Market News

Reliance Jio IPO: Here is how SEBI's latest rules on large firms will benefit the telecom giant

.png)

3 min read | Updated on September 15, 2025, 08:54 IST

SUMMARY

SEBI board meeting: The regulator on Friday decided to relax IPO rules for very large companies and also extend the timeline by up to 10 years for them to meet minimum public shareholding norms.

Stock list

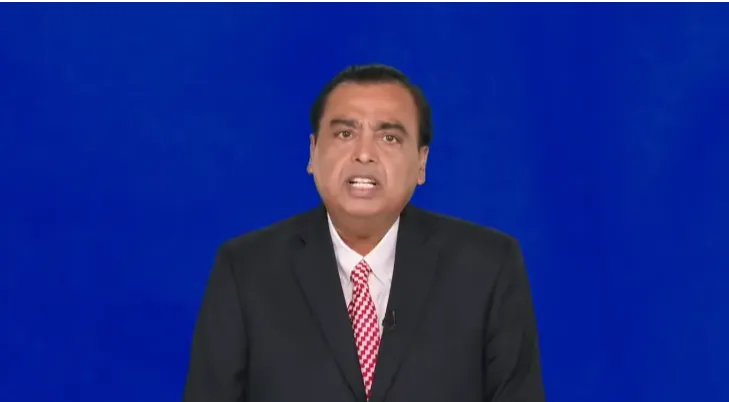

According to market analysts, the initial share sale of Reliance Jio is expected to be the biggest IPO in India. | Image: Shutterstock

The regulator on Friday decided to relax IPO rules for very large companies and also extend the timeline by up to 10 years for them to meet minimum public shareholding norms.

The move is expected to benefit mega IPOs, including that of Reliance Jio Infocomm and the National Stock Exchange (NSE).

The new framework, if implemented, would reduce the immediate dilution burden while still ensuring gradual compliance with public shareholding norms.

Under the new framework, companies with a market capitalisation between ₹50,000 crore and ₹1 lakh crore would be required to float 8% of their equity instead of the current 10%. Such firms would also get a timeline of five years instead of the present three years for achieving the minimum public shareholding (MPS) requirement of 25%.

For companies with a market capitalisation above ₹1 lakh crore, mandatory offer requirements would be reduced to 2.75% from the current 5%, while those above ₹5 lakh crore would need to dilute only 2.5%.

Such large companies would also be given up to 10 years to achieve the 25% minimum public shareholding requirement, compared with five years at present.

This means companies can list with smaller IPOs initially while gradually increasing their public shareholding over a longer period, reducing the immediate burden of large-scale equity dilution.

It is expected to help large issues, which often find it challenging to dilute substantial stakes through an IPO, as the market may not be able to absorb such a large supply of shares.

The regulator noted that for large-sized companies, the revised minimum public offer will still be large enough to provide sufficient stock to the market, including retail investors, and facilitate liquidity.

According to market analysts, the initial share sale of Reliance Jio is expected to be the biggest IPO in India.

Addressing the shareholders at its latest annual general meeting (AGM) on August 29, 2025, Mukesh Ambani had said, "Jio is making all arrangements to file for its IPO. We are aiming to list Jio by the first half of 2026, subject to all necessary approvals."

While Ambani did not disclose the quantum of shares to be listed, markets are speculating a 10% share sale. Jio Platforms – the holding company of all digital properties, including the telecom arm – is currently 66.3% owned by Reliance Industries (RIL) Ltd.

"Regular dilution post listing impacts issuers until MPS requirements are complied with and may lead to price overhang due to the impending equity dilution, thereby adversely affecting the interest of existing public shareholders," Sebi chairman Tuhin Kanta Pandey told reporters in Mumbai.

What experts say

Market analysts note that the recent reforms announced by SEBI are likely to have a positive impact on investor sentiments.

"The relaxation in timelines with regard to the minimum public shareholding (MPS) is a positive and realistic step for ease of doing business, and the large as well as medium-level companies need to concentrate on their core businesses at this stage rather than focus on the reallocation of equity," said Jyoti Prakash Gadia, Managing Director at Resurgent India, a SEBI-registered Category 1 merchant bank.

Related News

About The Author

Next Story