Market News

HDFC Bank Q3 results: Net profit likely to rise up to 7% YoY on robust loan growth

.png)

4 min read | Updated on January 17, 2026, 09:56 IST

SUMMARY

HDFC Bank will announce its results for the December quarter on January 17, 2025. Ahead of the earnings, the bank reported steady business momentum, with gross advances rising 11.9% YoY to ₹28.44 lakh crore and deposits growing 12.2% YoY to ₹27.52 lakh crore. Investors will continue to focus on management commentary regarding the sustainability of credit growth, deposit traction, and net interest margins, amid concerns over the elevated loan-to-deposit ratio (LDR).

Stock list

HDFC Bank shares declined nearly 6% this month on concerns around rising Loan-to-deposit ratio (LDR). | Image: Shutterstock

India's largest private sector lender, HDFC Bank, will announce its December quarter results on January 17, 2025. Ahead of the results, the bank released its business update for the third quarter of FY26.

Q3FY26 business updates

HDFC Bank reported an 11.9% YoY increase in gross advances to ₹28.44 lakh crore during the third quarter. Meanwhile, its period-end deposits grew by 12.2% YoY, totalling ₹27.52 lakh crore. Its current account-savings account (CASA) deposits also rose by 9.9% YoY, reaching ₹8.9 lakh crore during the quarter.

Experts believe HDFC Bank is expected to report low single-digit growth in net interest income (NII) and profitability. Net interest income (NII) is likely to increase 6 to 7% YoY to range between ₹32,550 and ₹32,900 crore, driven by strong loan disbursement growth. The private lender reported an NII of ₹30,650 crore in the same quarter last year and ₹31,550 crore in the previous quarter.

Meanwhile, the standalone net profit could see a 5% to 7% YoY rise to ₹17,660 to ₹17,970 crore and fall by 3% to 4% on a sequential basis. HDFC Bank registered a standalone net profit of ₹16,736 crore in Q3FY25, while it was ₹18,641 crore in the previous quarter.

HDFC Bank investors will look forward to management commentary on credit and deposit growth and track key performance indicators like net interest margin and gross and net non-performing assets (NPAs) during the quarterly result announcement.

Ahead of the Q3 result announcement, HDFC Bank shares are trading 0.7% higher at ₹932 on Friday, January 16. So far this month, HDFC Bank shares have declined nearly 6%, despite strong business updates. The decline was attributed to a high loan-to-deposit ratio (LDR), as during the third quarter, HDFC Bank's LDR went up by 50 basis points to 99.5%.

Loan-to-deposit ratio (LDR) is one of the key metrics tracked in the banking sector, which shows how much of a bank’s deposits is being used to give loans.

Technical outlook

HDFC Bank experienced a sharp decline from its recent consolidation range, with prices falling decisively below the 50-day and 200-day exponential moving averages (EMAs). The inability to hold above the ₹980–₹1,000 zone, which was previously a strong resistance zone, suggests selling pressure at higher levels.

If the stock fails to reclaim the ₹940 support zone on a closing basis, the downside pressure may exist with crucial support now visible around the ₹850 zone. Any recovery on the upside is likely to face resistance near the 50-day EMA.

Options outlook

As of 16 January, the options market is anticipating a ±3.3% move in HDFC Bank shares, based on the at-the-money 935 strike and current implied volatility.

With the options market anticipating a ±3.6% move in HDFC Bank shares, based on the at-the-money 935 strike and current implied volatility. This sets the stage for strategies such as long or short straddles, depending on a trader’s view of potential price swings and volatility.

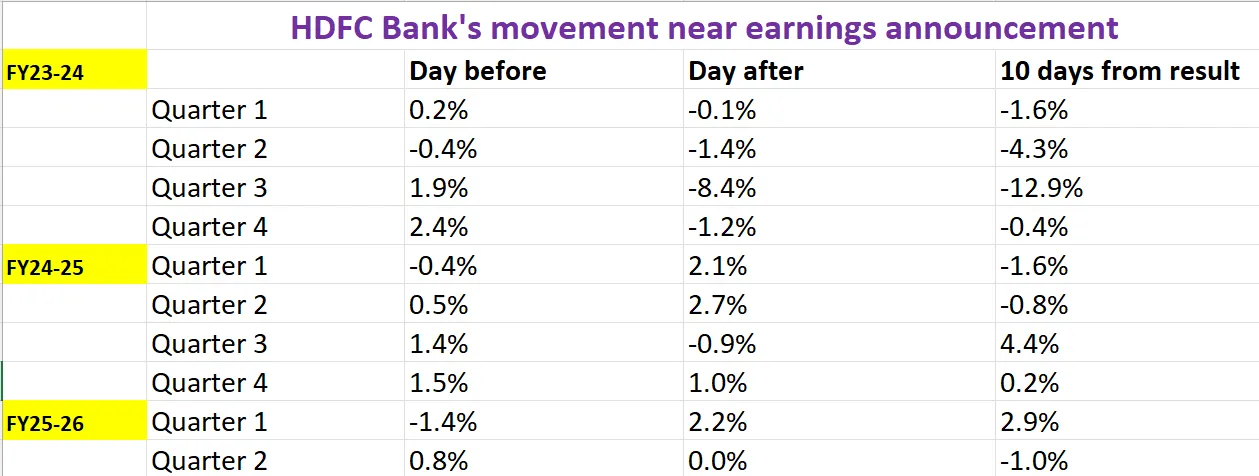

Before diving into strategies, let’s take a look at how HDFC Bank’s stock has responded to earnings over the last 10 quarters.

Options strategy for HDFC Bank

With the options market pricing in a ±3.6% move for HDFC Bank ahead of the 27 January expiry, traders can explore straddle strategies.

A long straddle involves buying both an at-the-money (ATM) call and put option with the same strike and expiry. This strategy pays off if the HDFC Bank moves more than ±3.6% in either direction.

On the other hand, if you expect HDFC Bank to stay range-bound and move less than ±3.6%, a short straddle might work better. It involves selling both an ATM call and a put, aiming to profit from limited price movement and a drop in volatility.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story