Market News

MCX Gold and Silver trade higher, finds support near 21-day EMA; check today’s trade setup

.png)

3 min read | Updated on November 03, 2025, 18:40 IST

SUMMARY

MCX Gold and Silver futures have regained footing after a brief correction, with both metals reclaiming their 21-day EMAs. Gold December futures are holding above ₹1,21,000, while Silver has crossed ₹1,49,000, signalling improving short-term momentum.

MCX Crude oil futures recover to trade at ₹5,437 after finding support around ₹5,200 last week

Market recap (as of 6:15 pm)

- Gold 5 Dec Futures: ₹1,21,750/ 10 gram (▲ 0.4%)

- Silver 5 Dec Futures: ₹1,48,850/ 1 kg (▲ 0.3%)

- Crude Oil 19 Nov Futures: ₹5,415/ 1 BBL (▼ 0.1%)

Technical view

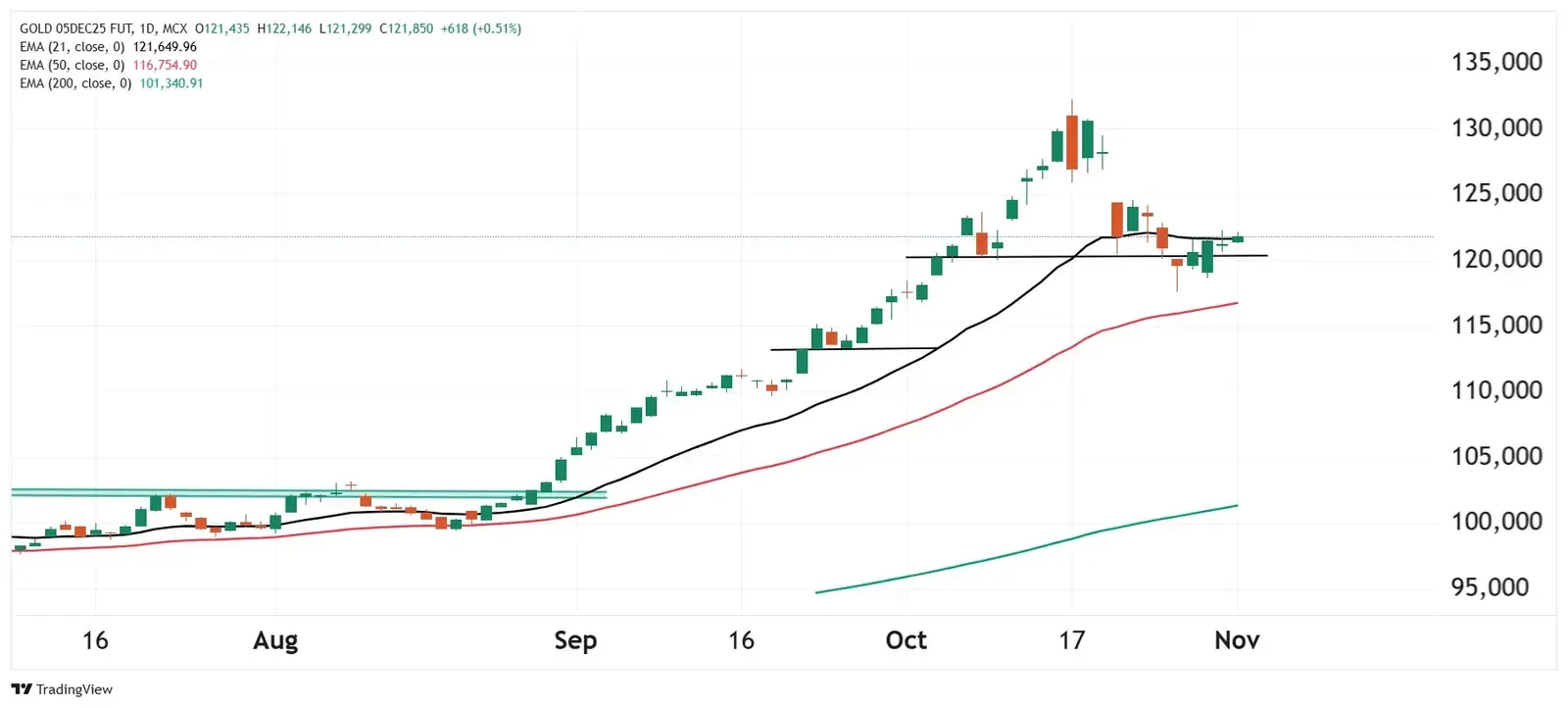

Gold December futures on the MCX have entered a consolidation and the contract is currently trading at around ₹1,21,850, close to its 21-day exponential moving average (EMA).Despite this short-term pause, the 50-day EMA of ₹1,16,750 remains comfortably below current levels, indicating that the medium-term trend remains positive.

