Market News

Reliance Q4 Results LIVE Updates: Reliance Industries Q4 revenue rises 11.3% YoY, net profit remains flat, announces ₹10 dividend

.png)

13 min read | Updated on April 22, 2024, 20:17 IST

SUMMARY

RIL Q4 Results Today LIVE Updates: Reliance Industries consolidated revenue rises 11.3% YoY at ₹2.40 lakh crore. Net profit for the quarter declined by 0.39% YoY at ₹21,243 crore, sequentially net profit rose 8.1%.

Stock list

Reliance Jio Q4 net profit rises over 13% YoY to ₹5,337 crore.

-

The Reliance Industries board declared a dividend of ₹10 per share for FY24.

-

Date for the payment of the dividend will be announced in due course on which the company will hold its annual general meeting.

-

This payment of dividend is subject to approval of members of the Company at the ensuing annual general meeting of the company.

-

Oil to chemicals segment Q4 revenue from operations rose 10.9% YoY to ₹142,634 crore, primarily on account of improved realisation for transportation fuels segment and higher volumes.

-

Segment EBITDA for 4Q FY24 marginally increased by 3.0% YoY to ₹ 16,777 crore ($ 2.0 billion) supported by advantageous feedstock sourcing, ethane cracking and higher domestic product placement.

-

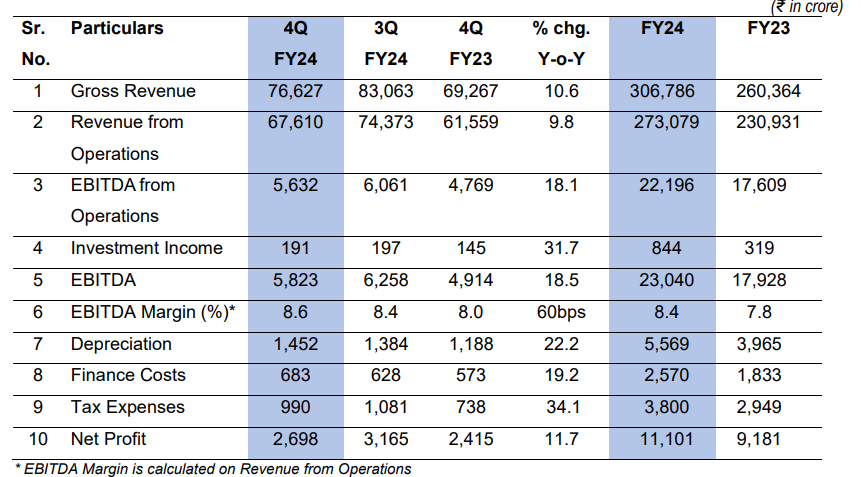

Reliance Retail delivered resilient performance. Revenue from operations rose 9.8% YoY to ₹67,610 crore, while its net profit stood at ₹2,698 crore, up 11.7% YoY.

-

For FY24, revenue from operations stood at ₹273,079, up 18% YoY, while net profit was at ₹11,101, up over 20% YoY

-

As of 31 March 2024, total store count stood at 18,836. The company expanded its store network with 562 new store openings during the quarter. The quarter recorded footfalls of over 272 million across formats, a growth of 24.2% YoY.

-

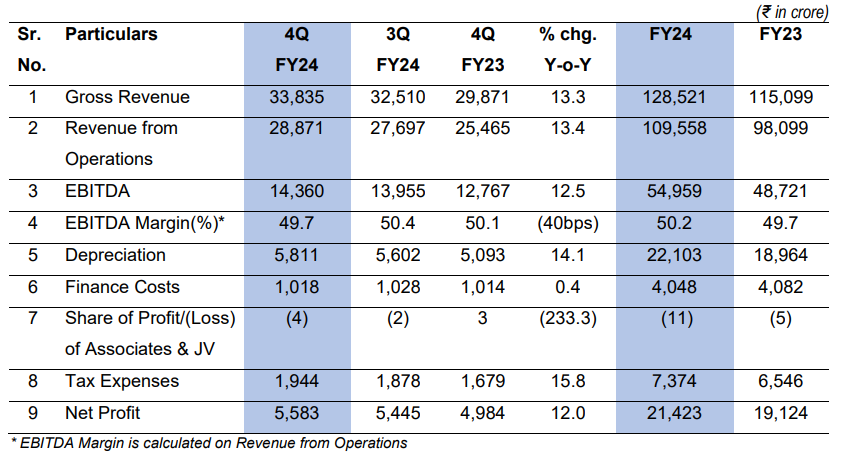

Reliance Jio Q4 revenue from operations rose 13.4% YoY to ₹28,871 crore, while its net profit stood at ₹5,583 crore, up 12.0% YoY.

