Market News

UltraTech Cement Q4 Result Highlights: Net profit rises 36% YoY to ₹2,259 crore, revenue up 9.4%

.png)

8 min read | Updated on April 29, 2024, 16:58 IST

SUMMARY

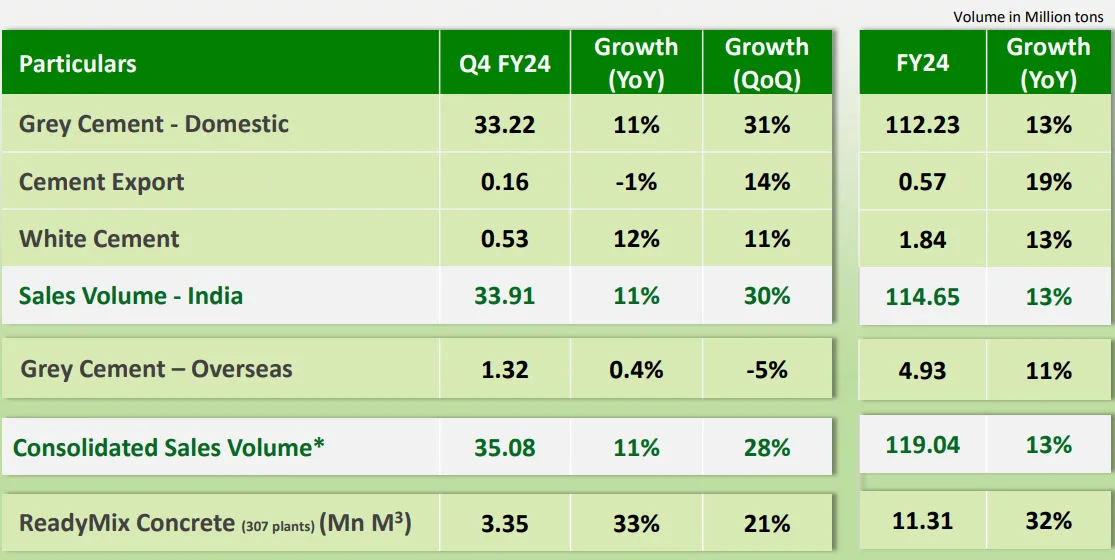

UltraTech Cement Q4 Results: The company logged robust sales volume growth of 11% YoY at 35 million metric tonnes. The cement maker also declared a dividend of ₹70 per equity share. Here are the key highlights.

Stock list

UltraTech Cement shares settled 2.7% higher on the NSE after the release of Q4 results

"Demand for cement across all sectors continues to remain robust which augur well for the company," UltraTech said in its earnings report.

"23.6% of UltraTech's power requirements are met through green power sources. During the quarter, the company commissioned additional 156 MW of solar power taking its capacity to 612 MW in addition to Waste Heat Recovery Systems of 278 MW," UltraTech Cement said.

UltraTech Cement recorded an 11% year-on-year climb in domestic sales in the fourth quarter, as the company's earnings presentation. The capacity utilisation in the same period stood at 98%.

The consolidated sales volume of UltraTech jumped to 35.08 million metric tonnes (mt), an increase of 11% as against the year-ago period. Out of the total sales, grey cement accounted for 33.22 mt.

The Aditya Birla Group company's total expenses in the fourth quarter climbed by 6.7% YoY to ₹17,381 crore.

Meanwhile, the total income, which includes income apart from the revenue from operations, increased by 9.4% YoY to ₹20,555 crore.

"The company continues to deliver strong cash flows. During FY24, the Company's net debt increased only by ₹77 crore after spending over ₹9,400 crore on capex. Over the last five years UltraTech has delivered a 24% CAGR growth in its earnings per share," UltraTech Cement said.

The consolidated revenue from operations in the fiscal year ended March 31, 2024, came in at ₹70,908 crore, higher by 12% as compared to ₹63,239 crore in FY23.

The profit after tax for the entire fiscal year ended March 31, 2024, came in at ₹7,005 crore, higher by 38% as against ₹5,064 crore in FY23.

