Market News

Asian Paints Q3 results: Revenue and net profit likely to see up to 9% YoY growth, aided by higher sales volumes; check key technical levels

.png)

4 min read | Updated on January 27, 2026, 09:16 IST

SUMMARY

Asian Paints is expected to report stable Q3 earnings, with revenue and profit growth in the high single digits, supported by healthy volume growth and improving margins due to lower input costs.

Stock list

Asian Paints broader technical structure remains range-bound with resistance around the 2,900–2,920 zones. | Image: Shutterstock

Asian Paints will announce its December quarter results on January 27, 2025. The company is likely to report stable quarterly earnings with high single-digit growth in revenue and net profit during the quarter.

According to experts, Asian Paints could report a 6% to 8% YoY rise in consolidated revenue in the range of ₹9,050 to ₹9,100 crore, supported by improvement in decorative paint volumes, which is expected to remain in the range of 8% to 10%.

Net profit may see a rise of 7% to 9% YoY to range between ₹1,190 and ₹1,210 crore, driven by an improvement in EBITDA margin because of lower raw material costs for key inputs like crude derivatives during the quarter. EBITDA margin is likely to improve by 70 to 90 basis points to 19.8% to 20.1%.

The company registered a consolidated revenue of ₹8,549 crore in Q3FY25, while it stood at ₹8,531 crore in the previous quarter. Meanwhile, Asian Paints' net profit was at ₹1,110 crore in the December quarter of FY25 and ₹994 crore in the previous quarter.

During the announcement of the quarterly results, investors will be closely monitoring sales and volume growth, as well as key performance metrics. Management commentary on demand outlook and rising competition intensity will also be important.

Ahead of the Q3 result announcement, Asian Paints shares are trading 0.5% higher around ₹2,712 apiece. So far this month, Asian Paints shares are down 2.3%.

Technical outlook

Asian Paints broader technical structure remains range-bound, with the stock facing resistance around the 2,900–2,920 zones. It is trading below the 21-day and 50-day exponential moving averages (EMAs), which indicates short-term weakness. The recent sell-off has brought the stock close to a key support area near 2,650, where its 200-day EMA also acts as important medium-term trend support.

For short-term traders, a decisive break below ₹2,640 could open the way for further weakness. Conversely, a break above ₹2,900 will revive the bullish strength. Until then, the price is likely to remain volatile between ₹2,900 and ₹2,640.

Options outlook

The at-the-money (ATM) strike for Asian Paints' 24 February expiry is ₹2,720, with a combined option premium of ₹175. This implies that the market expects a move of about ±6.5% from the closing price on 23 January.

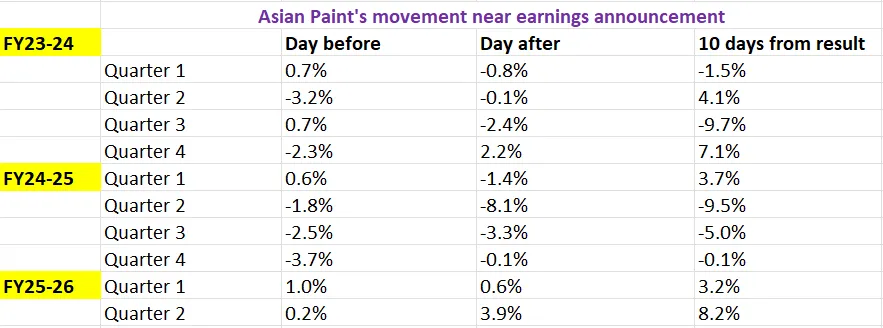

Let’s examine how Asian Paints stock has reacted to its quarterly earnings announcements over the past two years to gain insights into its price movements.

Options strategy for Asian Paints

Given the implied move of ±6.5% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

Meanwhile, for directional bias, whether bullish or bearish, spreads offer a better risk profile. A bull call spread (buying a low strike call and selling a higher strike call) limits both cost and potential profit, but is suitable for steady price increases. Similarly, a bear put spread (buy a higher strike put and sell a lower strike put) limits risk and return, offering a more conservative approach.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story