Market News

HCL Tech Q3 results: Net profit may see double-digit growth; focus on management guidance, interim dividend

.png)

4 min read | Updated on January 12, 2026, 09:50 IST

SUMMARY

HCL Technologies is set to announce its Q3 results on Monday, with analysts expecting a decent earnings performance. Technically, HCL Tech is trading above its 50- and 200-day EMAs, and a Golden Crossover is reinforcing a positive medium-term outlook.

Stock list

HCL Tech chart shows a 50-day EMA crossing above the 200-day EMA to form a golden crossover. | Image: Shutterstock

HCL Tech is set to reveal its third-quarter earnings on Monday, 12 January. The company is expected to publish its results after the market hours. According to experts, HCL Tech could report decent quarterly earnings, with double-digit growth in net profit.

HCL Tech's Q3 revenue is expected to rise by a low single digit. Revenue is expected to remain within the range of ₹31,330 to ₹33,100 crore, representing growth of 4% to 5% quarter-on-quarter and 10 to 11% year-on-year. This increase in revenue is mainly due to an increase in deal wins, high growth in key sectors and foreign exchange gains. HCL Tech reported ₹31,942 crore in Q2 FY26 and ₹29,890 crore in Q3 FY25.

Meanwhile, net profit could rise by 11-13% sequentially to a range of ₹4,650-₹4,790 crore. On a yearly basis, net profit could rise by 1-4%. In the previous quarter, HCL Technologies reported a net profit of ₹4,235 crore, compared to ₹4,591 crore in the same quarter last year.

The EBIT margin is expected to rise by 50 to 70 basis points to 18% and 18.5% respectively, and new deal wins are projected to be worth between $2.5 billion and $3 billion.

Investors will be watching closely for any changes in the company's revenue and margin guidance, new deal wins during the December quarter and management's comments on the overall business outlook and revenue from AI services.

Ahead of the Q3 results announcement, HCL Tech shares are trading marginally higher at ₹1,666 apeice, up 0.3% on NSE. HCL Tech stock has fallen over 14% in the last year.

Technical outlook

HCL Tech is trading above its 50-day and 200-day exponential moving averages (EMAs), with the 50-day EMA crossing above the 200-day EMA to form a Golden Crossover. It is a bullish signal for the medium-to long-term trend. The stock has rebounded from the ₹1,580–1,600 support zone, which indicates strong buying interest during periods of decline. Immediate resistance is seen near ₹1,690. A sustained close above this level could trigger an upward movement. The broader outlook remains positive as long as the price remains above the EMA support zones.

Options outlook

Open interest data for the 27 January expiry indicates a significant accumulation of call options at the 1,660 strike. This suggests that traders anticipate consolidation around this zone. Meanwhile, significant unwinding of call options was also seen at 1,640 and 1,700 strikes.

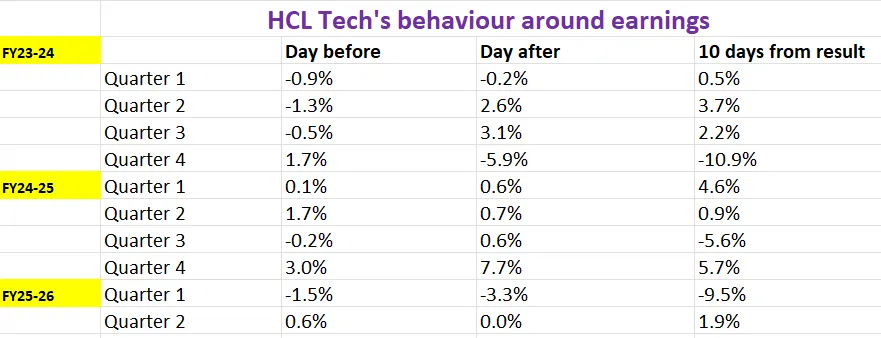

As of 12 January, HCL Tech’s ATM strike for January expiry is at 1,660, with both the call and put options priced at ₹80. This suggests that traders are expecting a price movement of ±5% ahead of the January expiry. However, let's take a look at HCL Tech's historical price behaviour during past earnings announcements in order to make more informed trading decisions.

Options strategy and approach

The options market is currently pricing in a potential move of ±5% for HCL Technologies ahead of the January expiry. This indicates that traders can structure their strategies based on whether they anticipate a breakout or consolidation around this implied move.

If expecting a volatile move (up or down), consider a Long Straddle strategy. It involves buying both an at-the-money (ATM) Call and Put option of the same strike and expiry. This strategy profits when the stock moves sharply beyond the implied ±5% range in either direction. The larger the move, the higher the potential gain.

If expecting a range-bound move, then opt for a Short Straddle strategy. This involves selling both an ATM Call and Put to capture time decay and fall in volatility. This works best if the stock stays within the expected ±5% range until expiry. However, traders should manage risk actively, as sharp moves can cause losses.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop losses. The information is only for educational purposes. We do not recommend any particular stock, securities or strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story