Market News

Westlife Foodworld Q1 result: McDonald's restaurants operator posts over 60% drop in profit; check details

.png)

3 min read | Updated on July 23, 2025, 16:09 IST

SUMMARY

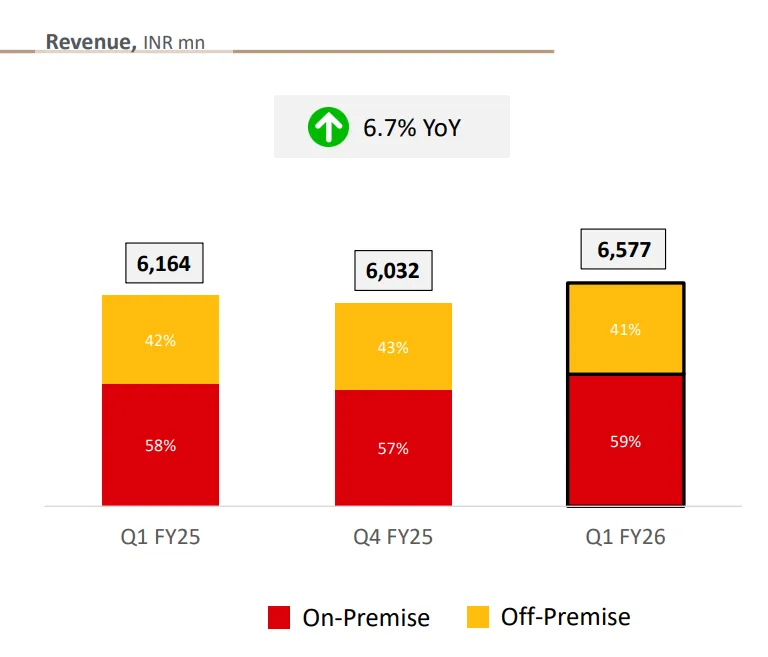

Westlife Foodworld Q1 results: Its sale rose 6.7% to ₹658 crore in the June quarter of FY26. In the year-ago period, the figure stood at ₹616 crore.

Stock list

Shares of Westlife Foodworld on Wednesday ended at ₹772.10 apiece on the NSE, up 1.57%. | Image: Shutterstock

The company had reported a consolidated net profit of ₹3.25 crore in the April-June quarter a year ago, according to a regulatory filing from Westlife Foodworld.

However, its sale rose 6.7% to ₹658 crore in the June quarter of FY26. In the year-ago period, the figure stood at ₹616 crore.

Its operating profit, or EBITDA (earnings before interest, taxes, depreciation, and amortisation), rose 8.5% to ₹85.2 crore from ₹78.5 crore logged in the year-ago period.

In a separate filing, Westlife Foodworld informed that its board approved an interim dividend of 75 paise per equity share with a face value of ₹2 each for FY26.

This is on the basis of the financial performance by the company in the June quarter.

Key Highlights

-

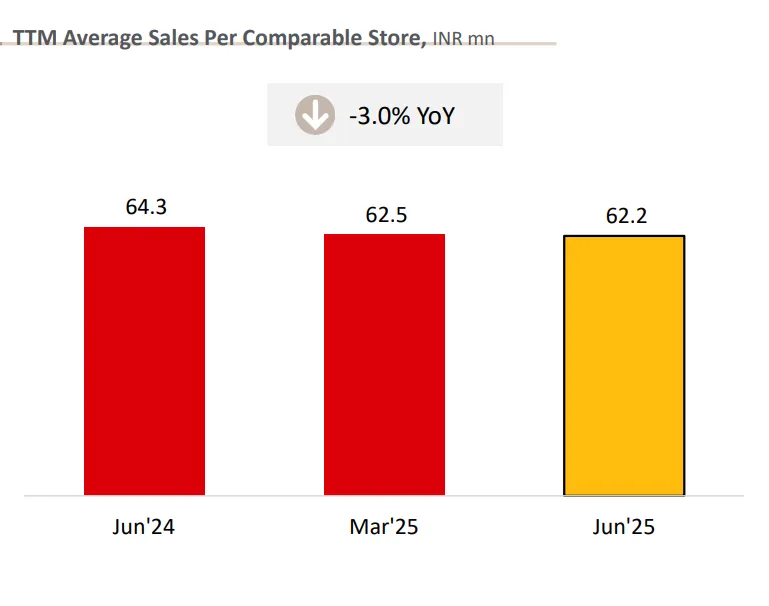

The company said Q1 FY26 was the third consecutive quarter of positive same store sales growth (SSSG) at 0.5% YoY, driven by stable guest count and average check;

-

On-Premise sales grew by 8% YoY, while Off Premise sales increased by 4% YoY. Off-Premise business salience at 41% remains in line with last 3-year average, reinforcing the strength and relevance of our robust omnichannel presence;

-

Consumption trends remain stable, and the company expects eating out to pick up gradually this year. This improvement is likely to be supported by lower inflation and government stimulus.

-

The McSaver Meals and McSaver+ Combo’s platform continues to drive affordability metrics and guest count;

-

Limited-time Korean Range of Burgers, Sides, and Drinks launched in March saw good consumer traction;

-

Digital sales contribution at nearly 75% grew by over 500 bps YoY driven by its mobile Apps and SOKs.

The company said that its digital sales largely include sales from mobile apps and self-ordering kiosks.

Key financial numbers

-

The company said that the gross margin increased by 160 bps sequentially to 71.6%, driven by significant enhancements in supply chain efficiencies. "We expect gross margin to remain in the +70% range in the near term," it added.

-

Restaurant operating margin increased by nearly 80 bps, led by a strong focus on operational excellence. Operating EBITDA grew by 7% YoY with margin stable at 13.0%.

-

Profitability expected to improve with higher volumes, targeting 18-20% Op. EBITDA margin by 2027.

-

Cash profit after tax stood at ₹47.4 crore, or 7.2% of sales.

The company said it added nine restaurants in Q1 FY26 and closed three restaurants. The company further said it was on track to achieve its target of 580-630 restaurants by the year 2027.

Shares of the company on Wednesday ended at ₹772.10 apiece on the NSE, up 1.57%. The results were declared during market hours.

Related News

About The Author

Next Story