Market News

L&T Q3 results: Net profit could surge up to 29% YoY led by higher revenue and steady order execution; check key details

.png)

3 min read | Updated on January 28, 2026, 11:08 IST

SUMMARY

arsen & Toubro is expected to report healthy double-digit growth in revenue and net profit for the quarter ending in December. This is supported by robust order execution and a strong order book. Technically, the stock has slipped below its short-term moving averages and is hovering near the 200-day exponential moving average (EMA). This makes the ₹3,720–₹3,700 zone a key area of support.

Stock list

L&T Q3 revenue and net profit could see double-digit growth. | Image: Shutterstock

Engineering and construction giant Larsen and Toubro Limited (L&T) will announce its December quarter results on Wednesday, January 28. According to experts, L&T could report healthy double-digit growth in revenue and net profit, aided by strong growth in order execution and a robust order book.

The company’s consolidated revenue could rise between 15% and 17% to ₹75,100 to ₹75,750 crore, supported by steady order execution. L&T reported revenue of ₹64,668 crore in the same quarter of the last fiscal year and ₹67,984 crore in the previous quarter.

L&T could see robust 26% to 29% YoY growth in net profit in the range of ₹4,250 to ₹4,370 crore. The company reported a net profit of ₹3,359 crore in Q3FY25, while it stood at ₹3,926 crore in the previous quarter.

During the December quarter earnings, investors will monitor the company’s order execution capability, operating margins, order inflow numbers, project pipeline and segment performance. Management commentary on domestic economic activity and government capital expenditure will also be keenly watched.

Ahead of the Q3 result announcement, L&T shares are trading 0.3% higher at ₹3,800 apiece on the NSE. The stock is down over 7.2% this month amid a fall in broader markets.

Technical outlook

L&T has witnessed a sharp drop after hitting a fresh all-time high in January 2026. The recent price action shows a breakdown below the 21-day and the 50-day exponential moving averages (EMAs), signalling a shift from short-term bullish momentum. The stock is hovering near the ₹3,750–₹3,800 zone, which coincides closely with the 200-day EMA — a critical long-term trend support.

In the short-term, the ₹3,950–₹4,000 region now acts as immediate overhead resistance, aligning with the 50-day EMA and a prior consolidation zone. On the downside, ₹3,720–₹3,700 remains the first line of defence. A sustained breakdown below this level could open up further downside.

Options outlook

For the 24 February expiry, the at-the-money (ATM) strike as of 28 January is 3,840 is priced at ₹215, implying an expected move of approximately ±5.6% by expiry.

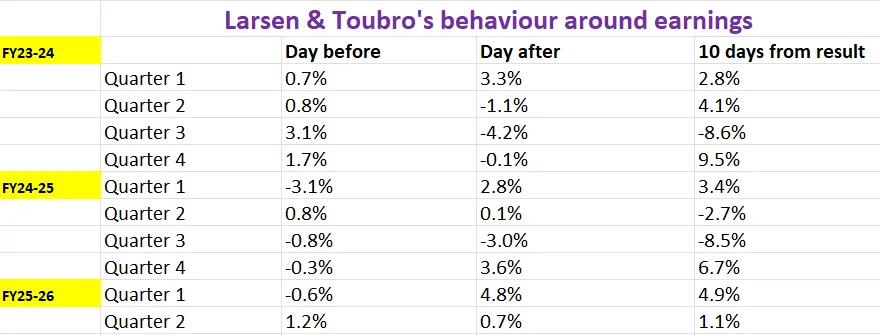

Before we consider options strategies, let’s examine the historical price behaviour of Larsen & Toubro around its earnings over the past two years.

Options strategy for Larsen and Toubro

The implied move of ±5.6% opens up opportunities for both volatility and directional trades. Traders expecting a significant price swing can opt for a Long Straddle, buying both call and put options of the same strike and expiry. The strategy benefits if Larsen and Toubro move beyond the implied range of ±5.6%.

Meanwhile, those anticipating limited movement may consider a Short Straddle, which benefits if the stock stays within the ±5.6% band post-earnings.

For directional traders, a Bull Put Spread may be ideal for a breakout from the ₹3,950 resistance zone, while a Bear Call Spread suits those expecting a breakdown below the immediate support zone of ₹3,700.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story