Market News

HDFC Bank Q1 results preview: Earnings, Bonus issue, Dividend, Technical structure & Options strategy

.png)

4 min read | Updated on July 18, 2025, 14:30 IST

SUMMARY

Ahead of its first quarter earnings, the options market is implying a move of ±3% ahead of its 31 July expiry. In addition to the earnings, market participants will be closely watching for the bank's first-ever announcement of a bonus share and special dividend.

Stock list

HDFC Bank board will consider first ever bonus issue on Saturday. Image source: Shutterstock.

India's largest private sector lender, HDFC Bank, will announce its June quarter results on July 19, 2025. Ahead of the results, the bank released its business update for the first quarter of FY26.

Q1FY26 business updates

HDFC Bank reported a 6.7% YoY increase in gross advances to ₹26.53 lakh crore during the first quarter. The bank’s deposits grew by 16.2% YoY, totalling ₹27.64 lakh crore. Its current account-savings account (CASA) deposits also rose by 8.5% YoY, reaching ₹9.3 lakh crore during the quarter.

According to experts, HDFC Bank is expected to report muted growth in net interest income (NII) and profit. Net interest income (NII) is likely to increase 5-4% YoY to range between ₹31,760 and ₹31,890 crore. The private lender reported an NII of ₹29,837 crore in the same quarter last year.

Meanwhile, net profit could increase by 4-5% YoY to ₹17,110 to ₹17,380 crore. HDFC Bank registered a standalone net profit of ₹16,174 crore in Q1FY25. Muted growth is mainly due to weak growth in the loan book. Additionally, the margins are expected to remain under pressure despite RBI's repo rate cuts in April and June 2025 due to faster loan repricing

Investors will be looking for management commentary on credit and deposit growth, as well as tracking key performance indicators such as the net interest margin and gross and net non-performing assets (NPAs), during the announcement of the quarterly results. Investors will also be looking out for a special dividend and a bonus issue alongside Q1 earnings.

Ahead of the Q1 result announcement, HDFC Bank closed Thursday’s trading session at ₹1,986, down 0.4%. Despite this slight dip, the shares have gained more than 12% year-to-date.

Technical view

The short-term technical structure of the HDFC Bank remains sideways to bullish as the stock is consolidating within the range of recent all-time high (₹2,027) and the immediate support zone of ₹1,970. Additionally, the stock is trading above its three key daily exponential moving averages (EMAs) like 21, 50 and 200, indicating strength.

However, it is important to note that the stock has jumped over 15% in the last four months and is currently consolidating around its all-time high. For short-term clues, traders can monitor the immediate support zone of ₹1,970 and the resistance zone of ₹2,027. A breakout or breakdown above or below these levels on a closing basis will provide further directional clues.

Options outlook

As of 17 July, the options market is anticipating a ±3% move in HDFC Bank shares, based on the at-the-money ₹1,980 strike and current implied volatility. This sets the stage for strategies such as long or short straddles, depending on a trader’s view of potential price swings and volatility.

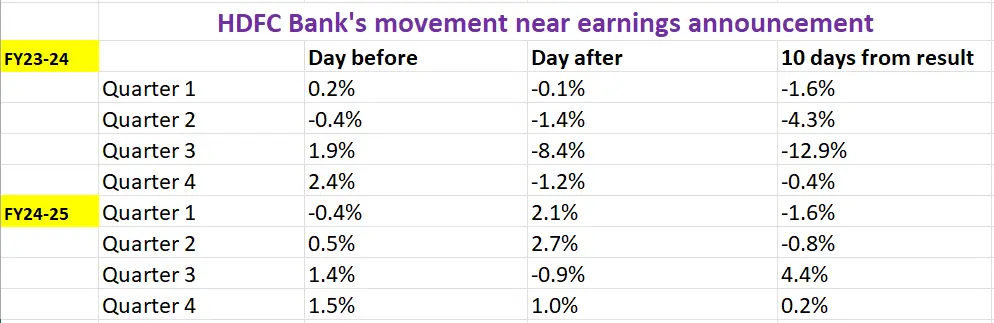

Before diving into possible trades, it’s useful to look back at how HDFC Bank’s stock has responded to earnings over the last eight quarters.

Options strategy for HDFC Bank

With the options market pricing in a ±3% move for HDFC Bank ahead of the 31 July expiry, traders can explore straddle strategies to play this expected volatility.

A Long Straddle involves buying both an at-the-money (ATM) call and put option with the same strike and expiry. This strategy pays off if the HDFC Bank moves sharply—more than ±3%—in either direction.

On the other hand, if you expect HDFC Bank to stay range-bound and move less than ±3%, a Short Straddle might work better. It involves selling both an ATM call and put, aiming to profit from limited price movement and a drop in volatility.

Meanwhile, traders seeking a directional approach to bullish or bearish strategies can explore directional spreads, which provide a refined alternative to simple option buying.

For a bullish outlook and a close above the recent all-time high, traders can consider bull call spread. It involves buying a call option while simultaneously selling a higher strike call with the same expiration, reducing cost while capping potential gains.

Conversely, if HDFC Bank closes below the crucial support zone of ₹1,970 on a closing basis, you can consider a bear put spread strategy. It consists of buying a put option and selling a lower strike put, balancing risk and reward.

Disclaimer Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story