Market News

HUL Q1 results: FMCG major expected to report muted earnings; check preview and key technical levels

.png)

3 min read | Updated on July 31, 2025, 09:25 IST

SUMMARY

Hindustan Unilever (HUL) is trading above its key exponential moving averages—21, 50, and 200—after breaking out of a symmetrical triangle pattern. As long as HUL holds above the ₹2,350 level on a closing basis, the bullish momentum is likely to continue.

Stock list

During the Q1 results announcement, investors will be keen to hear the management's views on the overall demand outlook and price inflation.

Hindustan Unilever (HUL) will report its Q1 FY26 results on Thursday, 31 July. The consumer goods giant is expected to report subdued quarterly earnings.

HUL could report a 1–3% year-on-year (YoY) rise in revenue, reaching ₹15,950–₹16,050 crore. Last year, the company reported revenue of ₹15,707 crore in the June quarter and ₹15,670 crore in Q4FY25. Meanwhile, net profit could decline by 4–5%, ranging from ₹2,510 to ₹2,570 crore, compared to a net profit of ₹2,646 crore in the same quarter last year and ₹2,565 crore in the previous quarter.

Experts believe that the subdued earnings are mainly due to rising commodity prices and weak urban demand. HUL is also expected to report volume growth of just 1% YoY, while its EBITDA margin is expected to fall by 50 to 70 basis points.

During the Q1 results announcement, investors will be keen to hear the management's views on the overall demand outlook and price inflation in key raw materials, as well as the impact this will have on margins.

Ahead of the Q1 results announcement, HUL shares are trading 0.3% higher at ₹2,445. So far in 2025, the company's shares have provided investors with a return of 4.8%.

Technical view

The technical structure of the Hindustan Unilever (HUL) is currently sustaining above all the crucial exponential moving averages like 21, 50 and 200 after breakout from the symmetrical triangle pattern. Unless HUL slips below ₹2,350 zone on a closing basis, it may sustain the bullish price action. However, a close below the ₹2,350 zone will invalidate the breakout and signal weakness.

Options outlook

As per the open interest data of 28 August expiry, Hindustan Unilever’s at-the-money (ATM) strike of 2,440 suggests that market participants expect a move of ±4.8% ahead of August expiry.

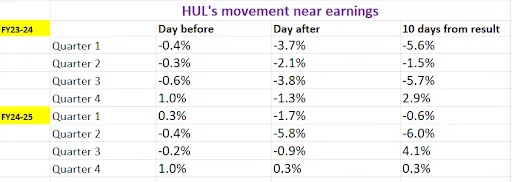

To get a clear perspective on price behaviour, let's look at how Hindustan Unilever’ share price has performed over the eight quarters around its earnings announcements.

Options strategy for Hindustan Unilever

With the options market implying a movement of ±4.8%, traders can strategise using Long and Short Straddles to capitalise on anticipated volatility and price movements.

By opting for the Long Straddle strategy, you purchase both an at-the-money call option and an at-the-money put option for HUL, with the same strike price and expiry date. The aim of this strategy is to make a profit if the stock price moves sharply — by more than ±4.8% — in either direction.

Meanwhile, with a short straddle strategy, you sell both an at-the-money call option and an at-the-money put option with the same strike price and expiry date. This approach is based on the expectation that the stock price will remain relatively stable, fluctuating within a range of ±4.8%, until the contracts expire.

Meanwhile, traders who expect further bullish momentum or breakdown of the symmetrical triangle pattern can consider bull put spread or bear call spread.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story