Market News

HUL Q2 results: Revenue, net profit likely to fall as GST cut weighs on sales volume; check key technical levels

.png)

4 min read | Updated on October 23, 2025, 10:50 IST

SUMMARY

Hindustan Unilever is set to announce its Q2 FY26 results on October 23. Analysts are anticipating a subdued quarter due to short-term trade disruptions resulting from GST rate reductions on key FMCG products. Technically, the stock is holding firm above the key EMAs, with support at ₹2,415–₹2,515 and resistance at ₹2,850.

Stock list

HUL's consolidated business growth may be near flat or in the low single digits

Hindustan Unilever (HUL) is set to unveil its Q2 FY26 results on Thursday, October 23. The consumer goods giant is expected to report subdued quarterly earnings.

Ahead of the quarterly earnings report, HUL released Q2 business updates. The company announced that recent GST reforms had lowered the rate on almost 40% of its products, including soaps, shampoos, toothpaste, hair oils, talcum powder, lifestyle nutrition products and other foods, from 12% and 18% to just 5%.

However, the change in the GST rate has caused short-term disruption at distributor and retailer level, as trade partners have been clearing old stock before ordering new products at updated prices. Consequently, the company's consolidated business growth may be near flat or in the low single digits. The company anticipates this to be a one-off, temporary impact and expects recovery to begin in November, when prices will stabilise.

HUL could report a year-on-year (YoY) decline in revenue of 1-3%, to ₹15,780-15,830 crore. Last year, the company reported consolidated revenue of ₹15,926 crore in the September quarter and ₹16,514 crore in Q1 FY26. Meanwhile, net profit could decline by 3-6%, ranging from ₹2,470 to ₹2,510 crore, compared to a net profit of ₹2,603 crore in the same quarter last year and ₹2,862 crore in the previous quarter.

Meanwhile, HUL is expected to report volume growth of just 1 to 2% YoY, while its EBITDA margin is expected to fall by 120 to 130 basis points.

During the announcement of the Q2 results, investors will pay close attention to management's comments on the overall demand outlook, particularly in light of the GST 2.0 reforms. They will also be closely monitoring price inflation in key raw materials and its impact on margins.

Ahead of the Q2 results announcement, HUL shares are trading at ₹2,588, down 0.5%. So far in 2025, the company has provided investors with a return of 11.3%.

Technical view

Hindustan Unilever is trading at around ₹2,590, with a positive outlook on the weekly chart. This follows the stock reclaiming its 21, 50 and 200-week exponential moving averages (EMAs), which are now converging around the ₹2,415–₹2,515 zone. This zone will act as a medium-term support. Remaining above this zone keeps the structure bullish.

On the upside, the ₹2,750–₹2,850 band remains a crucial supply zone, having repeatedly capped rallies since 2022. A decisive breakout above this resistance could trigger a move towards ₹3,000–₹3,100.

Options outlook

The open interest data for the 28 October expiry indicates that Hindustan Unilever’s at-the-money (ATM) strike of ₹2,580 is implying a potential price move of around ±2.7% ahead of the expiry.

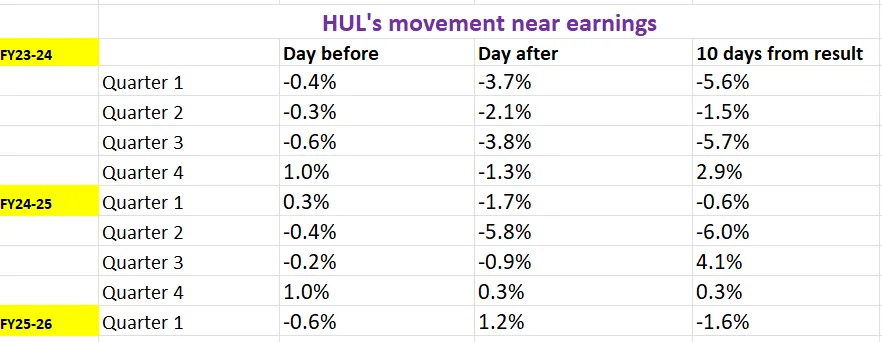

To get a clear perspective on price behaviour, let's look at how Hindustan Unilever’ share price has performed over the nine quarters around its earnings announcements.

Options strategy for Hindustan Unilever

With the options market pricing in a potential move of ±2.7%, traders can use volatility-based strategies, such as long or short straddles, to align with their market outlook.

A long straddle involves buying an at-the-money (ATM) call and put option with the same strike price and expiry date. This strategy can benefit from a sharp price movement, beyond the expected range of ±2.7% in either direction.

Conversely, a short straddle involves selling both an ATM call and put option with the same strike price and expiry date. This strategy aims to profit from time decay if the stock price remains within the expected range of ±2.7%.

Those expecting a directional breakout or continuation may consider bull put spreads to capture further upside momentum, or bear call spreads if a breakdown from the current consolidation occurs.

About The Author

Next Story