Market News

SBI Q1 Results Highlights: Net profit up 0.9% YoY at ₹17,035.2 crore, NII rises 5.7%

.png)

4 min read | Updated on August 03, 2024, 14:32 IST

SUMMARY

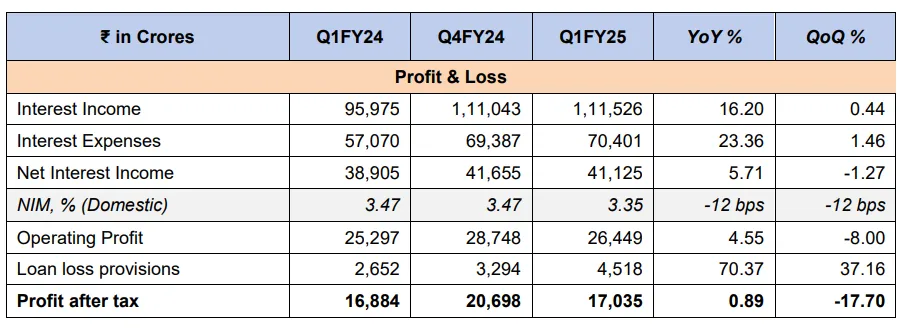

SBI Q1 Results Highlights The net interest income (NII), which is the difference between interest earned and interest paid, rose 5.7% YoY to ₹41,125 crore. In the June 2023 quarter, it stood at ₹38,905 crore.

Stock list

Shares of SBI settled in the red at the end of the last trading session on Friday

India's largest public lender SBI reported a marginal 0.9% YoY increase in its Q1 net profit at ₹17,035.2 crore, whereas its net interest income during the quarter climbed 5.7% YoY to ₹41,125 crore.

