Market News

RIL Q3 results: Revenue could jump upto 7% YoY supported by strong performance from Jio and retail business

.png)

4 min read | Updated on January 16, 2026, 10:42 IST

SUMMARY

Reliance Industries is expected to post steady growth in Q3 FY26, driven by strong performance in telecoms and retail segments. Technically, the stock has slipped below its 50-day EMA and is testing long-term support near the 200-day EMA, suggesting short-term caution.

Stock list

Reliance Industries stocks could experience a price movement of approximately ±3.7% as per options market data. | Image: Shutterstock

Oil-to-telecom conglomerate Reliance Industries will announce its results for the December quarter on Thursday, January 16. According to experts, Reliance is expected to report sustained growth in revenue and net profit, aided by its telecom and retail businesses.

As per experts, Reliance Industries consolidated Q3 revenue could range between ₹2.54 to ₹2.56 lakh crore, rising 6.2% to 7.1% YoY and 0.5% to 1% compared to previous quarter. The company reported revenue of ₹2.54 lakh crore in the previous quarter and ₹2.39 lakh crore in Q3FY25.

Net profit is expected to rise by 2 to 3% compared to the previous quarter, between ₹18,550 crore and ₹18,700 crore, while remaining flat on a yearly basis. The company reported a net profit attributable to owners of ₹18,540 crore in Q3FY25 and ₹18,165 in the previous quarter.

Furthermore, Reliance Industries’ consolidated EBITDA could range between ₹47,200 to ₹47,630 crore, a rise of 6 to 7% YoY aided by better refining margins, a weaker rupee in the oil-to-chemicals (O2C) business and a higher ARPU of the telecom business.

Investors will closely track Reliance Industries' Q3 results to gauge the performance of the retail, telecom and oil refining businesses. Management commentary on the overall business scenario will also be closely watched.

Ahead of the Q3 result announcement, Reliance Industries shares were trading 0.4% higher at ₹1,458 on Friday, January 16. The company's stock is down 7.1% so far this month amid volatility in crude oil prices and a sell-off in broader markets amid rising geopolitical concerns.

Technical view

Reliance Industries has seen a sharp reversal from the ₹1,600 zone. The stock has decisively slipped below the 50-day exponential moving average (currently around ₹1,515), which indicates a loss of short-term momentum. It is now testing the 200-day EMA, currently around ₹1,445, which is acting as immediate support.

The price action suggests a corrective phase within the broader range. Provided Reliance remains above ₹1,440–1,430, the medium-term structure will remain intact and the current move can be viewed as a pullback towards long-term support. However, a breakdown below ₹1,425 would weaken the setup and could drag the stock towards the ₹1,380–1,350.

Options outlook

The options market suggests that Reliance Industries could experience a price movement of approximately ±3.7%, based on an at-the-money (ATM) strike price of 1,460 of 27 January expiry.

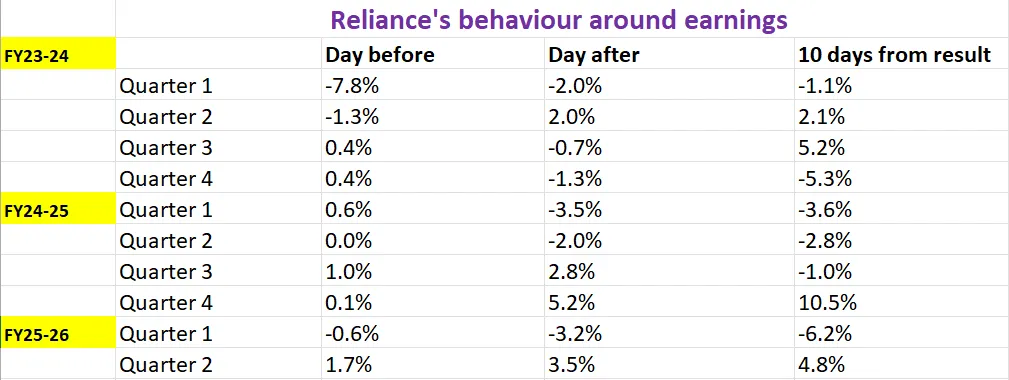

To gain a more in-depth understanding of Reliance Industries' historical volatility, let’s analyse its price behaviour around earnings announcements.

Strategies based on options data

With options market pricing in a possible price swing of ±3.7%, traders can consider a range of volatility-based strategies in Reliance Industries.

A long straddle is a strategy for traders who expect a sharp post-earnings move but are unsure about the direction. The strategy involves buying an at-the-money call and the put option of the same strike and expiry. If the stock moves more than ±3.7% in either direction, the position can turn profitable. The maximum risk is capped at the total premium paid for both options.

Meanwhile, a short straddle works for traders who expect volatility to cool off and range-bound movement in the stock after the results. This involves selling an at-the-money call and put option of the same strike and expiry. The strategy pays off if Reliance Industries stays within the implied ±3.7% range post the earnings announcement.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story