-

During the quarter, EBITDA stood at ₹14,360, while margins contracted by 40 basis points to 49.7

-

Average revenue per user (ARPU) remain flat at ₹181.7, with better subscriber mix partially offset by increasing mix of promotional 5G traffic, offered unlimited to subscribers and not yet charged separately.

-

Double-digit operating revenue (net of GST) growth was driven by industry-leading subscriber growth in mobility and ramp-up of wireline services leading to a better subscriber mix.

-

For the financial year FY24 reliance industries surpassed a new milestone of achieving ₹10 lakh crore of gross revenue for the first time.

-

Reliance became the first Indian company to cross the ₹100,000-crore threshold in pre-tax profits.

-

Jio Platforms EBITDA increased 12.8% YoY with higher revenue and margin improvement.

-

Reliance Retail Ventures EBITDA increased sharply by 28.5% YoY with margin expansion of 60 bps to 8.4%.

-

O2C EBITDA increased marginally, supported by optimised feedstock sourcing and strong domestic demand in a challenging margin environment.

-

Oil and Gas EBITDA increased sharply by 48.6%, led by higher gas and condensate production with the commissioning of the MJ field during the year.

- Reliance Industries consolidated revenue rises 11.3% YoY at ₹2.40 lakh crore

- Net profit for the quarter declined by 0.39% YoY at ₹21,243 crore, sequentially net profit rose 8.1%.

- For the financial year FY24 the net profit increased by 6.6% YoY at ₹79,020 crore

As per experts, Reliance Jio’s Q4 result was in-line with expectations, with no major surprises. Average revenue per user (ARPU) is likely to remain flat as the company did not announce any major price hike during the quarter.

- Net profit rises 13% YoY to ₹5,337 crore

- Revenue from operations up 11% YoY to ₹25,959 crore

- For the fiscal year ended 31 March 2024, revenue stood at ₹1,00,119 crore, up 10.2% over the preceding fiscal.

- EBITDA jumps 11% YoY ₹13,612 crore

-

Reliance Industries retail arm, Reliance Retail Ventures likely to report higher Q4 revenue and net profit on back of store expansions and increased consumer footfalls.

-

During the December quarter, revenue from operations for Reliance Retail stood at ₹ 74,373 crore, up 23.8% YoY.

-

The business expanded its store network with 252 new store openings taking the total store count at the end of the quarter to 18,774 stores with an area of 72.9 million sq ft.

-

December quarter saw a record footfalls of over 282 million across formats, a growth of 40.3% Y-o-Y.

-

India's largest telecom operator Reliance Jio on Monday posted a 13% year-on-year rise in its standalone net profit at ₹5,337 crore in March quarter.

-

Its revenue from operations for Q4FY24 came in at ₹25,959 crore, up 11% over the year-ago period.

-

The net profit was pegged at ₹5,337 crore for the just-ended quarter, up from ₹4,716 crore in the fourth quarter of FY23, which translated into a 13.16% increase.

-

According to a BSE filing by the company, for the full FY24, the net profit stood at ₹20,466 crore, which was 12.4% higher than that of FY23.

-

The revenue for full fiscal ended March 2024 was ₹1,00,119 crore, up 10.2% over the preceding fiscal.

-

More details are awaited Reports PTI

-

As per experts, Telecom arm of Reliance Industries, Jio Platform to report robust earning in the fourth quarter. Reliance Jio's revenue and net profit could see a double digit rise compared to same quarter last year.

-

During the December quarter, revenue from operations for Jio Platform stood at ₹ 27,697 crore, up 11.3% YoY.

Along with the Q4 result, the RIL Board will also discuss and recommend dividends on equity shares for FY24, the company had informed the stock exchanges.

The average revenue per user (ARPU) of Reliance Jio is likely to remain flat quarter-on-quarter at ₹182, reports said, citing a consensus of estimates shared by brokerages. However, the company's revenue is expected to rise by around 2.4% quarter-on-quarter to ₹25,990 crore, they added.

- Gross decreased to ₹2,48,160 crore compared to ₹2,55,996 crore in the second quarter.

- The net profit, at ₹19,641 crore, had decreased marginally by ₹237 crore when compared to the second quarter.

- The company had posted an earnings before interest, tax, depreciation and amortisation (EBITDA) of ₹44,678 crore, up 16.7% YoY.

The shares of Reliance Industries settled at ₹2,962.90 apiece on the NSE at closing bell, higher by 0.77% as against the previous day's close. The shares edged in the green throughout the day's trading session, in likely anticipation of robust Q4 numbers.

Reliance Industries is expected to declare the results of the fourth quarter shortly. The company was scheduled to post the earnings report after the conclusion of market hours. The net profit and operational revenue are likely to rise in the backdrop of a sharp rebound in oil-to-chemical business, along with a robust growth in retail and telecom.

