Market News

Silver price soars over 120% in 2025: Will the rally pause? What the gold–silver ratio says

4 min read | Updated on December 19, 2025, 09:08 IST

SUMMARY

Silver may continue to get the dual advantage of being a precious and an industrial metal. The strong demand outlook and supply worries are fuelling the current trend

The white metal jumped by ₹7,300 to hit an all-time high of ₹2,05,800 per kg on Wednesday, against the previous closing level of ₹1,98,500 per kilogram. Image: Freepik

The rally in silver prices has been among the major highlights of 2025. On Wednesday, December 17, silver prices breached the record ₹2 lakh-per-kilogram mark in the national capital for the first time, driven by strong demand in domestic and global markets, according to the All India Sarafa Association.

The white metal jumped by ₹7,300 to hit an all-time high of ₹2,05,800 per kg on Wednesday, against the previous closing level of ₹1,98,500 per kilogram.

So far this year, silver prices have added ₹1,15,300, or 127.40%, since the level of ₹90,500 per kilogram recorded on January 1, 2025.

In overseas trade, spot silver crossed the $66-per-ounce mark for the first time. The white metal climbed by $2.77, or 4.35%, to hit a fresh record of $66.52 per ounce.

Why are silver prices rallying?

-

Silver prices have surged to record highs, owing to a physical metal shortage, booming solar industry demand, strong Indian imports, and sustained inflows into silver ETFs.

-

The U.S. has classified silver as a ‘critical mineral’, while China, the second-largest exporter, has imposed export restrictions.

What lies ahead?

The latest report by Tata Mutual Fund notes that silver prices rallied through November, supported by supply tightness, rupee weakness and bets over a rate cut in December.

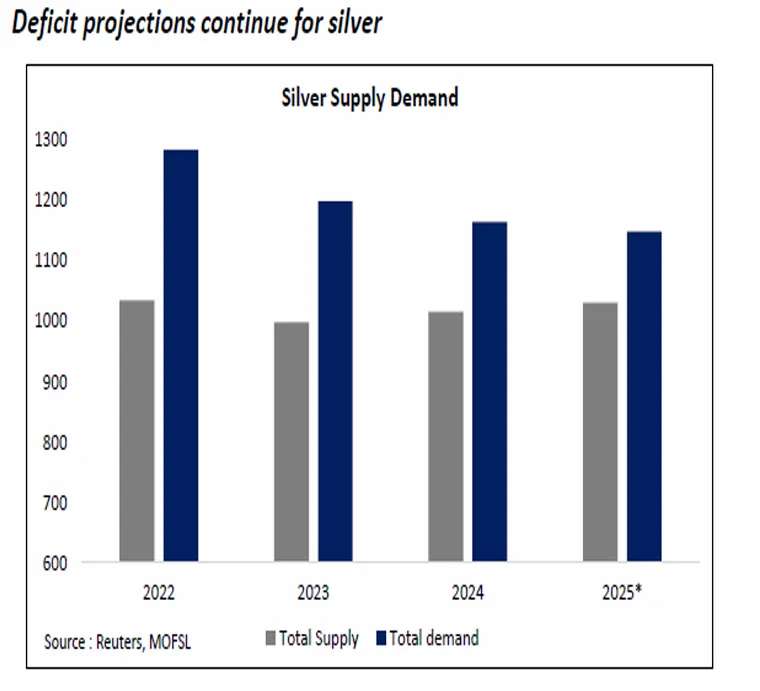

Silver prices are likely to move higher as the market is likely to remain in deficit and is expected to reach 95 Moz for the fifth consecutive year, and there are concerns over tightness in Chinese silver supplies.

Moz in silver refers to millions of ounces (Moz).

Industrial sectors like solar, AI/data centres, and EVs are still growing, but they’re using less silver per unit, so total industrial silver demand is expected to slip 2% in 2025.

Jewellery, silverware, and bar/coin demand are also down 4–11% this year due to high prices and weak US buying, though Indian purchases remain strong.

Mine production remains flat at 813 Moz, with no major new projects coming online. Since 70% of silver is a by-product of base-metal mining, supply can’t easily increase.

Further, weakness in the dollar and softening of U.S. Treasury yields across the curve would be supportive for the prices. Spot silver prices have gained more than 16% in the previous month.

Gold-Silver Ratio

The report added that the gold–silver ratio fell from 100+ to 74, still above the long-term average of 70, signalling upside potential and growing investor interest.

The gold–silver ratio is a metric that shows how many ounces of silver are needed to buy one ounce of gold.

How it’s calculated

Gold–Silver Ratio = Price of Gold per ounce ÷ Price of Silver per ounce

Tata Mutual Fund said, "We expect silver to outperform gold in the coming month, taking the ratio towards the 70 level, which is standing near 74 right now."

A slipping gold-silver ratio suggests outperformance of silver over gold.

"We expect the ratio to slip further towards the 70 mark in the coming months as the silver market is expected to remain in deficit for the 5th consecutive year and concerns over tightness in Chinese silver supplies," the report added.

Silver Outlook

Silver may continue to get the dual advantage of being a precious and an industrial metal. The strong demand outlook and supply worries are fuelling the current trend.

Analysts believe silver prices may do well in the medium to long term with a data-dependent approach, while a boost in industrial demand and a Fed rate cut are the key bullish factors.

Investors may look to accumulate/invest in silver through SIP/staggered mode, considering the volatile nature of the commodity.

Related News

About The Author

Next Story