Market News

Will Jio Financial Services deliver strong Q2 earnings? Check options strategy and key technical levels

.png)

4 min read | Updated on October 16, 2025, 09:37 IST

SUMMARY

Jio Financial Services will report its second-quarter results on October 16. The NBFC has been in focus after completing the unit allocation of its Jio BlackRock Flexi Cap Fund. Investors will track management’s outlook on business expansion, mutual fund AUM, and deposit growth. Shares ended 2.3% higher at ₹312 ahead of results.

Stock list

Jio Financial Services is facing resistance from the upper trendline, which is located near ₹320–₹330

Reliance Industries' subsidiary, Jio Financial Services, will announce its second-quarter results on October 16.

The NBFC has been in the news in recent weeks after the company concluded its open-ended flexi-cap fund in October. The unit allocation of the fund is completed, and it will reopen for investment on October 17. The Jio BlackRock Flexi Cap Fund will invest across large cap, mid cap, and small cap stocks using BlackRock’s Aladdin technology, a global platform that combines artificial intelligence, data analytics and risk management.

Jio Financial Services is also entering the insurance industry through reinsurance 50:50 joint venture (JV) with Allianz Group. Two companies will focus on general and life insurance businesses in India.

The company also introduced ‘Savings Pro’ during the quarter, which allows customers to earn higher returns on surplus funds in their bank accounts through automated investments in overnight mutual funds. Meanwhile, Jio Financial Services' subsidiary, Jio Payments Bank, has won a contract to implement the FASTag Automatic Number Plate Recognition (ANPR)-based MLFF toll collection system.

Jio Financial reported consolidated revenue of ₹694 crore in the same quarter of FY25, while it stood at ₹612 crore in the previous quarter. Meanwhile, its net profit stood at ₹689 crore in the September quarter of FY25 and ₹325 crore in the June quarter. The company also announced a dividend of ₹0.50 per share.

During the result announcement, investors will closely track the management commentary on new business growth and future business outlook. Key metrics like mutual fund AUM and deposit growth will also be closely watched.

Ahead of the Q2 result announcement, Jio Financial shares ended the day 2.3% higher at ₹312 on Thursday, October 16. So far this year, Jio Financial shares have delivered over 4.5 % return to investors.

Technical view

Jio Financial Services is currently trading within a descending channel and is encountering resistance from the upper trendline, which is located near ₹320–₹330. The stock has formed a series of lower highs, reflecting a medium-term downtrend. However, recent price action shows an attempt to stabilise above the 21-week (₹304) and 50-week (₹296) exponential moving averages (EMAs). This suggests that short-term sentiment is gradually improving.

A decisive close above ₹330 would indicate a bullish breakout from the descending channel, potentially triggering a move towards ₹360–₹380. Conversely, if the stock fails to remain above ₹300, it could drift back down towards the ₹280–₹270 support zone. Overall, the trend remains neutral with a bullish bias as long as the stock continues to trade above its short-term averages.

.webp)

Options outlook for Jio Financial Services

The open interest data of 28 October expiry saw significant call options unwinding at the 320 strike, indicating short-covering. Meanwhile, the put options base was observed at 300 strike, hinting at support for the index around this zone.

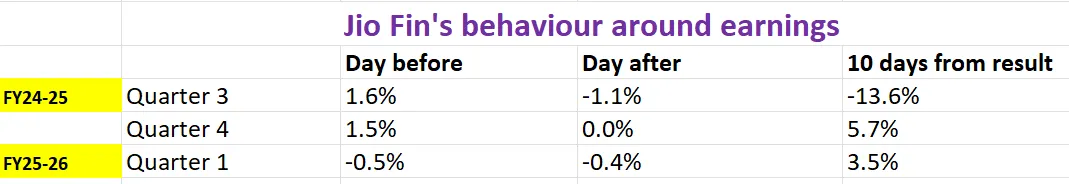

As of 15 October, the Jio Financial Services ATM strike is at 315, with both the call and put options priced at ₹13. This suggests an implied price movement of roughly ±4.4% ahead of October expiry. However, let's examine the historical price behaviour of Jio Financial Services during previous earnings announcements.

Options strategy for Jio Financial Services

With the options market implying a potential move of about ±4.4%, traders can plan volatility-based trades depending on their outlook. Those anticipating a sharp movement in either direction may wish to consider a long straddle, which involves buying both a call and a put option at the at-the-money (ATM) strike price with the same expiry date. This allows you to profit from a price swing greater than ±4.4%.

Conversely, if you anticipate a period of limited price action, a short straddle could be more suitable. This strategy involves selling both the ATM call and put with the same expiry date, with the aim of capturing the premium from time decay provided that the stock remains range-bound and volatility cools off.

About The Author

Next Story