Market News

HDFC Bank Q2 results: Net profit likely to remain flat amid repo rate cuts; check options strategy and key technical levels

.png)

4 min read | Updated on October 17, 2025, 14:41 IST

SUMMARY

HDFC Bank will announce its September-quarter results on 18 October 2025, with analysts expecting muted NII growth and flat profitability amid margin compression from RBI’s rate cuts. Technically, a bullish 21–50 EMA crossover supports upward momentum, with resistance near ₹1,050–₹1,070 and support at ₹940–₹950.

Stock list

Based on the at-the-money ₹1,005 strike and current implied volatility, HDFC Bank could see a ±3% move as of October 17 data.

India's largest private sector lender, HDFC Bank, will announce its results for the September quarter on 18 October 2025. Prior to this, the bank released its business update for the second quarter of FY26.

HDFC Bank reported a 9.9% year-on-year (YoY) increase in gross advances to ₹27.69 lakh crore during the second quarter. Meanwhile, its period-end deposits grew by 12.1% YoY, totalling ₹28.01 lakh crore. Its current account–savings account (CASA) deposits also increased by 7.4% year on year, reaching ₹9.4 lakh crore during the quarter.

According to experts, HDFC Bank is expected to report muted growth in net interest income (NII) and profitability, as the recent repo rate cuts by the RBI are likely to put pressure on margins. NII is expected to increase by 3–4% year on year, ranging between ₹31,130 and ₹31,270 crore. The private lender reported an NII of ₹30,111 crore in the same quarter last year.

The standalone net profit could also decline by 0.5–1% YoY, reaching ₹16,614–16,754 crore. HDFC Bank registered a standalone net profit of ₹16,821 crore in Q2 FY25, compared to ₹18,155 crore in the previous quarter. This muted growth is mainly due to weak loan book growth, while margins are expected to remain under pressure due to the rise in the RBI repo rate leading to loan repricing.

Investors will be looking to the management for commentary on credit and deposit growth, as well as for updates on key performance indicators such as the net interest margin and gross and net non-performing assets (NPAs).

Ahead of the Q2 results announcement, HDFC Bank shares were trading at ₹1,003 on Friday, 17 October, up 1%. So far this year, HDFC Bank shares have risen by over 12%.

Technical view

HDFC Bank continues to trade within a rising parallel channel, maintaining an uptrend. The stock recently rebounded from its 21-week EMA (₹968), demonstrating renewed strength following the retention of key support in the ₹940–₹950 zone.

The broader trend remains bullish, with higher highs and higher lows having remained intact since mid-2024. Having now crossed above ₹1,000, the stock is poised to retest the upper channel resistance at around ₹1,050–₹1,070. A decisive breakout above this zone could allow for further growth.

On the downside, the ₹900–₹920 area is a significant support level, coinciding with the lower channel trendline and the 50-EMA (₹932). A close below this level would be the first indication of weakness in the current uptrend.

Options outlook

As of 17 October, the options market is anticipating a ±3% move in HDFC Bank shares, based on the at-the-money ₹1,005 strike and current implied volatility. This sets the stage for strategies such as long or short straddles, depending on a trader’s view of potential price swings and volatility.

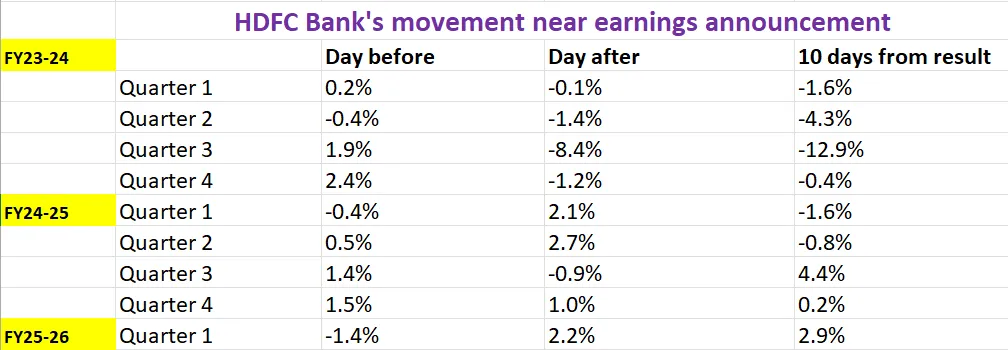

Before diving into possible trades, it’s useful to look back at how HDFC Bank’s stock has responded to earnings over the last eight quarters.

Options strategy for HDFC Bank

With the options market pricing in a ±3% move for HDFC Bank ahead of the 28 October expiry, traders can explore straddle strategies to play this expected volatility.

A Long Straddle involves buying both an at-the-money (ATM) call and put option with the same strike and expiry. This strategy pays off if the HDFC Bank moves sharply more than ±3% in either direction.

On the other hand, if you expect HDFC Bank to stay range-bound and move less than ±3%, a Short Straddle might work better. It involves selling both an ATM call and a put, aiming to profit from limited price movement and a drop in volatility.

About The Author

Next Story