Market News

Infosys Q2 results: Revenue, net profit likely to rise, key focus on interim dividend, growth guidance

.png)

4 min read | Updated on October 15, 2025, 13:35 IST

SUMMARY

Following the earnings announcement, Infosys investors will be closely monitoring the FY26 revenue guidance and new deal wins for further direction. Technically, the stock has been confined within the ₹1,530–₹1,650 range over the past two months, and has recently formed an inverted hammer candlestick pattern.

Stock list

Infosys share price could see a potential ±5% movement

IT major Infosys will announce its September quarter earnings on Thursday, October 16. Experts believe Infosys could report low single-digit growth in revenue and net profit on a sequential basis.

Infosys' net profit may range between ₹7,035 to ₹7,215 crore, up 1.5% to 4.2% compared to the previous quarter. The company reported a net profit of ₹6,921 crore in Q1FY26 and ₹6,506 crore in the same quarter last year.

Meanwhile, Infosys Q2 revenue could increase by 4.2 to 4.5% on a sequential basis to ₹44,100 to ₹44,210 crore. The company registered revenue of ₹42,279 crore in Q1FY26 and ₹40,986 crore in the September quarter of FY25.

Infosys is likely to report decent quarterly earnings compared to other tier-1 IT companies, aided by deal ramp-ups, continued growth in the financial services vertical and contribution from new acquisitions. The company’s EBIT margin is expected to improve by 20 to 30 basis points, supported by currency tailwinds. Infosys' new deal wins are likely to be around $3.1 to $3.2 billion during the quarter.

Investors will be closely monitoring Infosys' FY26 revenue guidance for any changes. New deals won during the September quarter and management's commentary on IT discretionary spending will also be closely watched. Commentary on the increase in H-1B visa fees will also be monitored, given that Infosys was the second-largest recipient of H-1B visas among domestic IT companies, with 8,137 approvals in FY24.

As of 1 pm on Wednesday, Infosys shares were trading 1% lower at ₹1,474. So far this year, Infosys shares have fallen by over 21%, in line with other IT stocks, amid uncertainty surrounding U.S. trade tariffs and reduced IT spending.

Technical view

Infosys is currently trading within an ascending channel, with support at around the ₹1,400–₹1,350 level (highlighted in green) and resistance at approximately ₹1,950–₹2,050 (the red zone). The stock has recently tested the lower end of this channel several times, indicating demand in this area. However, there is strong selling pressure below the stock's key moving averages — the 21-, 50- and 200-week EMAs — suggesting a weak long-term outlook. The convergence of these EMAs at around ₹1,520–₹1,580 creates an immediate resistance zone.

On the downside, a decisive break below ₹1,400 could open the way to the ₹1,320–₹1,280 zone. Conversely, sustained support in this region could trigger a rebound. The overall structure is neutral to bearish unless Infosys closes above the ₹1,580–₹1,600 zone with volume confirmation. Until then, the price action indicates continued consolidation within this long-term channel.

Options outlook

At 12 pm on 15 October, the at-the-money (ATM) strike for Infosys was ₹1,460, with the combined premium of the call and put options quoted at ₹73. This indicates that, ahead of the 28 October expiry, the options market is anticipating a potential ±5% movement in Infosys share prices.

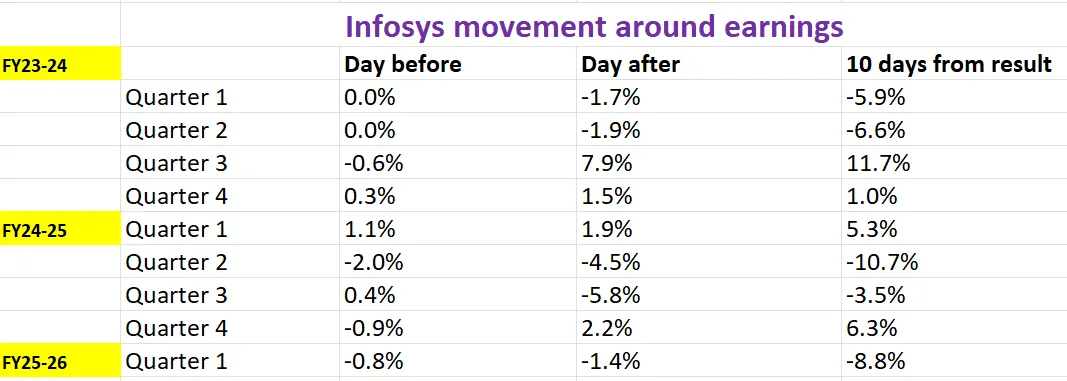

Let’s examine how Infosys stock has reacted to its quarterly earnings announcements over the past two years to gain insights into its price movements.

Options strategy for Infosys

Ahead of the 28 October expiry, the options market is implying a potential price move of around ±5% in Infosys, reflecting expectations of heightened volatility around this period. Depending on whether they anticipate a sharp price move or a period of consolidation, traders can position themselves accordingly.

Conversely, those expecting a large swing in either direction may find that a long straddle, buying both an at-the-money (ATM) call and put option with the same expiry, is an effective way to capitalise on volatility expansion.

On the flip side, if you believe that Infosys will remain range-bound within ±5%, a short straddle may be more suitable as it benefits from time decay and declining volatility while the price remains stable.

About The Author

Next Story