Market News

DMart Q2 preview: Net profit likely to decline, Revenue expected to grow in double digits; Check key technical levels

.png)

4 min read | Updated on October 10, 2025, 09:45 IST

SUMMARY

DMart continues to trade within a descending channel on the weekly chart, facing consistent resistance near ₹5,000–₹5,200. On the downside, it finds strong support in the ₹3,500–₹3,700 zone, backed by the rising 200-week EMA around ₹3,895. Holding above this level keeps the long-term structure intact, though short-term sentiment remains weak.

Stock list

Experts believe rising competition, delayed purchases due to GST 2.0 reforms and heavy rainfall to impact margins

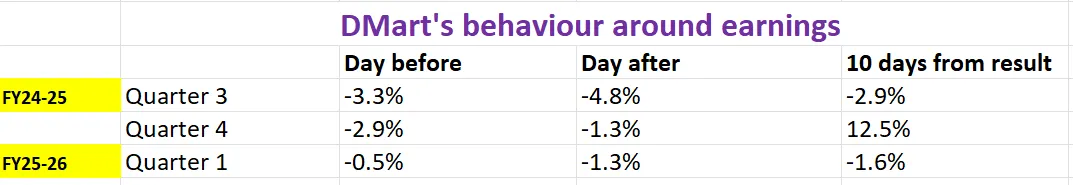

Avenue Supermarts, which operates the DMart supermarket chain, will announce its Q2 results on Saturday, 11 October.

Last week, the company released its business updates for the second quarter. Its standalone revenue from operations for the September quarter was ₹16,218 crore, marking a 15.4% year-on-year increase. In the same quarter last year, DMart reported revenue of ₹14,050 crore, while in the previous quarter it stood at ₹15,932 crore.

According to experts, DMart's net profit is expected to be between ₹624 crore and ₹655 crore, which is a year-on-year decrease of between 1% and 3%. The company reported net profit of ₹773 crore and ₹659 crore in the previous quarter and Q2 FY25 respectively. Meanwhile, Avenue Supermarts' EBITDA is expected to increase by 12% to 15% year on year to ₹1,235 to ₹1,267 crore. Meanwhile, DMart had 432 stores as of 30 September 2025.

Experts believe that the same-store growth metric will likely be impacted during the quarter due to delayed purchases resulting from the GST 2.0 reforms, heavy rainfall affecting store footfall, and increased competition from quick commerce companies.

Investors will be paying close attention to management's comments on the outlook for demand and the company's overall performance. Key metrics such as growth in the general merchandise and apparel segments, as well as same-store sales figures, will also be monitored closely.

Ahead of the Q2 result announcement, DMart shares are trading 0.6% higher at ₹4,332 on Friday, October 10. So far this year, DMart shares have delivered over 20% return to investors.

Technical view

The technical structure of DMart has been trading within the descending channel on the weekly timeframe, as indicated by the upper red resistance zone and lower green support band. It encountered resistance near the ₹5,000–₹5,200 price range, and has since declined, falling approximately 2.5% this week. This zone has acted as a supply region multiple times since late 2021, confirming a sustained downward-sloping resistance trendline.

On the downside, it continues to find strong structural support near the ₹3,500–₹3,700 range — a zone reinforced by the rising 200-week exponential moving average (EMA), currently placed around ₹3,895. Historically, every test of this zone has triggered accumulation, making it a crucial demand area. As long as DMart remains above the 200-week EMA, the long-term structure will remain intact, although short-term sentiment appears corrective.

Options outlook

Options data of DMart’s 28 October expiry saw significant call and put open interest (OI) at the 4,300 strike, suggesting rangebound movement around this zone. Additionally, the highest call base was also seen at 4,700 strike, indicating resistance for DMart around this zone.

The ATM strike for DMart on 9 October is 4,300, with both the call and put options priced at ₹256. This suggests an implied price movement of approximately ±5.9% ahead of its expiry.

Options strategy for DMart

With the options market pricing in a ±5.9% move ahead of the 28th October expiry, traders might consider long or short straddle strategies to capitalize on potential volatility.

A long straddle means buying both an at-the-money (ATM) call and put option on DMart with the same strike and expiry. This setup profits if the stock moves more than ±5.9% in either direction.

A short straddle involves selling the same pair of ATM options. It pays off if the stock stays relatively flat and moves less than ±5.9% by expiry.

About The Author

Next Story