The company's earning before interest, taxes, depreciation and ammortisation (EBITDA) came in at ₹4,114 crore in Q4 FY24, higher by 24% as compared to an EBITDA of ₹3,322 crore in the year-ago period.

-

UltraTech recorded volume growth of 13% during FY24, backed by 11% during Q4 FY24 and achieved full year EBITDA per metric tonne of ₹1,101.

-

Coal and petcoke (fuel) prices witnessed a drop during FY24. The company's imported fuel consumption cost during Q4FY24 was 13% lower than Q4FY23 and it remained flat QoQ.

-

Effective capacity utilization was 98% during the quarter and 85% for the full year

The net profit, at ₹2,259 crore, has surpassed the estimate of ₹1,977 crore, which was calculated as an average of projections shared by 12 brokerages.

The revenue from operations, at ₹20,418 crore, has also exceeded the estimation of ₹18,078 crore.

The Board of Directors have recommended a dividend of ₹70 per equity share of face value of ₹10 each, "aggregating ₹2,020.84 crore", UltraTech Cement informed the stock exchanges.

The revenue from operations has surged by 9.4% year-on-year to ₹20,418 crore. In Q4 of FY23, the company's revenue from operations had stood at ₹18,662 crore.

UltraTech Cement reported a consolidated net profit of ₹2,258 crore, as compared to a net profit ₹1,666 crore in the corresponding period of the previous year. This marked a rise of 36% year-on-year.

The cement maker's shares are in the green ahead of the release of fourth quarter results. The scrip was trading at ₹9,909 apiece on the NSE, up 2% as against the last closing price.

- UltraTech Cement reported a 68% year-on-year surge in net profit at ₹1,777 crore in the quarter ended December 2023.

- The company's revenue from operations had climbed to ₹16,740 crore, higher by 8% as compared to the year-ago period.

The earnings before interest, taxes, depreciation and ammortisation (EBITDA) likely to rise to ₹3,276 crore in the fourth quarter, up 11% YoY and 14% QoQ, as per the average of estimates shared by 12 brokerages.

The net revenue, as per the average of estimates shared by 12 brokerages, is likely to come in at ₹18,078 crore. This would mark a 9% surge YoY and a climb of 17% QoQ.

Ahead of the release of fourth quarter results, the shares of UltraTech Cement are edging higher. The scrip was valued at ₹9,879 apiece on the NSE at 11:30 am, higher by around 2% as against the previous day's close.

UltraTech Cement, according to several brokerages, is expected to report a strong quarter. The net profit is seen rising to ₹1,977 crore, up 23% as compared to the year-ago period, as per an average of estimates shared by 12 brokerages. Sequentially, it is seen growing by 15%.

The earnings scorecard of UltraTech Cement, the country's top cement maker, will be released today. The result assumes significance as it would shed light on the growth of construction sector, that has gained pace following the conclusion of winter season.

Along with the results of the fourth quarter, UltraTech Cement will also release the performance details for the entire financial year 2023-24. The board is also expected to propose a dividend, calculated on a per share basis. Its payout date would depend on the approval of shareholders.

UltraTech Cement Q4 preview

The cement manufacturer is expected to log strong gains in earnings on both, year-on-year (YoY) and quarter-on-quarter (QoQ) basis. The net profit is seen rising to ₹1,977 crore, up 23% as compared to the year-ago period and 15% higher sequentially, as per an average of estimates shared by 12 brokerages.

The net revenue, as per the estimates, is likely to come in at ₹18,078 crore. This would mark a 9% surge YoY and a climb of 17% QoQ.

The earnings before interest, taxes, depreciation and ammortisation (EBITDA) is seen at ₹3,276 crore, up 11% YoY and 14% QoQ, as per the estimates.

UltraTech Cement shares

The shares of UltraTech Cement, a Nifty50 listed entity, was valued at ₹9,700 apiece before the start of the market hours on April 29. In the last trading session, the stock had gained by 0.17%.

In the past one-year period, the stock has rallied by 30%. However, a deceleration has been witnessed in calendar year 2024 so far, with the shares plunging by 7.3% year-to-date.

About The Author

Next Story