Market News

Bharti Airtel Q2 results: Revenue, net profit likely to see double-digit growth aided by higher ARPU; check key technical levels

.png)

3 min read | Updated on November 03, 2025, 09:54 IST

SUMMARY

Telecom major Bharti Airtel is set to announce its Q2 results on 3 November 2025, with analysts expecting a robust performance driven by higher 5G data usage, subscriber additions, and an uptick in ARPU. On the technical front, Airtel has given a decisive breakout above the ₹2,000–₹2,030 resistance zone, signalling continued bullish momentum.

Stock list

Airtel shares has broken out strongly above the ₹2,000–₹2,030 resistance zone. | Image: Shutterstock

Bharti Airtel, a telecom service provider, will announce its second quarter results on 3 November 2025.

According to experts, the company is expected to report strong quarterly earnings, with double-digit growth in revenue and net profit. Its Q2 consolidated revenue is expected to increase by 22–24% year-on-year (YoY) to ₹50,730–51,270 crore, aided by continued subscriber additions, a higher average revenue per user (ARPU), and rising 5G data consumption. Net profit could rise substantially by 86–96% YoY to ₹6,685–7,050 crore, compared to a low base last year.

Bharti Airtel reported revenue of ₹41,473 crore in Q2 FY25 and ₹49,463 crore in Q1 FY26. Meanwhile, its net profit was ₹3,593 crore in Q2 FY25 and ₹5,948 crore in Q1 FY26.

Experts believe Airtel's ARPU could range from ₹254 to ₹256, up from ₹250 in the previous quarter, due to an improved subscriber mix. During the Q2 results announcement, investors and traders will be looking for updates on key performance indicators such as market share gain, growth in the Africa business, ARPU growth and new subscriber additions.

Ahead of the Q2 results announcement, Bharti Airtel ended the day at ₹2,054, down 0.5%. So far this year, the stock has surged by over 29% and is trading close to its 52-week high.

Technical view

Bharti Airtel has broken out strongly above the ₹2,000–₹2,030 resistance zone, which had limited its potential for several months. It closed the week at ₹2,054, marking an increase of 1.2% and confirming a sustained uptrend.

The 21-week exponential moving average (EMA) (₹1,924) and the 50-week EMA (₹1,803) continue to slope upwards, indicating robust medium-term momentum. The breakout candle formed with a healthy body size, showing follow-through buying after a brief consolidation phase. On the downside, the ₹1,950–₹1,900 zone now acts as major support, with immediate resistance seen near the ₹2,110–₹2,150 levels.

Options outlook

Bharti Airtel's open interest data for the 25 November expiry has an at-the-money (ATM) strike of 2,060. As of 2 November, the combined premium of the call and put options for Bharti Airtel is ₹87.15, indicating an implied movement of ±4.2% until the November expiry.

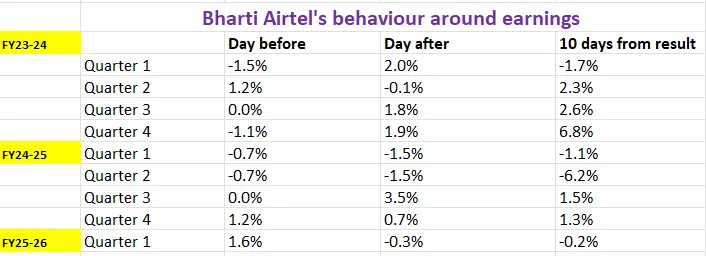

However, before planning any options strategy, it is worth taking a look at the historical price behaviour around the earnings announcement for the last nine quarters.

Options strategy for Bharti Airtel

If you expect significant movement in Bharti Airtel, regardless of direction—the Long Straddle strategy is well-suited. This approach involves simultaneously buying an at-the-money (ATM) call and an ATM put option (of same strike and expiry), positioning yourself to profit from sharp moves greater than ±4.2% either up or down.

In contrast, if you believe volatility will decrease and anticipate minimal price movement in Bharti Airtel following its earnings announcement, the Short Straddle may be more appropriate. In this setup, you sell both an ATM call and an ATM put with the same strike and expiry, effectively anticipating that Bharti Airtel's price will stay confined within a range of ±4.2%.

Traders anticipating a continued bullish trend can use strategies such as the bull put spread to align their positions with their view on price direction.

About The Author

Next Story