Market News

ITC Q1 results: Net profit expected to remain flat; check earnings preview and key technical levels

.png)

3 min read | Updated on August 01, 2025, 09:02 IST

SUMMARY

ITC's price action is currently consolidating below its 21-week and 50-week exponential moving averages, suggesting a range-bound trend.

ITC technical structure remains rangebound below its 21-week and 50-week exponential moving averages (EMAs).

The diversified conglomerate ITC is set to unveil its first-quarter results on 1 August 2025. The consumer goods giant is expected to report mixed earnings, with low single-digit growth in revenue and net profit.

According to experts, ITC could report a 3–5% year-on-year (YoY) increase in standalone revenue, reaching ₹17,518–₹17,700 crore. This growth is expected to be driven by higher revenue in the agri business and a 3–6% rise in cigarette sales. In the same quarter last year, ITC reported revenue of ₹17,000 crore, while in the previous quarter it was ₹17,248 crore.

Meanwhile, ITC's net profit is expected to remain flat at ₹4,950–5,050 crore, mainly due to margin pressure from higher raw material prices. In Q1FY25, the company registered a standalone net profit of ₹4,917 crore, compared to ₹19,562 crore in the previous quarter, due to a one-time exceptional gain relating to the demerger of ITC’s hotels business.

During the result announcement, investors will closely monitor revenue and volume growth across different business segments, such as FMCG, cigarettes, and agribusiness. Additionally, management’s commentary on demand and overall consumption, particularly in rural regions. Investors are also looking forward to the ITC dividend announcement.

Ahead of the Q1 results announcement, ITC shares closed 1% higher at ₹411 per share on Thursday, 31 July. So far this year, ITC shares have fallen by 9.7%.

Technical view

The technical structure of the ITC remains rangebound below its 21-week and 50-week exponential moving averages (EMAs). It is facing resistance around the ₹444 zone which connects the downward sloping trendline connecting previous all-time high and swing high of December 2024. Meanwhile, the support for ITC is around ₹395. Unless ITC breaks this range on a closing basis, the trend may remain sideways.

Options outlook

ITC's at-the-money (ATM) strike price for 28 August expiry is 415, with both call and put options priced at ₹16. This implies that traders are anticipating a price movement of approximately ±3.9%.

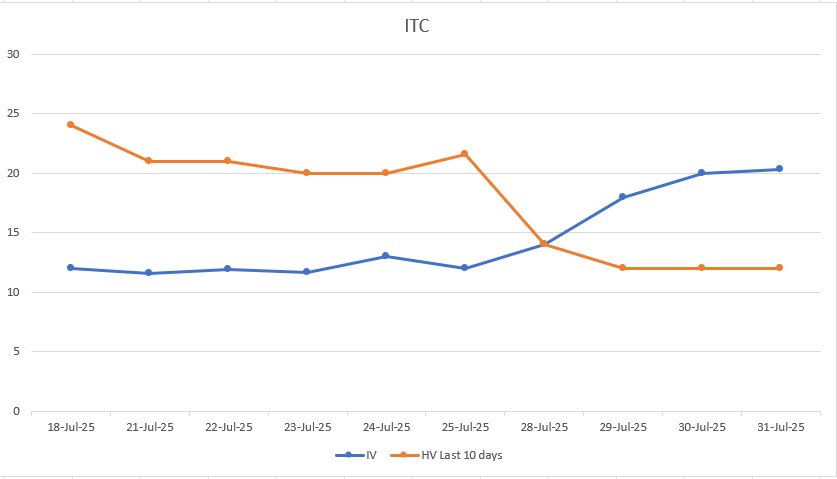

Meanwhile, the implied volatility of last ten sessions inched towards 20, sharply outpacing the 10-day historical volatility (HV), which has remained relatively flat after a brief spike.

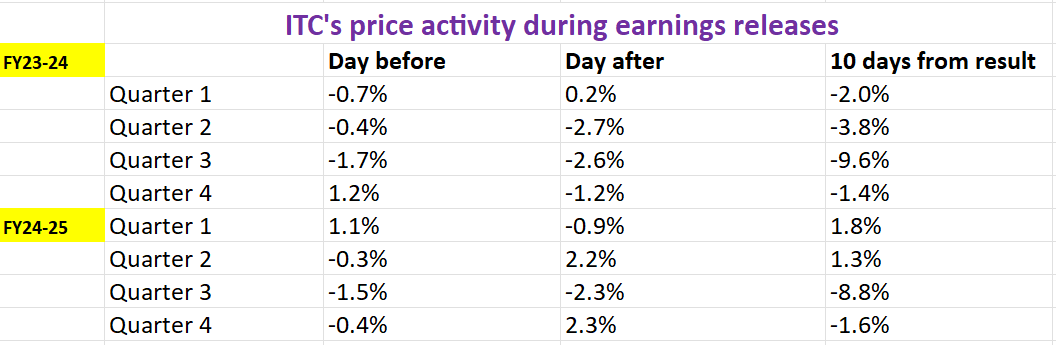

Before planning strategies, let's examine ITC’s historical price behaviour during past earnings announcements.

Options strategies for ITC

With the options market predicting a price movement of ±3.9% till 28 August, traders can consider long and short straddle strategies to take advantage of the expected volatility.

A long straddle involves buying both an at-the-money call and put option on ITC with the same strike price and expiry date. This option buying strategy will profit if the share price moves significantly more than ±3.9% in either direction.

Conversely, if you expect ITC to remain rangebound and move less than ±3.9% till 28 August expiry, you can implement a short straddle strategy. This involves selling an ATM call and a put option with the same strike price and expiry date. The strategy will profit from the fall in volatility if the stock moves less than ±3.9% before the options expire.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story