Market News

Eternal Q3 results: Revenue may jump up to 200% YoY driven by Blinkit; focus on profitability and dark store expansion

.png)

4 min read | Updated on January 21, 2026, 10:56 IST

SUMMARY

Eternal Ltd is expected to report strong performance in Q3, driven by robust growth in the Blinkit business. However, despite positive earnings expectations, the stock's technical outlook remains cautious as it trades below its key exponential moving averages like 21, 50 and 200, keeping sentiment cautious.

Stock list

Eternal Q3 revenue could substantially increase, driven by shift in Blinkit's business model. | Image: Shutterstock

Experts believe Eternal could report a substantial rise in revenue and net profit during the December quarter, aided by strong sales from the Blinkit business. The company’s revenue could be in the range of ₹15,885 to ₹16,275 crore during the third quarter, marking a 190–200% year-on-year increase, driven by the shift in the Blinkit business model to an inventory-led model. This allows the company to buy, store and sell products directly, giving it control over pricing and margins.

On a sequential basis, Eternal's revenue could increase by 16-19%. The company registered revenues of ₹5,405 crore in Q3 FY25, and ₹13,590 crore in the previous quarter.

Eternal's net profit could rise by 49-55% year on year to a range of ₹88-₹92 crore, while it could rise by 30-35% sequentially. Eternal reported a net profit of ₹59 crore in Q3 FY25 and ₹65 crore in the previous quarter.

During the result announcement, investors will be looking for key metrics such as gross merchandise value (GMV) for the food delivery business, which is expected to grow by double digits. Meanwhile, the net order value of the Blinkit business could rise substantially by 14–15% quarter on quarter (QoQ) and 100–120% year on year (YoY), backed by the rapid addition of dark stores and higher order volumes.

Other key metrics, such as the number of new dark stores added to the Blinkit business, will also be closely monitored. Management commentary on the profitability of the quick commerce business, competition, and margins across different businesses will also be monitored.

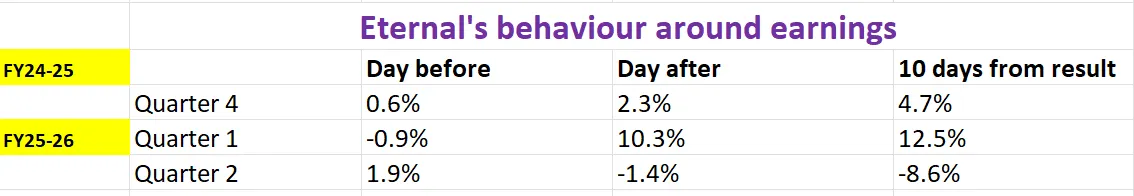

Ahead of the Q3 results announcement, Eternal shares are trading 0.1% higher at ₹271 on Wednesday, 21 January. The stock has fallen nearly 3% so far this month.

Technical outlook

The technical structure of Eternal remains bearish with stock slipping below the crucial support zone of ₹299. The stock is trading below all the short and long-term moving averages like 21, 50 and 200, indicating weakness. The stock will face resistance around ₹295–₹300. Failure to reclaim this zone could weaken the trend. The stock is now drifting lower, with the next crucial support zone around ₹240–₹245. Overall, the outlook remains negative unless the stock closes above ₹300, with any rallies likely to encounter selling pressure.

Options outlook

The open interest data of Eternal’s (Zomato) 27 January expiry shows significant call open interest build-up at 310 and 300 strikes, indicating resistance around these levels. Meanwhile, the at-the-money (ATM) strike of Eternal as per 20 January’s closing price is 270, with both call and put options priced at ₹20. This pricing reflects traders' anticipation of a price movement of approximately ±5.5% ahead of 27 January expiry.

To capitalise on the expected price swing, traders can explore strategies that align with volatility projections, such as straddles, to benefit from price movements.

Options strategy for Eternal (Zomato)

For traders anticipating a rise in volatility, a long straddle could be an effective approach. This strategy involves buying an at-the-money (ATM) call and put option with the same strike price and expiry date. It generates a profit when Eternal (Zomato's) price moves significantly in either direction, exceeding the ±5.5% range.

Conversely, if you anticipate minimal price movement or volatility, a short straddle might be more suitable. This strategy involves selling both an ATM call option and an ATM put option with the same strike price and expiry. It generates profits if Eternal (Zomato's) price remains relatively stable within a ±5.5% range.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story