In the short term, the price movement indicates an ongoing battle between bulls and bears around the ₹121,000–₹120,500 support zone. A sustained move above ₹1,23,000 would confirm a rebound and open the door to a retest of the ₹1,25,000 resistance zone. Conversely, a daily close below ₹1,20,500 could push prices towards the 50-day EMA.

MCX Silver December futures are trading at around ₹1,49,200, showing signs of recovery following a sharp correction from the October peak of approximately ₹1,70,000. Having reclaimed the 21-day EMA at ₹1,47,560, the price is signalling a gradual turnaround in short-term momentum.

Meanwhile, the 50-day EMA, currently at around ₹1,39,740, continues to provide strong support, maintaining the overall uptrend structure. A decisive close above ₹1,50,000 could pave the way for a retest of the ₹1,53,000–₹1,55,000 zone, whereas a failure to hold above ₹1,47,000 could prompt some profit-taking.

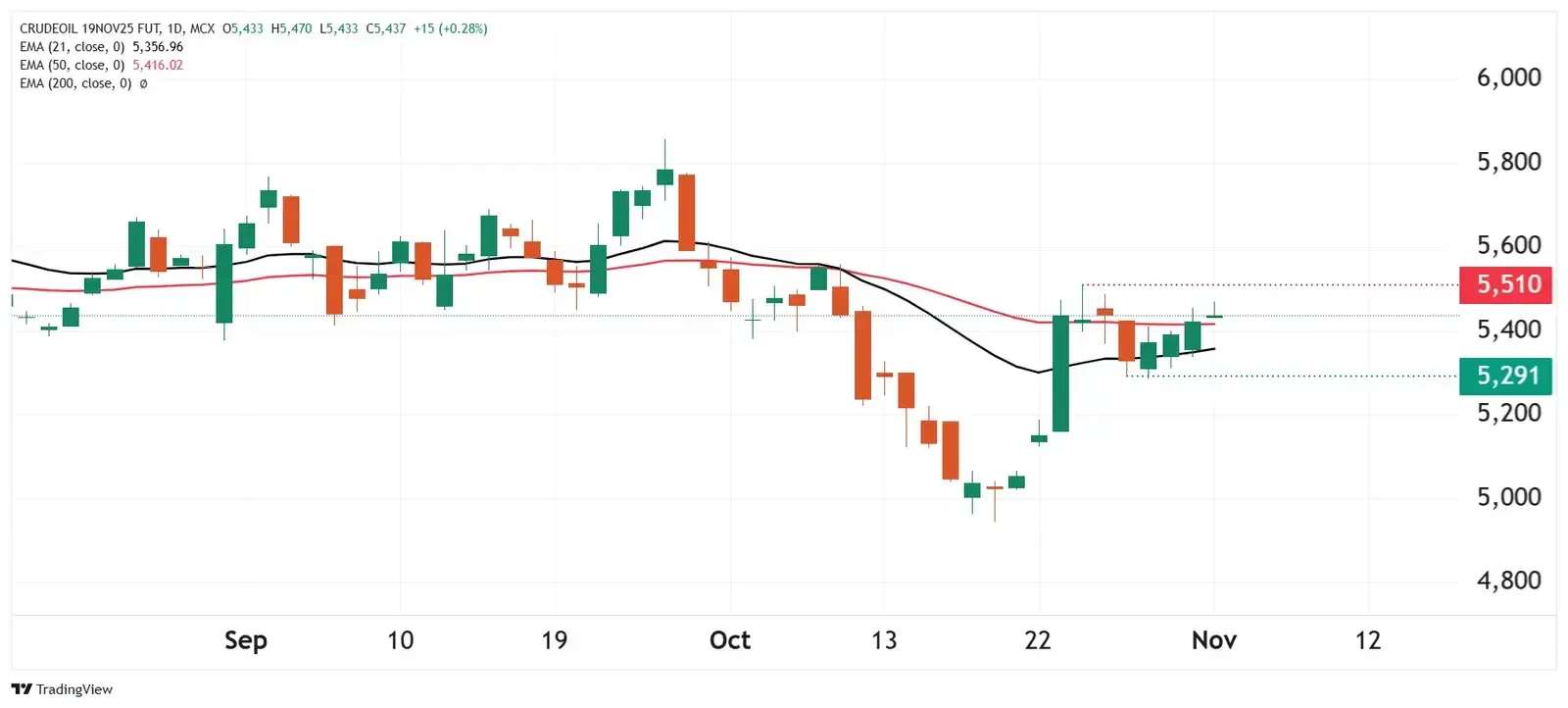

MCX Crude oil futures is trading at ₹5,437, having shown a mild recovery after finding support at around ₹5,200 last week. The price is currently close to the 21-day EMA of ₹5,357. The close crossover of these two averages suggests a period of consolidation, with neither the bulls nor the bears currently in control.

The key resistance level is currently ₹5,510, which has repeatedly capped upside attempts over the past two weeks. Breaking out above this level could trigger fresh buying momentum towards ₹5,600. On the downside, immediate support is found around ₹5,290–₹5,250. A breach below this level could lead to renewed weakness towards.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story