Market News

HCL Tech Q2 preview: Revenue, profit to rise, key focus on interim dividend, growth guidance

.png)

4 min read | Updated on October 13, 2025, 09:52 IST

SUMMARY

Ahead of HCL Tech’s Q2 results, options pricing indicates a potential movement of ±5%. Technically, the stock closed above its 50-day EMA on Friday, indicating short-term buying support. However, it remains below the 200-day EMA, indicating ongoing resistance at higher levels.

Stock list

HCL Tech shares have shown a strong rebound on the weekly chart after testing the support zone near ₹1,370–₹1,400

HCL Tech is set to announce its second-quarter earnings on Monday, 13 October. Following the release of TCS's results, HCL Tech will be the second major IT company to announce its results for the September quarter. The results will be declared after the market hours.

According to experts, HCL Tech's Q2 revenue may rise by a low single digit. Revenue is expected to remain within the range of ₹31,490 crore and ₹31,585 crore, representing growth of 3–4% a quarter-on-quarter (QoQ) and 9–10% year-on-year (YoY). It is believed that the rise in revenue is mainly due to an increase in deal wins and foreign exchange gains.

Meanwhile, net profit is expected to increase by 7–9% sequentially to a range of ₹4,135–₹4,190 crore. On a yearly basis, however, net profit could fall by 2–3%. In the previous quarter, HCL Technologies reported a net profit of ₹3,843 crore, compared to ₹4,235 crore in the same quarter last year.

The EBIT margin is expected to shrink slightly, staying between 17% and 18%, and new deal wins are projected to be worth between $2.5 billion and $3 billion.

Investors will be watching closely for updates on revenue and margin guidance, along with any new deals secured in the September quarter. Management’s outlook on the broader business environment will also be under scrutiny, especially in light of U.S. tariffs and economic uncertainty. Commentary on rising H-1B visa fees and employee attrition will be another key focus.

Ahead of the Q2 results announcement, HCL Tech shares were trading 0.3% lower at ₹1,491 per share on Monday, 13 October. So far this year, HCL Tech shares have fallen 22%, largely due to global economic uncertainties.

Technical view

HCL Technologies has shown a strong rebound on the weekly chart after testing the key support zone near ₹1,370–₹1,400, which coincides with the 200-week EMA. This level has acted as a multi-month demand area. The latest weekly candle is a large bullish bar, up over 7%, signalling the emergence of buyers. The technical structure may gain momentum if follow-through buying sustains above ₹1,500, where the 21-week EMA currently lies.

The immediate resistance zone lies between ₹1,570 and ₹1,750 — an area that saw supply earlier in the year. A sustained move above ₹1,750 will confirm a trend reversal and open the way toward ₹1,900. Until then, the stock may consolidate between ₹1,400 and ₹1,700.

Options outlook

Open interest data for the 28 October expiry indicates a significant accumulation of call options at the 1,500 strike and above. This suggests that traders anticipate resistance in this area. Meanwhile, the put base was observed at the 1,400 strike, albeit with lower volume.

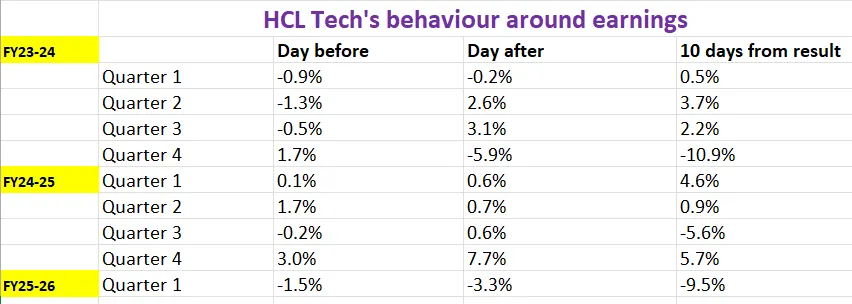

As of 10 October, HCL Tech’s ATM strike for October expiry is at 1,480, with both the call and put options priced at ₹68. This suggests that traders are expecting a price movement of ±5% ahead of the October expiry. However, let's take a look at HCL Tech's historical price behaviour during past earnings announcements in order to make more informed trading decisions.

Options strategy for HCL Tech

The options market is currently pricing in a potential move of ±5% for HCL Technologies ahead of the 28 October expiry. This indicates heightened volatility expectations. Traders can structure their strategies based on whether they anticipate a breakout or consolidation around this implied movement.

If expecting a sharp move (up or down):

Consider a Long Straddle, which involves buying both an at-the-money (ATM) Call and Put option of the same strike and expiry. This strategy profits when the stock moves sharply beyond the implied ±5% range in either direction. The larger the move, the higher the potential gain.

If expecting a range-bound move:

Opt for a Short Straddle, which involves selling both an ATM Call and Put to capture time decay and fall in volatility. This works best if the stock stays within the expected ±5% range until expiry. However, traders should manage risk actively, as sharp moves can cause losses.

About The Author

Next Story