Market News

Emami Q1: PAT grows 9% YoY; early monsoon, soft summer impact Talc/PHP portfolio; shares rally 6%. Top highlights

4 min read | Updated on August 01, 2025, 07:30 IST

SUMMARY

Emami Q1 Results: Emami said the quarter witnessed persistent pressure on urban discretionary consumption, while rural demand displayed signs of recovery.

Stock list

Shares of the company rallied as much as 8.22% to ₹611.80 apiece on the NSE. | Image: Shutterstock

In its earnings release, Emami said the quarter witnessed persistent pressure on urban discretionary consumption, while rural demand displayed signs of recovery.

However, an unusually soft and shortened summer, caused by unseasonal rainfall and the early arrival of the monsoon, negatively impacted consumption across the company's summer-centric portfolio.

Despite these macro headwinds, the company maintained a stable topline performance, Emami said in its release.

"Revenues remained broadly flat on a year-on-year basis, with a 2-year CAGR of 5%. Excluding the talcum/PHP (prickly heat powder) portfolio, the company’s core domestic business delivered a 6% revenue growth, reflecting the strength and resilience of its diversified offerings. Categories like the Pain Management range and BoroPlus Antiseptic Creams delivered strong growth during the quarter," the company said.

The talcum and prickly heat powder (PHP) category, which is highly reliant on peak summer sales, declined by 17% due to adverse weather conditions. However, this decline comes against an exceptionally high base of 54% growth in Q1FY25.

On a 2-year CAGR basis, the category continued to grow at 13%, underscoring long-term strength. For the full summer season this year (January to June 2025), the category posted flat growth, despite weather-related headwinds, Emami said.

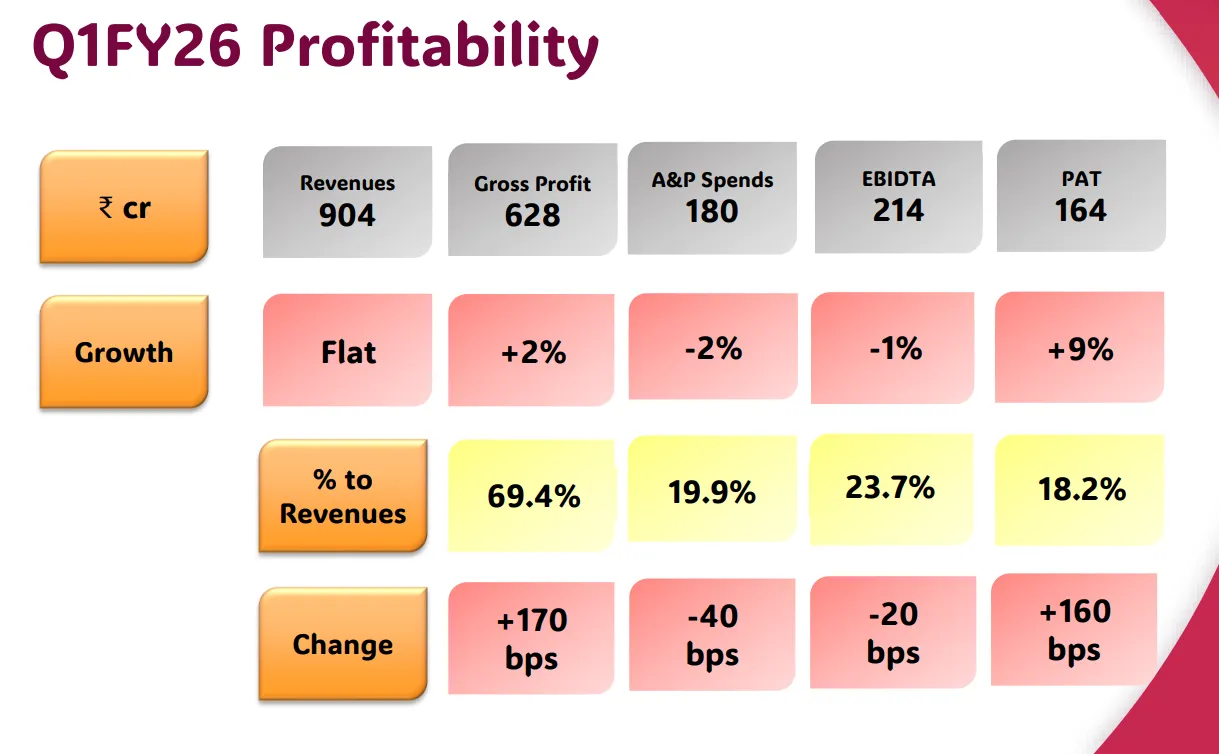

Emami Q1 FY26: Key Numbers

Emami reported a 0.2% decline in its consolidated revenue from operations at ₹904.1 crore against ₹906.1 crore reported in the year-ago period. Its operating profit, also known as EBIDTA, or earnings before interest, taxes, depreciation, and amortisation, came in at ₹214.2 crore, down 1% YoY.

Profit After Tax (PAT) for the quarter under review increased by 9.1% YoY to ₹164.3 crore, as per the company's financial statement.

The company's A&P spending stood at ₹180 crore, down 2% YoY. A&P stands for advertising and promotion.

Its gross margins expanded by 170 basis points to 69.4%, supported by benign input costs and judicious price increases.

Other Key Highlights

The International Business delivered modest growth despite ongoing macroeconomic and geopolitical uncertainties across key markets such as Bangladesh, the Middle East, and Africa. "The company remains committed to long-term value creation in these regions through focused portfolio strategies and localised innovations," it said.

Emami Q1 FY26: New Offerings

The company said it introduced several new offerings, including Dermicool Prickly Heat Spray, Navratna Ayurvedic Hairfall Control Oil, Navratna Cool Talc—Fresh Floral, and BoroPlus Icy Citrus Blast Prickly Heat Powder. In line with its digital-first strategy, the company rolled out innovations exclusively through its Zanducare platform: Zandu Shilajit Cool Rush Capsules & Resin, Zandu Kansa Wand Ayurvedic Massager, and Zandu Chia & Flax Seeds.

Outlook

Emami expects the macro environment to gradually improve, supported by a buoyant monsoon, stabilising inflation, and ongoing consumption recovery. With strategic levers of innovation, distribution expansion, digital acceleration, and cost agility firmly in place, the company is well-positioned to drive sustainable and profitable growth in the quarters ahead.

Management Commentary

Harsha V Agarwal, Vice Chairman and Managing Director, Emami Limited, said, “Our performance this quarter reflects the underlying strength and resilience of our brands, even in the face of an unusually subdued summer. Our Talc/PHP category maintained a 2-year CAGR of 13%. Our flagship brands are being future-proofed; Kesh King is undergoing a strategic transformation to enhance long-term relevance, while Smart & Handsome is expanding into adjacent male grooming categories."

The MD added, "The Man Company’s return to growth in June 2025 is especially encouraging, and we are confident of sustaining this trajectory through sharper positioning and a comprehensive brand revamp. Looking ahead, we are optimistic about growth in the coming months, driven by strong monsoon conditions, easing inflation, and potential interest rate reductions. These factors are expected to support a recovery in consumption and strengthen overall economic momentum."

Emami stock performance

Shares of the company rallied as much as 8.22% to ₹611.80 apiece on the NSE during the trade after the result announcement. The stock eventually ended at ₹599, up 5.96% on the NSE.

Related News

About The Author

Next Story