SBI Q1 Results: Check key metrics

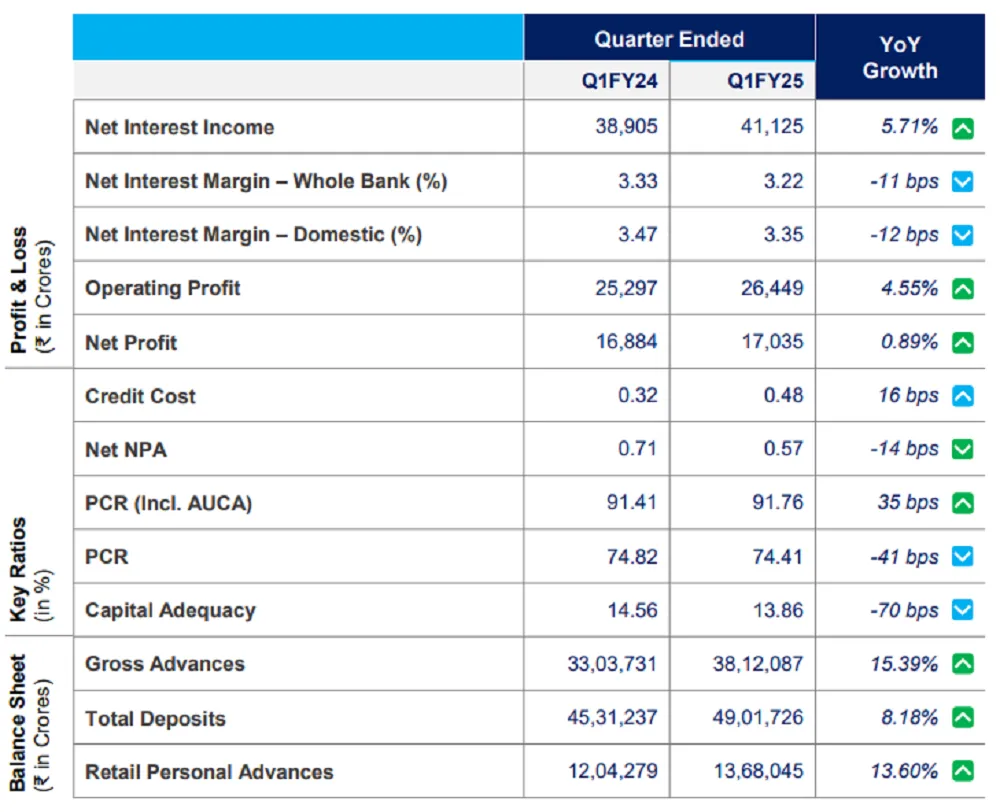

- Net profit for Q1FY25 stands at ₹17,035 crores witnessing a growth of 0.9% YoY.

- Operating profit for Q1FY25 grew by 4.55% YoY to ₹26,449 crores.

- Bank’s ROA and ROE for Q1FY25 stand at 1.10% and 20.98%, respectively.

- Net interest income (NII) for Q1FY25 increased by 5.71% YoY.

- Whole bank net interest margin (NIM) for Q1FY25 is at 3.22% and domestic NIM is at 3.35%.

SBI Q1 Results LIVE Update at 2:18 pm: Balance sheet improves

- Credit growth is at 15.39% YoY with domestic advances growing by 15.55% YoY.

- Foreign offices’ advances grew by 14.41% YoY.

- Domestic advances growth is driven by SME Advances (19.87% YoY) followed by agri advances which grew by 17.06% YoY. • Retail personal advances and corporate loans registered YoY growth of 13.6% and 15.92%, respectively. • Whole bank deposits grew at 8.18% YoY, out of which CASA deposit grew by 2.59% YoY.

- CASA ratio stood at 40.7% as on June 30, 2024.

SBI Q1 Results LIVE Update at 2:13 pm: A look at the key indicators

SBI Q1 Results LIVE Update at 2:08 pm: Asset quality improves

- Gross NPA ratio at 2.21% improved by 55 bps YoY

- Net NPA ratio at 0.57% improved by 14 bps YoY

- Slippage ratio for Q1FY25 improved by 10 bps YoY and stands at 0.84%

- Credit cost for Q1FY25 stands at 0.48%

SBI Q1 Results LIVE Update at 2:03 pm: SBI board gives nod to raise ₹25,000 crore via bonds

SBI Q1 Results LIVE Update at 1:52 pm: Net profit surpasses estimates, NII misses projection

The net profit clocked by the bank, at ₹17,035.2 crore, has surpassed the estimate of ₹16,999 crore, which was based on the average of estimates shared by five brokerages.

The NII, at ₹41,125 crore, has missed the mark, as the estimated net interest income was ₹42,614 crore.

SBI Q1 Results LIVE Update at 1:45 pm: NII rises 5.7% YoY to ₹41,125 crore

The net interest income (NII), which is the difference between interest earned and interest paid, rose 5.7% YoY to ₹41,125 crore. In the June 2023 quarter, it stood at ₹38,905 crore.

SBI Q1 Results LIVE Update at 1:40 pm: Net profit up 0.9% YoY at ₹17,035.2 crore

The bank has reported a net profit of ₹17,035.2 crore in the June 2024 quarter, which is 0.9% higher as compared to ₹16,884.3 crore in the year-ago period.

Ahead of the results, an average of estimates shared by five brokerages saw the net profit flat at ₹16,999 crore, whereas the net interest income (NII) was projected to increase 9.53% year-on-year to ₹42,614 crore.

In the year-ago quarter, SBI had reported a net profit of ₹16,884.3 crore, whereas its NII stood at ₹38,905 crore.

In the preceding quarter ended March 2024, the lender had reported a net profit of ₹20,698.4 crore and NII of ₹38,905 crore.

Shares of SBI settled in the red at the end of the last trading session on Friday. The stock last traded at ₹847.85, down 1.72% as against the last session's close.

Year-to-date, the stock has given returns of around 32%, whereas the surge has been sharper at 47.67% in the past 12 months.

About The Author

Next Story