Market News

Airtel Q3 results: Revenue likely to grow up to 20% YoY aided by higher ARPU; check key technical levels

.png)

4 min read | Updated on February 05, 2026, 09:29 IST

SUMMARY

Bharti Airtel is set to announce its Q3 results on February 5, with analysts expecting strong revenue growth driven by higher ARPU, rising 5G data usage and steady performance from its Africa business. From a technical standpoint, the stock has found support near its 200-day EMA, keeping the broader structure intact.

Stock list

According to Airtel technical structure, the stock took support around its 200-day EMA. | Image: Shutterstock

Telecom service provider, Bharti Airtel will announce its third quarter results on Thursday, February 5, 2025.

According to experts, Bharti Airtel is expected to report strong quarterly earnings, with double-digit growth in revenue and net profit. Bharti Airtel Q2 consolidated revenue may increase by 17 to 19% YoY to ₹52,950 to ₹53,150 crore aided by higher average revenue per user (ARPU), rising 5G data consumption and growth in African business. Meanwhile, net profit is expected to see single-digit growth in the range of ₹7,410 to ₹8,100 crore.

Bharti Airtel reported revenue of ₹45,129 crore in Q3FY25 and ₹52,145 crore in Q2FY26. Meanwhile, its net profit stood at ₹8,332 crore in Q3FY25 and ₹6,792 crore in Q2FY26.

Experts believe, Airtel ARPU could range between ₹256 and ₹258 from ₹255 in previous quarter amid improved subscriber mix. During the Q3 results, investors and traders will look forward to key monitorable like market share gain, growth in African business, ARPU growth and new subscriber addition. Impact of currency fluctuations will also be monitored closely.

Ahead of the Q3 result announcement, Bharti Airtel shares closed 1.2% higher at ₹2,022. The stock started the year on a weak note and is down 3.7% so far in 2026.

Technical outlook

The technical structure of the Bharti Airtel remains sideways to bullish as the stock took support around its 200-day exponential moving average (EMA), which is considered as crucial support zone. However, it is facing resistance at its 50-day EMA, which indicates short-term weakness and a loss of momentum. Although the recent bounce suggests some buying interest.

On the downside, the 200-day EMA, act as a crucial support and trend-defining level. A decisive break below this zone would weaken the broader structure. On the upside, sustained movement above 2,050, followed by a breakout above 2,175, would signal a resumption of the trend.

Options outlook

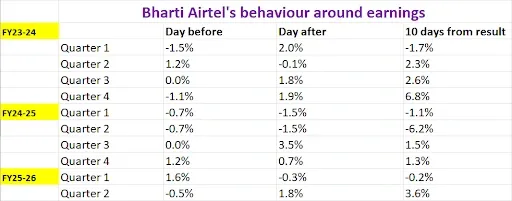

Looking at the option chain for Bharti Airtel's 24 February expiry, the at-the-money strike is ₹2,040. If you add up the call and put premiums at this strike price as of 4 February, you get ₹72.9. This suggests that the market anticipates a potential price movement of around ±3.6% in either direction before the expiry date. Now, let’s check how the stock behaved around earnings in the past ten quarters before considering options stratgies.

Options strategies ahead of the earnings

If you expect Bharti Airtel's share price to move sharply after it announces its earnings, but you're not sure which way it will move, a long straddle could be a good option. In this strategy, a trader buys both the at-the-money (ATM) call and put options. The approach is straightforward, if the stock moves more than ±3.6%, the strategy will make profit.

Conversely, perhaps if you believe that Bharti Airtel will remain range-bound after the results are announced, with all the volatility already priced in. In that case, the short straddle might be the right strategy. It involves selling the same ATM call and put, and pocket the premium if the stock stays within that ±3.6% range.

Meanwhile, for those anticipating a bullish move above the 50-day EMA, bull call or put spread strategies enable you to take a directional approach while keeping risk defined.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story