Market News

Titan Q3 results: Check earnings preview and technical structure ahead of results

.png)

4 min read | Updated on February 04, 2025, 08:23 IST

SUMMARY

Titan shares reclaimed their 21-day and 50-day EMAs on February 1st and are currently trading above the ₹3,500 support zone. The options market anticipates a potential price swing of ±6.4% ahead of the February 27th expiry. Traders should monitor these levels for short-term directional clues; a break below ₹3,500 or continued strength above it will provide further insight.

Shares of Titan gained nearly 6% past three trading session.| image source:shutterstock.

Titan will announce its results for the December quarter on February 4, 2025. Driven by strong festive and wedding season demand, the company is anticipated to report robust quarterly performance.

Titan's quarterly business update projected a 26% year-over-year revenue increase for its jewelry segment, fueled by higher gold prices, double-digit growth in average purchase value and robust festive and wedding season sales. The watches and wearables segment is expected to show 15% year-over-year growth, while the eyecare business anticipates an 18% increase. During the quarter, the Tata Group company expanded its retail footprint, opening 69 new stores across its various verticals, bringing the total count to 3,240.

Analysts forecast Titan's standalone Q3 revenue to grow by 25-28% year-over-year (YoY), reaching between ₹16,500 and ₹16,800 crore. Net profit is projected to rise by 10-13% YoY between ₹1,105 and ₹1,185 crore. However, a one-time inventory loss of ₹250 to ₹300 crore due to customs duty reductions could impact overall profitability.

Investors will be focusing on management commentary regarding the demand outlook, particularly in light of record-high gold prices, as well as revenue growth and margins across the different segments.

As of, February 3rd, Titan shares closed 0.8% higher at ₹3,580 per share, ahead of the Q3 results announcement.

Technical View

On the daily chart, Titan has reclaimed its 21, 50, and 200-day EMAs and closed above the ₹3,500 resistance zone. This zone now acts as immediate support; a close below it would indicate weakness.

Options outlook

Options strategy for Titan

The options data suggests a potential price swing of ±6.4%. Traders can capitalize on this expected volatility by implementing either a long or short volatility strategy. Straddles are a common approach for this purpose.

A Long Straddle involves buying both the at-the-money (ATM) call and put options with the same strike price and expiry (in this case, Titan options). This strategy profits if the price moves by more than ±6.4% in either direction.

Conversely, a Short Straddle involves selling both the ATM call and put options with the same strike and expiry. This strategy is employed when a trader anticipates the price remaining within the ±6.4% range after the earnings announcement, profiting from the decline in volatility.

Meanwhile, traders seeking a more strategic approach to bullish or bearish options trading can explore directional spreads, which provide a refined alternative to simple option buying.

For a bullish outlook, a bull call spread involves buying a call option while simultaneously selling a higher strike call with the same expiration, reducing cost while capping potential gains.

Conversely, for a bearish stance, a bear put spread consists of buying a put option and selling a lower strike put, balancing risk and reward.

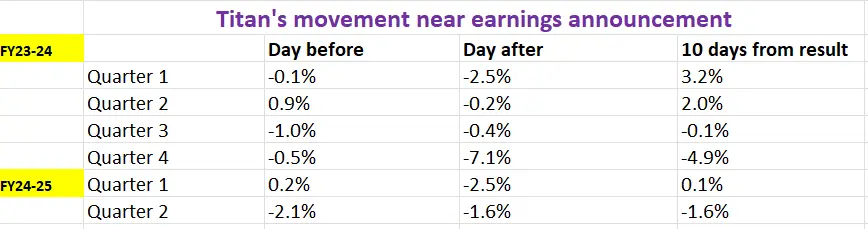

Interested to know more about straddles? Check out our UpLearn education content. If you want to see more historical earnings price data like in the table above for this stock, sign-up for our community, let us know, and we will share it!

About The Author

Next Story