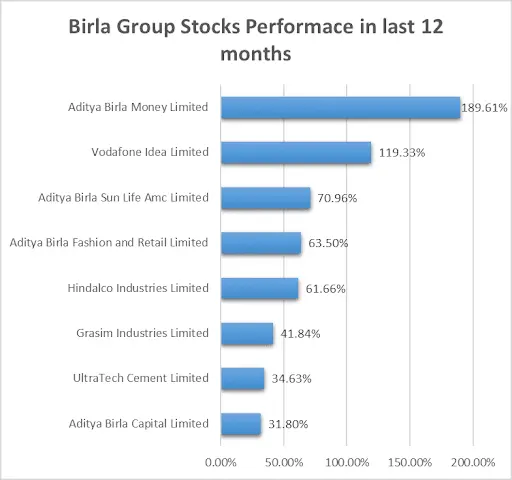

Aditya Birla Group’s stock performance

(Source: NSE Data)

(Source: NSE Data)Top performing stocks

ABML derives over 87% of its revenue from broking, 12% from trading, and 1% from other allied activities. FY24 results have been stellar, with revenue at ₹390 crore and net profit at ₹53 crore. Throughout FY24, the company maintained strong margins in the range of 40-43%.

The stock price of ABML has more than doubled investors' money in the last 12 months. The company has a pan-India distribution network of 29 branches and 942 franchise offices across 14 states. It operates a ‘Phygital’ model, balancing physical and digital reach effectively.

The company is also expecting a revival package from the government, which holds a 32.19% equity stake. Vodafone Idea has over ₹70,000 crore in AGR dues to the government. The stock value has doubled, with promoters expected to infuse capital. Media reports suggest K.M. Birla may infuse less than ₹1,000 crore into the company in response to the government’s revival package.

For FY24, the company reported a net loss of ₹31,238 crore, while its total liabilities stood at ₹289,165 crore.

| Company Name | NSE Price | M-Cap ( Rs Lakhs) | Last 1 Year Return |

|---|---|---|---|

| Aditya Birla Money Limited | 164.5 | 930 | 189.61% |

| Vodafone Idea Limited | 16.45 | 1,11,661 | 119.33% |

| Aditya Birla Sun Life Amc Limited | 640 | 18,438 | 70.96% |

| Aditya Birla Fashion and Retail Limited | 327.5 | 33,241 | 63.50% |

| Hindalco Industries Limited | 673.8 | 1,51,417 | 61.66% |

| Grasim Industries Limited | 2446.05 | 1,61,067 | 41.84% |

| UltraTech Cement Limited | 11038 | 3,18,664 | 34.63% |

| Aditya Birla Capital Limited | 233.74 | 60,806 | 31.80% |

(Source: NSE Data)

Wrap up

Both the Tata Group and Aditya Birla Group have been instrumental in India’s economic growth. The Tata Group, with over 15 actively traded listed companies and a market capitalization exceeding ₹30,09,670 crore, is mammoth in scale, with businesses spanning across every sector. In comparison, the Aditya Birla Group has only 8 listed companies.

From an investor's perspective, both groups have generated wealth. Examples include Trent, Tata Investment Corporation, and Tata Motors from the Tata Group, and Aditya Birla Money and Vodafone Idea from the Aditya Birla Group.

About The Author

Next Story