Market News

L&T Tech Q2 Results: Net profit rises 1.9% QoQ to ₹319.6 crore; interim dividend of ₹17 per share announced

3 min read | Updated on October 16, 2024, 17:35 IST

SUMMARY

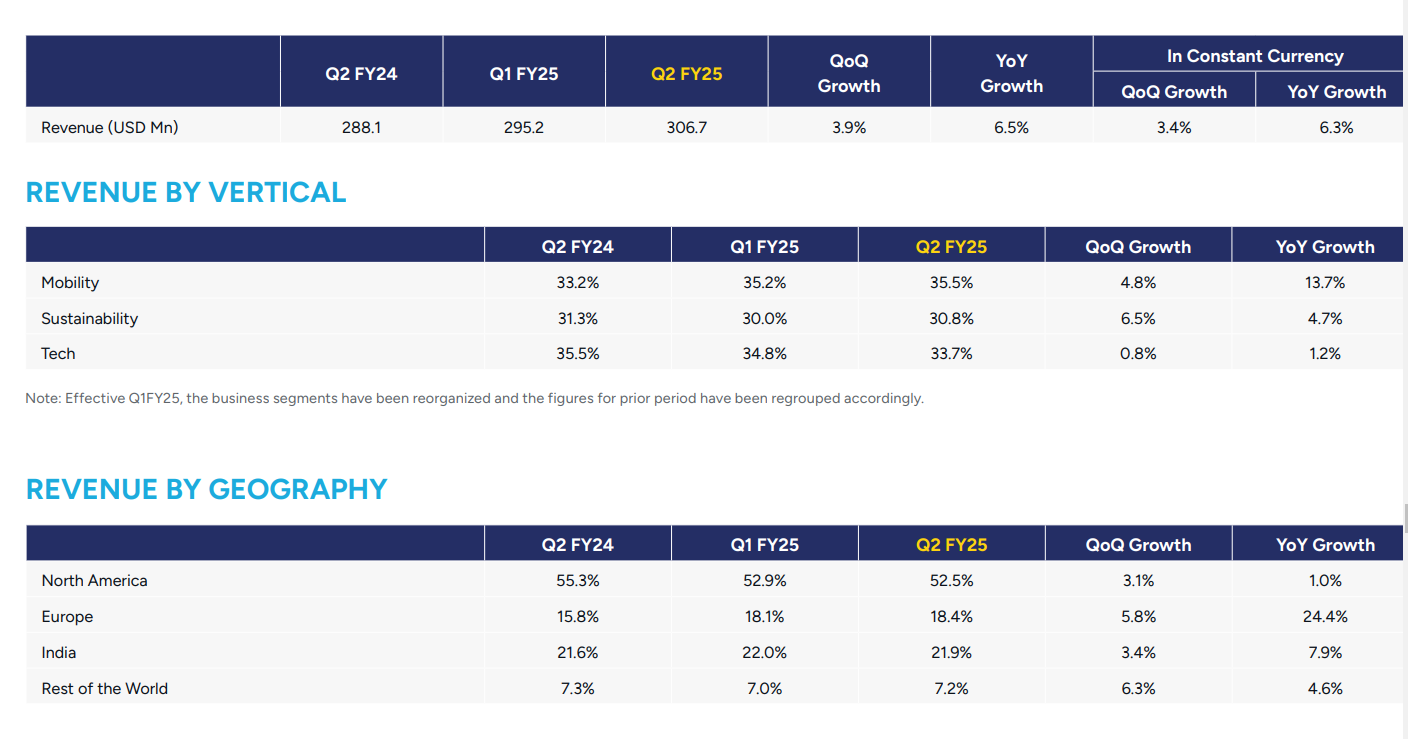

Revenue in US dollar terms stood at $306.7 million, up 3.9% QoQ and 6.5% YoY, while in constant currency, revenue was up 3.4% QoQ and 6.3% YoY.

Stock list

Revenue for the period came in at ₹2,572.9 crore, up 4.5% QoQ and 7.8% YoY.

Revenue for the period came in at ₹2,572.9 crore, up 4.5% QoQ and 7.8% YoY.

Revenue in US dollar terms stood at $306.7 million, up 3.9% QoQ and 6.5% YoY, while in constant currency, revenue was up 3.4% QoQ and 6.3% YoY.

EBITDA or earnings before interest, taxes, depreciation, and amortisation for the quarter, came in at ₹466 crore, up 2.1% QoQ. However, on a YoY basis, the figure dropped 2%.

EBIT, or earnings before interest and taxes, for the company came in at ₹387.7 crore, up 1.1% QoQ but down 4.9% on a YoY basis.

EBIT margin decreased to 15.1% from 17.1% in the year-ago period and 15.6% in the June quarter. EBITDA margin slipped to 18.1% from 19.9% in the September 2023 quarter and 18.5% in the previous quarter.

Net income margin stood at 12.4% for the second quarter against 13.2% in the year-ago quarter and 12.7% in the June quarter.

Interim Dividend and Record Date

The company also announced an interim dividend of ₹17 per share. The record date for the same has been fixed as October 25, 2024.

"The interim dividend shall be paid to equity shareholders of the company whose names will appear in the Register of Members or in the records of the depositories as Beneficial Owners of Equity shares as of Friday, October 25, 2024, which is the Record Date fixed for the aforesaid purpose," the company said.

Deal wins & CEO comment

"During the quarter, LTTS won two $20 million and four $10 million TCV deals. Additionally, the company won two significant empanelment agreements in Sustainability," the company said in its investor presentation.

Commenting on the results, Amit Chadha, CEO & Managing Director, at LTTS, said, "Our ‘Go Deeper to Scale’ strategy at the start of the year and focused investments into our 3 segments are starting to show results. We had a strong quarter with 4% sequential growth led by broad-based performance across all 3 segments."

The CEO added, "Sustainability picked up very well, growing by 6.5% on the back of earlier large deals and empanelment agreements. Mobility also had a strong showing, with 5% growth driven by our differentiated story on SDV and hybridization. In the Tech segment, we are seeing the growth momentum improving, especially with our hyperscaler customers, where our product, platform, and silicon engineering play is helping us win larger deals and supersize our engagements."

FY25 guidance

LTTS reaffirmed its FY25 guidance of 8-10% revenue growth in constant currency and a medium-term outlook of $2 billion in revenue with an EBIT margin of 17-18%.

Operational Performance

Employee Statistics

The company's total headcount at the end of the September quarter stood at 23,698. It is lower than 23,880 reported in the September 2023 quarter but higher than 23,577 staff in the June quarter.

Voluntary Attrition (last twelve months) in percentage terms declined to 14.3% from 16.7% in the corresponding quarter of the previous fiscal and 14.8% in the previous quarter.

About The Author

Next Story