Market News

Reliance Q1 results: Revenue growth in mid-single digits, profit estimates and technical outlook

.png)

4 min read | Updated on July 18, 2025, 09:00 IST

SUMMARY

Reliance Industries slipped below its 21-day EMA on 14 July, giving up all gains made since its June 20 breakout. The stock met resistance near ₹1,550 and is now fluctuating between its 21-day and 50-day EMAs.

Reliance Industries shares have surged 18% in the first quarter of current financial year. | Image: Shutterstock

Oil-to-telecom conglomerate Reliance Industries will announce its June quarter results on Friday, July 18. According to experts, Reliance is expected to deliver a strong quarterly performance, aided by growth in key businesses like oil-to-chemicals (O2C), retail and telecom.

As per experts, Reliance Industries’ consolidated Q1 revenue could increase by 4-7% YoY to ₹2.40 to ₹2.45 lakh crore, while sequentially revenue could see a single-digit decline. The company reported revenue of ₹2.32 lakh crore in the same quarter last year and ₹2.61 lakh crore in Q4FY25.

Net profit is expected to rise strongly by 30-35% YoY to range between ₹21,030 to ₹21,180 crore. The company reported net profit at ₹15,138 crore in Q1FY25 and ₹19,407 crore in Q4FY25.

Furthermore, Reliance Industries’ consolidated EBITDA could range between ₹44,350 to ₹45,210 crore, a rise of 15-18% YoY aided by growth across different business segments.

Investors will closely track Reliance Industries' Q1 results to gauge the performance of the retail, telecom and oil refining business. Management commentary on the overall business scenario will also be closely watched.

Ahead of the Q1 result announcement, Reliance Industries shares closed 0.6% lower at ₹1,476 on 17 July. So far this year, Reliance shares have delivered over 21% return to its investors.

Technical View

Shares of Reliance Industries slipped below its 21-day exponential moving average (EMA) and surrendered all its gains after breakout on 20th June. It faced resistance around the crucial resistance zone of ₹1,550 and is currently trading between its 21-day and 50-day EMAs.

In the upcoming sessions, traders should monitor the price action around the 50-day EMA and ₹1,450 zone. A break below this zone on a closing basis will signal weakness. Conversely, if Reliance Industries reclaims its 21-day EMA on a closing basis, it may extend its gains up to ₹1,500 zone.

Options outlook

As of 17 July, the options market suggests that Reliance Industries could experience a price movement of approximately ±3%, based on an at-the-money (ATM) strike price of 1,480.

Examining the open interest data for the 31 July expiry reveals a high concentration of call options at the 1,550 and 1,500 strike prices, indicating potential resistance at these levels.

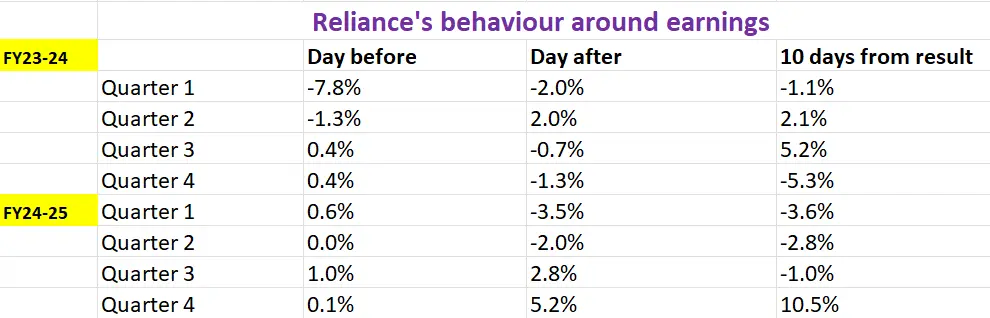

To better understand Reliance Industries’ historical volatility and trends, it is useful to examine its price behaviour around earnings announcements.

Strategies based on options data

With options data pricing in a possible price swing of ±3%, traders can consider a range of volatility-based strategies in Reliance Industries.

Long straddle: Ideal for those expecting a significant price move, regardless of direction. This strategy involves purchasing both an ATM call and an ATM put option of same strike prices and expiry. A sharp movement—greater than ±3%—in either direction allows for potential profits. The risk of this strategy is limited to the combined premium paid for both options.

Short straddle: Suitable when traders expect volatility to decrease or the stock to trade within a defined range post-event (such as after earnings). Here, one sells both an ATM call and an ATM put option with the same strike and expiry. This strategy profits if Reliance Industries’ share price remains inside the implied ±3% after the announcement, as both options could expire worthless.

Meanwhile, for traders expecting a break above or below 21-day and 50-day EMA can consider directional spreads like Bull Put Spreads or Bear Call Spreads. These strategies allow traders to align their positions with their expectations for both price direction and volatility, helping manage risk and potential return.

Related News

About The Author

Next Story