Market analysts and investors are expected to observe the management commentary for debt profile, guidance on capital expenditure and commissioning schedule of new energy business, experts said. They are also expected to track the growth in retail stores, and whether Reliance Jio unveils any action on the pricing front.

The core retail revenue of Reliance Retail, the retail business arm of RIL, is expected to rise 23% year-on-year to ₹55,700 crore. The earnings before interest, taxes, depreciation and amortisation or EBITDA is seen at ₹6,100 crore, up 28% as compared to the year-ago period.

The earnings before interest, tax, depreciation and amortisation (EBITDA) is seen at ₹42,191 crore, down 5.2% sequentially, according to the analysts polled by Bloomberg. Year-on-year, the EBITDA will rise by 2.2%, as per their estimate.

However, a section of analysts project the EBIDTA to increase sequentually as well, in the backdrop of higher margins seen in the oil-to-chemical business. The refinery business has also profited due to the increased crude oil prices, they said.

The shares of RIL have consistently risen at the stock markets. The scrip has gained by around 14% year-to-date, and the surge has been sharper at about 25% in the last one-year period. At 1:25 pm, the scrip was trading at ₹2,949 apiece on the NSE, up 0.3% as against the previous day's close.

-

The consolidated net profit is expected to come in at ₹19,727 crore in Q4 FY24, higher by 14.3% as compared to the preceding quarter, according to analysts tracked by Bloomberg.

-

The consolidated revenue from operations is likely to come in at ₹2.4 lakh crore, as per 12 analysts polled by the news agency. The projection is 4.96% higher as compared to the revenue clocked in the October-December quarter.

The revenue to be clocked by Reliance Jio, the telecom arm of RIL, is likely to rise by 2.4% sequentially to ₹25,990 crore, as per the estimates shared by a consenesus of brokerages. The average revenue per user (ARPU) is likely to remain flat quarter-on-quarter at ₹182, they said.

The EBITDA to be clocked by Reliance Digital is expected to rise by around 2.5% sequentially to over ₹14,000 crore, analysts said, citing a consensus of estimates shared by brokerages. The average revenue per user (ARPU) is expected to improve to ₹182.5 from ₹181.7 in the preceding quarter, as per the estimates.

The operational revenue is likely to get a boost from the earnings in the oil-to-chemical (O2C) segment, analysts said. The gross refining margins have been improve, they said, pointing towards the the Singapore Gross Refining Margin, which stood at $7.3 a barrel in the March quarter as compared to $5.5 per barrel in the preceding three months period of October-December.

The Mukesh Ambani-led conglomerate's net profit is likely to rise in the backdrop of strong business registered by its retail arm, Reliance Retail Ventures Ltd, and telecom arm, Reliance Jio, analysts said. The higher margins in the oil-to-chemical (O2C) business is also expected to positively impact the Q4 earnings, they added.

The board of directors of Reliance Industries will declare the dividend to be issued to shareholders for the year ending March 31, 2024. The record date, along with the date of payout, is expected to be shared with the exchanges after the board meet ends.

Reliance Industries is expected to declare the results of the fourth quarter after the market hours, on April 22. The stock market sessions end at 3:30 pm, which means that the earnings report could be released in the subsequent period.

RIL is expected to report a surge in its net profit and operational revenue in Q4 FY24, as its telecom, retail and refinery businesses have logged strong performances.

RIL Q4 results: What to expect?

According to a consensus of analysts polled by Bloomberg, the company is likely to register a consolidated net profit of ₹19,727 crore during the quarter, up 14.3% as against the October-December period.

The consolidated revenue from operations is expected to rise 4.9% sequentially to ₹2.4 lakh crore, as per 12 analysts polled by the news agency.

However, the EBITDA or earnings before interest, tax, depreciation and amortisation is expected to drop 5.2% quarter-on-quarter to ₹42,191 crore, according to the analysts tracked by Bloomberg. Year-on-year, the EBITDA will increase by 2.2%, they estimated.

RIL Q4 Results: How shares were trading ahead of results?

Ahead of the release of Q4 results, RIL was edging in the green at the stock market. At 10:34 am, the scrip was valued at ₹2,949 apiece on the NSE, up 0.3% as against the previous day's close. Notably, Reliance's shares have rallied by 13.6% year-to-date, and and by 24.81% over the last one-year period.

How RIL performed in Q3 FY24

In December quarter, Reliance Industries had posted a 9% year-on-year surge in consolidated net profit to ₹17,265 crore. The revenue from operations had came in at ₹2.28 lakh crore, up 4% as against the year-ago period.

About The Author

Next Story