Market News

Bajaj Auto Q3 results: Net profit may surge up to 21% YoY driven by higher volumes; check key technical levels

.png)

4 min read | Updated on January 30, 2026, 10:28 IST

SUMMARY

Bajaj Auto is expected to deliver strong double-digit growth in revenue and net profit in the December quarter, aided by steady domestic demand, traction during the festive season, export momentum and a weaker rupee. Technically, the stock remains in a broad consolidation phase.

Stock list

Bajaj Auto revenue is expected to increase by 19-22% YoY to ₹15,250 to ₹15,430 crore. | Image: Shutterstock

Two-wheeler maker Bajaj Auto will announce its December quarter results on January 30, 2026. The Pulsar bike maker is expected to report strong earnings with double-digit growth in revenue and net profit.

According to experts, Bajaj Auto’s net profit could rise by 18 to 21% YoY to ₹2,490 to ₹2,550 crore during the quarter. The company registered a standalone net profit of ₹2,109 crore in Q3FY25. Meanwhile, the net profit may increase by 2-3% sequentially compared to ₹2,480 crore profit in the previous quarter.

Its revenue is expected to increase by 19-22% YoY to ₹15,250 to ₹15,430 crore and remain flat sequentially. The company registered a standalone revenue of ₹12,807 crore in Q3FY25, while it stood at ₹14,922 crore in the previous quarter. Meanwhile, its EBITDA margins are likely to be between 20% and 21%.

Bajaj Auto is expected to report a 10% to 12% year-on-year rise in sales volume, aided by post-GST cut demand, festive season demand and strong export growth. The company is also likely to benefit from rupee depreciation.

During the quarterly result announcement, investors will look forward to management commentary on the demand outlook, export sales numbers, and growth in the electric 2-wheeler segment.

Ahead of the Q3 result announcement, Bajaj Auto shares are trading 0.5% lower at ₹9,458 apeice . So far this month, Bajaj Auto shares are trading flat, up 1.8%.

Technical outlook

Bajaj Auto has been in a broad consolidation on the weekly chart, with price action largely guided by two key trendlines. The stock has spent several months moving higher along a rising support trendline, while the upside has been capped by a gently declining trendline drawn from the November 2024 peak. This price action and build-up suggests gradual accumulation rather than aggressive momentum.

For short-term traders, the stock has now moved slightly out of the declining trendline, shifting the focus to last week’s low. As long as Bajaj Auto defends last week's low, the broader consolidation setup will remain intact and buyers will retain control. However, a decisive break below this level could signal a loss of trend.

Options outlook

The open interest data for the 24 February expiry indicates that Bajaj Auto’s at-the-money (ATM) strike of ₹9,500 is implying a potential price move of around ±6.2% ahead of the expiry.

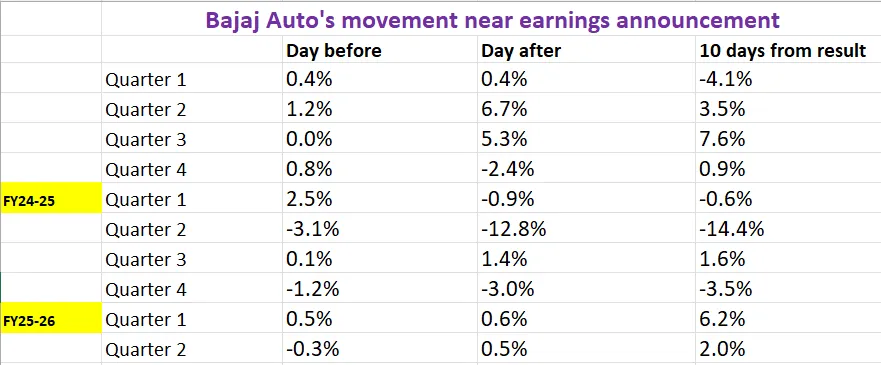

To get a clear perspective on price behaviour, let's look at how Bajaj Auto's share price has performed over the ten quarters around its earnings announcements.

Options strategy for Bajaj Auto

With the options market pricing in a potential move of ±6.2%, traders can use volatility-based strategies, such as long or short straddles, to align with their market outlook.

A long straddle involves buying an at-the-money (ATM) call and put option with the same strike price and expiry date. This strategy can benefit from a sharp price movement, beyond the expected range of ±6.2% in either direction.

Conversely, a short straddle involves selling both an ATM call and put option with the same strike price and expiry date. This strategy aims to profit from time decay if the stock price remains within the expected range of ±6.2%.

Those expecting a directional breakout or continuation may consider bull put spreads to capture further upside momentum, or bear call spreads if a breakdown from the current consolidation occurs.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story