Market News

Axis Bank Q2 results: Net profit likely to see double-digit fall; check options strategy and key technical levels

.png)

3 min read | Updated on October 14, 2025, 09:33 IST

SUMMARY

Ahead of its Q2 results, the options market is pricing in a ±4.2% move by the 28 October expiry. On the charts, Axis Bank remains rangebound between ₹1,215 and ₹1,163. A breakout on either side of this range could trigger a directional move.

Experts believe Axis Bank could report low single-digit growth in its loan book and deposits during the second quarter

Private sector lender Axis Bank is set to announce its results for the September quarter on Wednesday, 15 October 2025, marking the beginning of the banking sector's earnings season.

Axis Bank is expected to report a double-digit decline in standalone net profit. Its net profit could drop by 19-22% YoY to range between ₹5,355 and ₹5,530 crore. A sharp decline in profitability is likely due to weak growth in the loan book, higher provisions and operating expenses. The private lender reported a standalone net profit of ₹6,918 crore in the September quarter of FY25, while it stood at ₹5,806 crore in the previous quarter.

Experts believe Axis Bank could report low single-digit growth in its loan book and deposits during the second quarter. Meanwhile, the asset quality could also deteriorate with a rise in gross and net non-performing assets (NPAs).

Net interest income (NII) of the bank is expected to increase by 1 to 3% YoY to ₹13,150 to ₹13,330 crore. The private lender reported NII of ₹13,480 crore in the same quarter last year.

Axis Bank investors will closely watch the management commentary on business outlook, especially after recent RBI repo rate cuts. Key metrics like gross and net NPAs, loan disbursements and CASA deposit growth will also be tracked closely.

Ahead of the Q2 result announcement, Axis Bank shares ended the day 0.7% higher at ₹1,189 on October 14. So far this year, Axis Bank shares have delivered over 11% return to investors.

Technical view

Axis Bank has shown a steady recovery, climbing above both its 21- and 50-week exponential moving averages (EMAs). These now act as strong short-term support around ₹1,130–₹1,125. The stock recently encountered resistance at around ₹1,215, which aligns with a descending trendline drawn from its previous swing highs. Breaking out above this level could trigger an upward movement. Meanwhile, the first sign of weakness will come below ₹1,130–₹1,125.

Options outlook

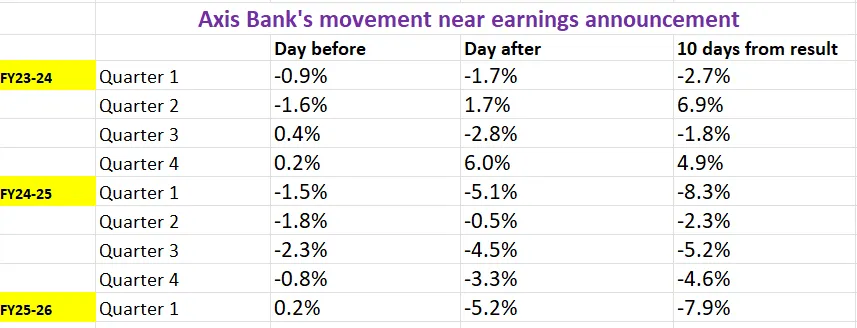

Axis Bank's at-the-money (ATM) strike is 1,190, with both call and put options priced at ₹50. This indicates an expected price movement of ±4.2% before 28 October expiry. To make more informed trading decisions, let's examine how Axis Bank's share price has reacted to previous earnings announcements.

Options strategy for Axis Bank

Options data imply a potential move of ±4.2% in Axis Bank, opening the door to both long and short volatility plays.

For a strong move in either direction, A Long Straddle makes sense. This strategy involves buying both an at-the-money call and put with the same strike and expiry. It turns profitable if Axis Bank moves more than ±4.2%, regardless of direction.

Expecting a quiet reaction post-earnings?: Then a Short Straddle fits. This strategy involved selling the same ATM call and put. The strategy yields profit if the stock stays within the implied ±4.2% range. Ideal when traders expect volatility to drop.

Meanwhile, traders expecting a breakout past ₹1,215 or a breakdown below ₹1,163 can consider directional strategies like a Bull Call Spread (for upside moves) or Bear Put Spread (for downside moves).

About The Author

Next Story